[2025-11-27] - AI 주식 분석 요약: 두산에너빌리티(034020)

📊 종목 요약

삼성전자 (005930)

💰 현재가: 102,800.00

📈 변동률: +3.52%

🔄 거래량 비율: 1.02배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 524,000.00

📈 변동률: +0.96%

🔄 거래량 비율: 1.22배

🏷️ 태그: 없음

NAVER (035420)

💰 현재가: 263,500.00

📈 변동률: +4.15%

🔄 거래량 비율: 0.93배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 77,700.00

📈 변동률: +5.71%

🔄 거래량 비율: 0.51배

🏷️ 태그: 급등/급락

한화오션 (042660)

💰 현재가: 113,900.00

📈 변동률: +0.80%

🔄 거래량 비율: 0.33배

🏷️ 태그: 없음

Robinhood Markets, Inc. (HOOD)

💰 현재가: 128.38

📈 변동률: +11.09%

🔄 거래량 비율: 1.17배

🏷️ 태그: 급등/급락

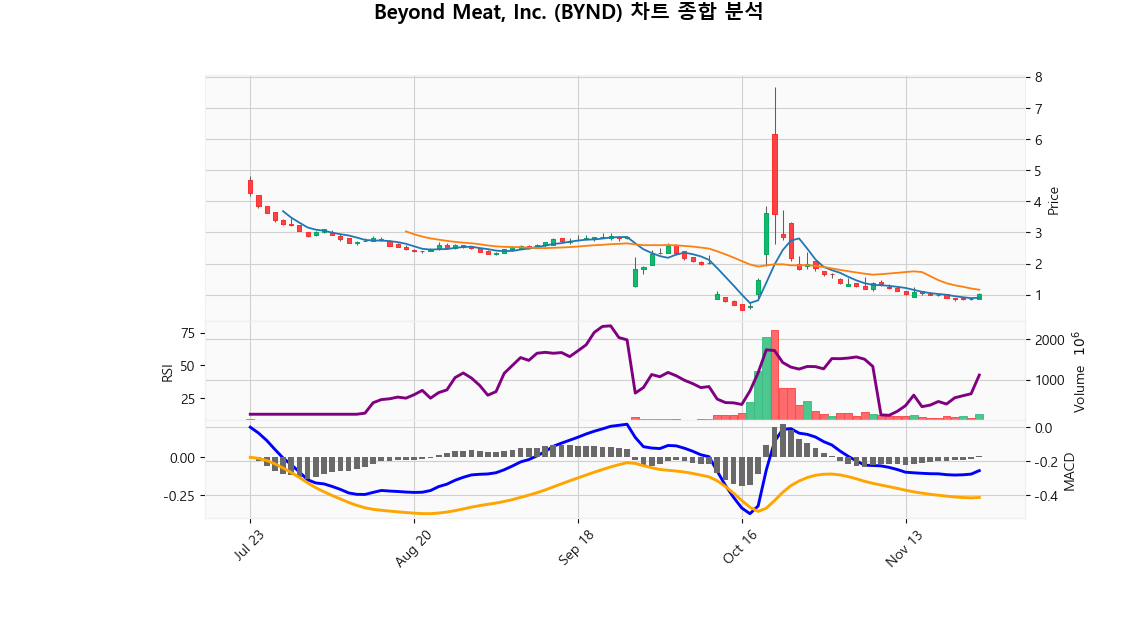

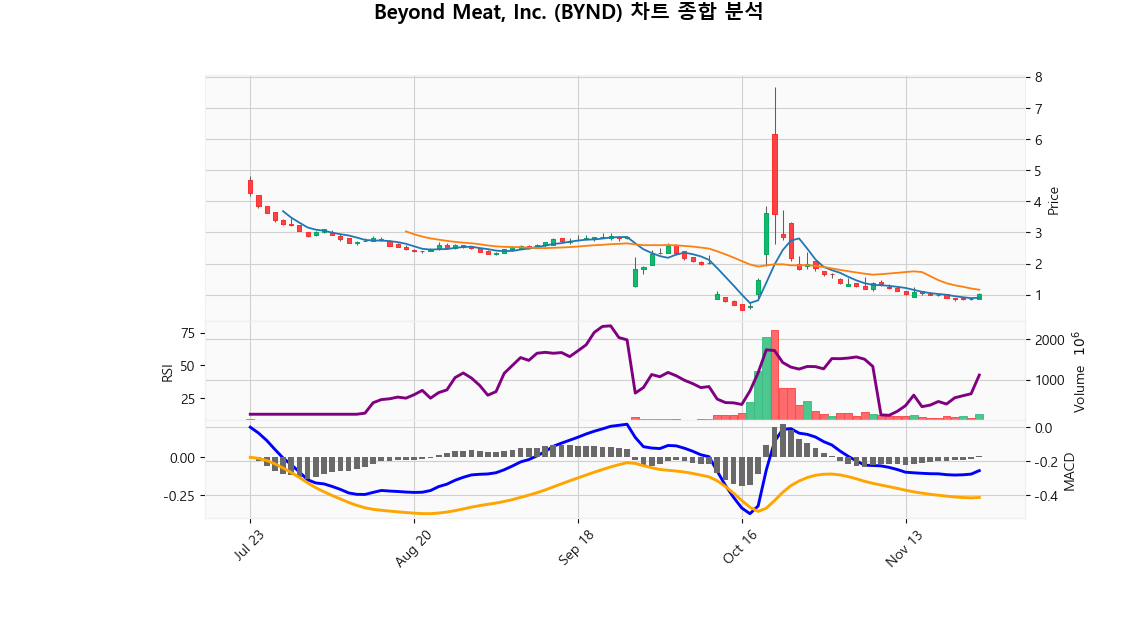

Beyond Meat, Inc. (BYND)

💰 현재가: 1.03

📈 변동률: +20.77%

🔄 거래량 비율: 4.75배

🏷️ 태그: 급등/급락, 거래량 급증

Zscaler, Inc. (ZS)

💰 현재가: 253.61

📈 변동률: -12.47%

🔄 거래량 비율: 3.89배

🏷️ 태그: 급등/급락, 거래량 급증

Nutanix, Inc. (NTNX)

