[2025-11-21] - AI 주식 분석 요약: 엔씨소프트(036570)

📊 종목 요약

SK하이닉스 (000660)

💰 현재가: 571,000.00

📈 변동률: +1.60%

🔄 거래량 비율: 1.13배

🏷️ 태그: 없음

삼성전자 (005930)

💰 현재가: 100,600.00

📈 변동률: +4.25%

🔄 거래량 비율: 1.21배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 77,700.00

📈 변동률: +4.44%

🔄 거래량 비율: 0.49배

🏷️ 태그: 없음

엔씨소프트 (036570)

💰 현재가: 187,000.00

📈 변동률: -2.45%

🔄 거래량 비율: 4.96배

🏷️ 태그: 거래량 급증

NAVER (035420)

💰 현재가: 257,000.00

📈 변동률: +3.42%

🔄 거래량 비율: 0.96배

🏷️ 태그: 없음

Walmart Inc. (WMT)

💰 현재가: 107.18

📈 변동률: +6.53%

🔄 거래량 비율: 2.18배

🏷️ 태그: 급등/급락, 거래량 급증

MercadoLibre, Inc. (MELI)

💰 현재가: 1,922.34

📈 변동률: -7.45%

🔄 거래량 비율: 1.77배

🏷️ 태그: 급등/급락, 거래량 급증

Palo Alto Networks, Inc. (PANW)

💰 현재가: 184.92

📈 변동률: -7.49%

🔄 거래량 비율: 1.89배

🏷️ 태그: 급등/급락, 거래량 급증

Bath & Body Works, Inc. (BBWI)