💰 현재가: 48.53

📈 변동률: -17.43%

🔄 거래량 비율: 7.39배

🏷️ 태그: 급등/급락, 거래량 급증

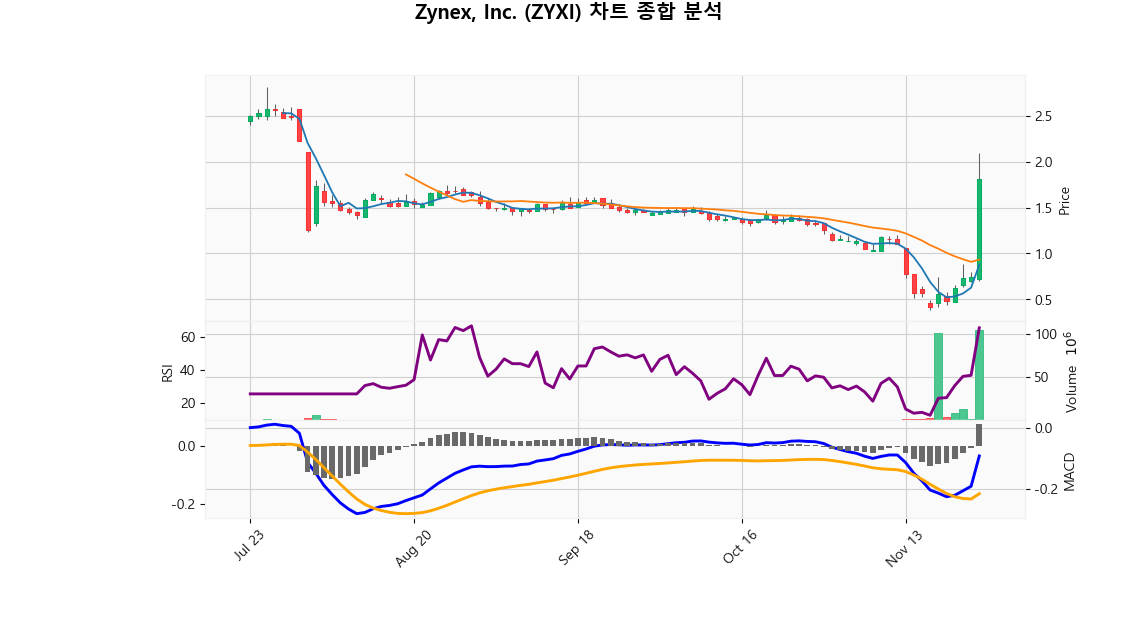

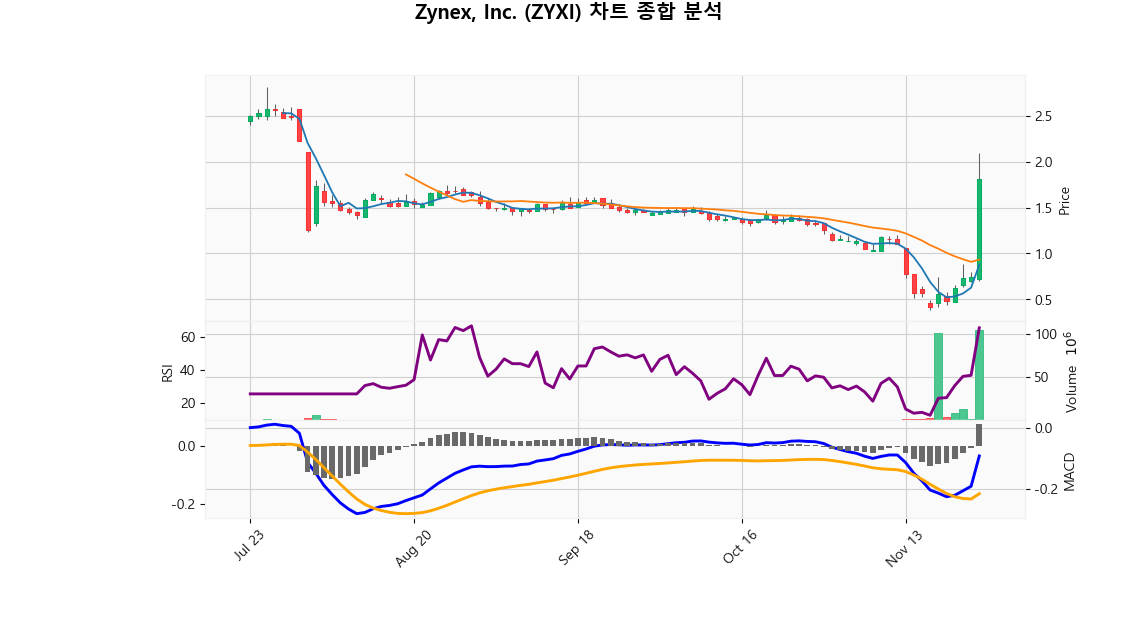

Zynex, Inc. (ZYXI)

💰 현재가: 1.81

📈 변동률: +144.59%

🔄 거래량 비율: 136.3배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 삼성전자 (005930)

현재가: 102800.00 | 변동률: 3.52% | 거래량 비율: 1.02배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 SK하이닉스 (000660)

현재가: 524000.00 | 변동률: 0.96% | 거래량 비율: 1.22배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 NAVER (035420)

현재가: 263500.00 | 변동률: 4.15% | 거래량 비율: 0.93배

설명:

동사는 1999년 설립, 2002년 코스닥 상장 후 2008년 유가증권시장에 이전 상장함.

The company was established in 1999 and was listed on the securities market in 2008 after being listed on KOSDAQ in 2002.

🔹 두산에너빌리티 (034020)

현재가: 77700.00 | 변동률: 5.71% | 거래량 비율: 0.51배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 한화오션 (042660)

현재가: 113900.00 | 변동률: 0.8% | 거래량 비율: 0.33배

설명:

동사는 2000년 대우중공업 분할로 설립되어 2001년 상장되었으며, 2024년 한화로부터 플랜트·풍력 사업을 양수하고 한화오션디지털을 합병했음.

The company was founded in 2000 as a division of Daewoo Heavy Industries and went public in 2001. In 2024, it acquired the plant and wind power business from Hanwha and merged Hanwha Ocean Digital.

🔹 Robinhood Markets, Inc. (HOOD)

현재가: 128.38 | 변동률: 11.09% | 거래량 비율: 1.17배

설명:

None

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: 해당 없음

🔹 Beyond Meat, Inc. (BYND)

현재가: 1.03 | 변동률: 20.77% | 거래량 비율: 4.75배

설명:

Beyond Meat, Inc. is a pioneering company in the plant-based food industry, focused on creating innovative meat substitutes that prioritize sustainability and health. Headquartered in El Segundo, California, the firm utilizes high-quality, responsibly sourced ingredients to develop a range of products, including ground beef, sausages, and burgers that effectively mimic the taste and texture of conventional meat. As consumer preferences shift towards plant-based diets driven by environmental and health concerns, Beyond Meat is strategically positioned to capture significant market opportunities in the rapidly growing alternative protein sector.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Zscaler, Inc. (ZS)

현재가: 253.61 | 변동률: -12.47% | 거래량 비율: 3.89배

설명:

Zscaler, Inc. is a premier cloud security provider based in San Jose, California, focusing on secure internet access for applications and data. Its cutting-edge Zero Trust Exchange platform empowers enterprises to transition from legacy network security models to a dynamic, cloud-native architecture, delivering robust protection against evolving cyber threats. As businesses increasingly embrace digital transformation, Zscaler is strategically positioned to capitalize on the surging demand for scalable, secure cloud solutions, solidifying its role in the future of cybersecurity.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Nutanix, Inc. (NTNX)

현재가: 48.53 | 변동률: -17.43% | 거래량 비율: 7.39배

설명:

Nutanix, Inc. is a premier provider of enterprise cloud solutions, empowering organizations to efficiently manage and scale their IT infrastructure. Based in San Jose, California, Nutanix's innovative platform seamlessly integrates compute, storage, and virtualization, making it easier for businesses to transition to hybrid and multi-cloud environments. With a robust global presence across North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, Nutanix is strategically positioned to capitalize on the increasing demand for cloud services, enhancing operational efficiency and facilitating digital transformation for its diverse client base.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Zynex, Inc. (ZYXI)

현재가: 1.81 | 변동률: 144.59% | 거래량 비율: 136.3배

설명:

Zynex Inc. (ZYXI) is a leading medical technology company headquartered in Englewood, Colorado, specializing in innovative solutions for chronic and acute pain management. The company is recognized for its cutting-edge electrical stimulation devices designed to aid in muscle rehabilitation and accelerate recovery, addressing the increasing demand for non-invasive therapeutic options in the healthcare sector. With a robust commitment to improving patient outcomes and a strategic advantage in the evolving pain management landscape, Zynex is poised for continued growth and technological advancement.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

📈 시장 요약

S&P500

미국 대형주 대표 지수

📈 +0.94%

Nasdaq

미국 기술주 중심 지수

📈 +0.62%

Dow Jones

30개 전통 우량주 지수

📈 +1.45%

10Y Treasury

미국 10년 만기 국채 수익률

📈 +0.26%

🔹 두산에너빌리티 (034020)

⏱️ 1D 분석

💰 현재가: $77,700.00

📊 거래량: 4,463,298

📈 RSI: 47.55

📉 MACD: -777.54

📌 예측:

- 3 기간 → Hold (신뢰도 64.73%)