💰 현재가: 15.59

📈 변동률: -25.91%

🔄 거래량 비율: 6.28배

🏷️ 태그: 급등/급락, 거래량 급증

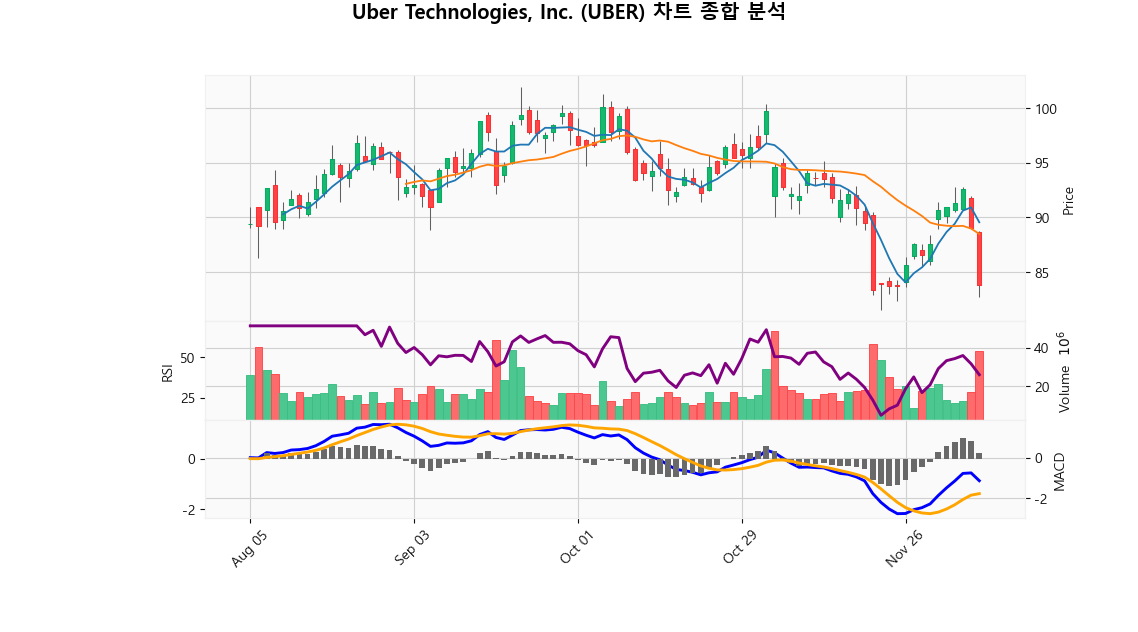

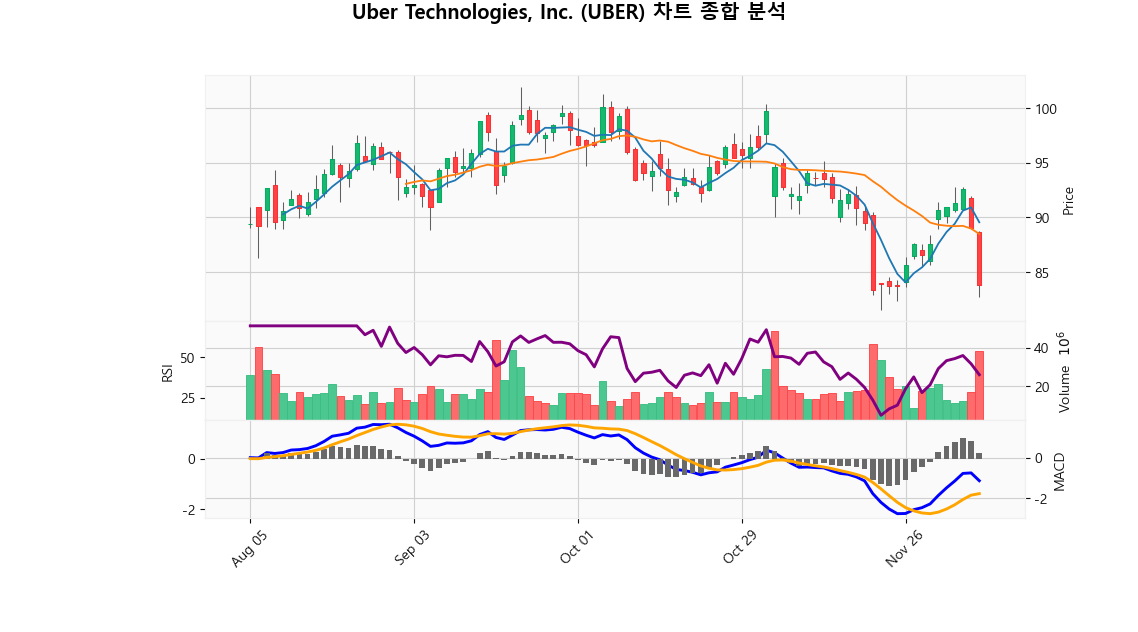

Uber Technologies, Inc. (UBER)

💰 현재가: 83.76

📈 변동률: -6.44%

🔄 거래량 비율: 1.6배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 SK하이닉스 (000660)

현재가: 571000.00 | 변동률: 1.6% | 거래량 비율: 1.13배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 삼성전자 (005930)

현재가: 100600.00 | 변동률: 4.25% | 거래량 비율: 1.21배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 두산에너빌리티 (034020)

현재가: 77700.00 | 변동률: 4.44% | 거래량 비율: 0.49배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 엔씨소프트 (036570)

현재가: 187000.00 | 변동률: -2.45% | 거래량 비율: 4.96배

설명:

동사는 1997년 설립된 한국 게임사로 코스닥 상장 후 유가증권시장으로 이전하였으며, 2025년 기준 23개 종속회사를 보유하고 있음.

The company moved to the securities market after being listed on KOSDAQ as a Korean game company established in 1997, and has 23 subsidiaries as of 2025.

🔹 NAVER (035420)

현재가: 257000.00 | 변동률: 3.42% | 거래량 비율: 0.96배

설명:

동사는 1999년 설립, 2002년 코스닥 상장 후 2008년 유가증권시장에 이전 상장함.

The company was established in 1999 and was listed on the securities market in 2008 after being listed on KOSDAQ in 2002.

🔹 Walmart Inc. (WMT)

현재가: 107.18 | 변동률: 6.53% | 거래량 비율: 2.18배

설명:

Walmart Inc. is a leading American multinational retail corporation headquartered in Bentonville, Arkansas, recognized for its extensive network of hypermarkets, discount department stores, and grocery outlets, including the operation of Sam's Club. Committed to providing low prices and a diverse product range, Walmart leverages advanced supply chain technologies and robust e-commerce strategies to maintain its competitive advantage. The company is at the forefront of retail innovation, focusing on sustainability and digital transformation to enhance operational efficiency and expand its market presence, while also contributing significantly to the U.S. economy.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 MercadoLibre, Inc. (MELI)

현재가: 1922.34 | 변동률: -7.45% | 거래량 비율: 1.77배

설명:

MercadoLibre, Inc. is a leading player in Latin America's e-commerce and fintech sectors, based in Buenos Aires, Argentina. The company boasts a comprehensive ecosystem that includes online marketplaces, payment solutions via Mercado Pago, and digital credit offerings, effectively bridging millions of buyers and sellers across the region. By harnessing advanced technology and data analytics, MercadoLibre not only optimizes user experiences and transaction efficiency but also plays a crucial role in driving trade facilitation and enhancing financial inclusion. Given its strategic positioning and the robust growth of the digital economy in Latin America, MercadoLibre represents a compelling investment opportunity within the expanding e-commerce landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Palo Alto Networks, Inc. (PANW)

현재가: 184.92 | 변동률: -7.49% | 거래량 비율: 1.89배

설명:

Palo Alto Networks, Inc. (PANW) is a premier player in the cybersecurity sector, headquartered in Santa Clara, California, renowned for its cutting-edge platform that safeguards organizations from a diverse range of cyber threats through advanced firewall technologies, cloud security solutions, and AI-enhanced threat intelligence. The company serves a varied global clientele and maintains a strong commitment to enterprise security, risk management, and continuous innovation. As the cybersecurity landscape evolves and the demand for comprehensive protection intensifies, Palo Alto Networks is poised for growth, driving expansion of its product portfolio and reinforcing its status as an essential partner for organizations seeking to navigate today’s complex security challenges.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Bath & Body Works, Inc. (BBWI)

현재가: 15.59 | 변동률: -25.91% | 거래량 비율: 6.28배

설명:

None

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: 해당 없음

🔹 Uber Technologies, Inc. (UBER)

현재가: 83.76 | 변동률: -6.44% | 거래량 비율: 1.6배

설명:

Uber Technologies, Inc. is a leading American technology company transforming the transportation and logistics sectors through its innovative digital platform. Founded in San Francisco, Uber operates in multiple segments, including ride-hailing, food delivery via Uber Eats, and freight services, positioning itself at the forefront of the mobility revolution. The company is committed to sustainability, expanding into urban mobility with electric bicycles and scooters, while leveraging cutting-edge technology to improve user experience and operational efficiency. As a key player in the dynamic global mobility ecosystem, Uber continues to shape the future of urban transportation.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

📈 시장 요약

S&P500

미국 대형주 대표 지수

📈 +0.39%

Nasdaq

미국 기술주 중심 지수

📈 +0.60%

Dow Jones

30개 전통 우량주 지수

📈 +0.10%

10Y Treasury

미국 10년 만기 국채 수익률

📉 -0.07%

🔹 엔씨소프트 (036570)

⏱️ 1D 분석

💰 현재가: $187,000.00

📊 거래량: 544,116

📈 RSI: 32.64

📉 MACD: -1430.71

📌 예측:

- 3 기간 → Hold (신뢰도 61.36%)

- 5 기간 → Hold (신뢰도 61.64%)

- 10 기간 → Hold (신뢰도 61.76%)

⏱️ 1WK 분석

💰 현재가: $187,000.00

📊 거래량: 1,807,780

📈 RSI: 43.52

📉 MACD: 7493.35

📌 예측:

- 3 기간 → Hold (신뢰도 77.03%)

- 5 기간 → Hold (신뢰도 76.32%)

- 10 기간 → Hold (신뢰도 76.7%)