- 5 기간 → Hold (신뢰도 64.72%)

- 10 기간 → Hold (신뢰도 64.73%)

⏱️ 1WK 분석

💰 현재가: $77,700.00

📊 거래량: 11,657,790

📈 RSI: 65.29

📉 MACD: 8844.97

📌 예측:

- 3 기간 → Hold (신뢰도 60.41%)

- 5 기간 → Hold (신뢰도 58.76%)

- 10 기간 → Hold (신뢰도 59.86%)

⏱️ 1MO 분석

💰 현재가: $77,700.00

📊 거래량: 98,014,234

📈 RSI: 78.13

📉 MACD: 15090.68

📌 예측:

- 3 기간 → Hold (신뢰도 60.74%)

- 5 기간 → Hold (신뢰도 60.61%)

- 10 기간 → Hold (신뢰도 60.6%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00

Stock Summary

삼성전자 (005930)

💰 현재가: 102,800.00

📈 변동률: +3.52%

🔄 거래량 비율: 1.02배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 524,000.00

📈 변동률: +0.96%

🔄 거래량 비율: 1.22배

🏷️ 태그: 없음

NAVER (035420)

💰 현재가: 263,500.00

📈 변동률: +4.15%

🔄 거래량 비율: 0.93배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 77,700.00

📈 변동률: +5.71%

🔄 거래량 비율: 0.51배

🏷️ 태그: 급등/급락

한화오션 (042660)

💰 현재가: 113,900.00

📈 변동률: +0.80%

🔄 거래량 비율: 0.33배

🏷️ 태그: 없음

Robinhood Markets, Inc. (HOOD)

💰 현재가: 128.38

📈 변동률: +11.09%

🔄 거래량 비율: 1.17배

🏷️ 태그: 급등/급락

Beyond Meat, Inc. (BYND)

💰 현재가: 1.03

📈 변동률: +20.77%

🔄 거래량 비율: 4.75배

🏷️ 태그: 급등/급락, 거래량 급증

Zscaler, Inc. (ZS)

💰 현재가: 253.61

📈 변동률: -12.47%

🔄 거래량 비율: 3.89배

🏷️ 태그: 급등/급락, 거래량 급증

Nutanix, Inc. (NTNX)

💰 현재가: 48.53

📈 변동률: -17.43%

🔄 거래량 비율: 7.39배

🏷️ 태그: 급등/급락, 거래량 급증

Zynex, Inc. (ZYXI)

💰 현재가: 1.81

📈 변동률: +144.59%

🔄 거래량 비율: 136.3배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 삼성전자 (005930)

현재가: 102800.00 | 변동률: 3.52% | 거래량 비율: 1.02배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.**Description:**

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 SK하이닉스 (000660)

현재가: 524000.00 | 변동률: 0.96% | 거래량 비율: 1.22배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 NAVER (035420)

현재가: 263500.00 | 변동률: 4.15% | 거래량 비율: 0.93배

설명:

동사는 1999년 설립, 2002년 코스닥 상장 후 2008년 유가증권시장에 이전 상장함.

→ **English Translation**: The company was established in 1999 and was listed on the securities market in 2008 after being listed on KOSDAQ in 2002.

🔹 두산에너빌리티 (034020)

현재가: 77700.00 | 변동률: 5.71% | 거래량 비율: 0.51배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 한화오션 (042660)

현재가: 113900.00 | 변동률: 0.8% | 거래량 비율: 0.33배

설명:

동사는 2000년 대우중공업 분할로 설립되어 2001년 상장되었으며, 2024년 한화로부터 플랜트·풍력 사업을 양수하고 한화오션디지털을 합병했음.

→ **English Translation**: The company was founded in 2000 as a division of Daewoo Heavy Industries and went public in 2001. In 2024, it acquired the plant and wind power business from Hanwha and merged Hanwha Ocean Digital.

🔹 Robinhood Markets, Inc. (HOOD)

현재가: 128.38 | 변동률: 11.09% | 거래량 비율: 1.17배

설명:

None

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: 해당 없음

🔹 Beyond Meat, Inc. (BYND)

현재가: 1.03 | 변동률: 20.77% | 거래량 비율: 4.75배

설명:

Beyond Meat, Inc. is a pioneering company in the plant-based food industry, focused on creating innovative meat substitutes that prioritize sustainability and health. Headquartered in El Segundo, California, the firm utilizes high-quality, responsibly sourced ingredients to develop a range of products, including ground beef, sausages, and burgers that effectively mimic the taste and texture of conventional meat. As consumer preferences shift towards plant-based diets driven by environmental and health concerns, Beyond Meat is strategically positioned to capture significant market opportunities in the rapidly growing alternative protein sector.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Zscaler, Inc. (ZS)

현재가: 253.61 | 변동률: -12.47% | 거래량 비율: 3.89배

설명:

Zscaler, Inc. is a premier cloud security provider based in San Jose, California, focusing on secure internet access for applications and data. Its cutting-edge Zero Trust Exchange platform empowers enterprises to transition from legacy network security models to a dynamic, cloud-native architecture, delivering robust protection against evolving cyber threats. As businesses increasingly embrace digital transformation, Zscaler is strategically positioned to capitalize on the surging demand for scalable, secure cloud solutions, solidifying its role in the future of cybersecurity.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Nutanix, Inc. (NTNX)

현재가: 48.53 | 변동률: -17.43% | 거래량 비율: 7.39배

설명:

Nutanix, Inc. is a premier provider of enterprise cloud solutions, empowering organizations to efficiently manage and scale their IT infrastructure. Based in San Jose, California, Nutanix's innovative platform seamlessly integrates compute, storage, and virtualization, making it easier for businesses to transition to hybrid and multi-cloud environments. With a robust global presence across North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, Nutanix is strategically positioned to capitalize on the increasing demand for cloud services, enhancing operational efficiency and facilitating digital transformation for its diverse client base.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Zynex, Inc. (ZYXI)

현재가: 1.81 | 변동률: 144.59% | 거래량 비율: 136.3배

설명:

Zynex Inc. (ZYXI) is a leading medical technology company headquartered in Englewood, Colorado, specializing in innovative solutions for chronic and acute pain management. The company is recognized for its cutting-edge electrical stimulation devices designed to aid in muscle rehabilitation and accelerate recovery, addressing the increasing demand for non-invasive therapeutic options in the healthcare sector. With a robust commitment to improving patient outcomes and a strategic advantage in the evolving pain management landscape, Zynex is poised for continued growth and technological advancement.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📈 +0.94%

Nasdaq

미국 기술주 중심 지수

📈 +0.62%

Dow Jones

30개 전통 우량주 지수

📈 +1.45%

10Y Treasury

미국 10년 만기 국채 수익률

📈 +0.26%

🔹 두산에너빌리티 (034020)

⏱️ 1D 분석

💰 현재가: $77,700.00

📊 거래량: 4,463,298

📈 RSI: 47.55

📉 MACD: -777.54

📌 예측:

- 3 기간 → Hold (신뢰도 64.73%)

- 5 기간 → Hold (신뢰도 64.72%)

- 10 기간 → Hold (신뢰도 64.73%)

⏱️ 1WK 분석

💰 현재가: $77,700.00

📊 거래량: 11,657,790

📈 RSI: 65.29

📉 MACD: 8844.97

📌 예측:

- 3 기간 → Hold (신뢰도 60.41%)

- 5 기간 → Hold (신뢰도 58.76%)

- 10 기간 → Hold (신뢰도 59.86%)

⏱️ 1MO 분석

💰 현재가: $77,700.00

📊 거래량: 98,014,234

📈 RSI: 78.13

📉 MACD: 15090.68

📌 예측:

- 3 기간 → Hold (신뢰도 60.74%)

- 5 기간 → Hold (신뢰도 60.61%)

- 10 기간 → Hold (신뢰도 60.6%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00