⏱️ 1MO 분석

💰 현재가: $187,000.00

📊 거래량: 3,256,660

📈 RSI: 49.26

📉 MACD: -28776.15

📌 예측:

- 3 기간 → Hold (신뢰도 66.05%)

- 5 기간 → Hold (신뢰도 64.73%)

- 10 기간 → Hold (신뢰도 65.33%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00

Stock Summary

SK하이닉스 (000660)

💰 현재가: 571,000.00

📈 변동률: +1.60%

🔄 거래량 비율: 1.13배

🏷️ 태그: 없음

삼성전자 (005930)

💰 현재가: 100,600.00

📈 변동률: +4.25%

🔄 거래량 비율: 1.21배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 77,700.00

📈 변동률: +4.44%

🔄 거래량 비율: 0.49배

🏷️ 태그: 없음

엔씨소프트 (036570)

💰 현재가: 187,000.00

📈 변동률: -2.45%

🔄 거래량 비율: 4.96배

🏷️ 태그: 거래량 급증

NAVER (035420)

💰 현재가: 257,000.00

📈 변동률: +3.42%

🔄 거래량 비율: 0.96배

🏷️ 태그: 없음

Walmart Inc. (WMT)

💰 현재가: 107.18

📈 변동률: +6.53%

🔄 거래량 비율: 2.18배

🏷️ 태그: 급등/급락, 거래량 급증

MercadoLibre, Inc. (MELI)

💰 현재가: 1,922.34

📈 변동률: -7.45%

🔄 거래량 비율: 1.77배

🏷️ 태그: 급등/급락, 거래량 급증

Palo Alto Networks, Inc. (PANW)

💰 현재가: 184.92

📈 변동률: -7.49%

🔄 거래량 비율: 1.89배

🏷️ 태그: 급등/급락, 거래량 급증

Bath & Body Works, Inc. (BBWI)

💰 현재가: 15.59

📈 변동률: -25.91%

🔄 거래량 비율: 6.28배

🏷️ 태그: 급등/급락, 거래량 급증

Uber Technologies, Inc. (UBER)

💰 현재가: 83.76

📈 변동률: -6.44%

🔄 거래량 비율: 1.6배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 SK하이닉스 (000660)

현재가: 571000.00 | 변동률: 1.6% | 거래량 비율: 1.13배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.**Description:**

Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 삼성전자 (005930)

현재가: 100600.00 | 변동률: 4.25% | 거래량 비율: 1.21배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.

→ **English Translation**: The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 두산에너빌리티 (034020)

현재가: 77700.00 | 변동률: 4.44% | 거래량 비율: 0.49배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 엔씨소프트 (036570)

현재가: 187000.00 | 변동률: -2.45% | 거래량 비율: 4.96배

설명:

동사는 1997년 설립된 한국 게임사로 코스닥 상장 후 유가증권시장으로 이전하였으며, 2025년 기준 23개 종속회사를 보유하고 있음.

→ **English Translation**: The company moved to the securities market after being listed on KOSDAQ as a Korean game company established in 1997, and has 23 subsidiaries as of 2025.

🔹 NAVER (035420)

현재가: 257000.00 | 변동률: 3.42% | 거래량 비율: 0.96배

설명:

동사는 1999년 설립, 2002년 코스닥 상장 후 2008년 유가증권시장에 이전 상장함.

→ **English Translation**: The company was established in 1999 and was listed on the securities market in 2008 after being listed on KOSDAQ in 2002.

🔹 Walmart Inc. (WMT)

현재가: 107.18 | 변동률: 6.53% | 거래량 비율: 2.18배

설명:

Walmart Inc. is a leading American multinational retail corporation headquartered in Bentonville, Arkansas, recognized for its extensive network of hypermarkets, discount department stores, and grocery outlets, including the operation of Sam's Club. Committed to providing low prices and a diverse product range, Walmart leverages advanced supply chain technologies and robust e-commerce strategies to maintain its competitive advantage. The company is at the forefront of retail innovation, focusing on sustainability and digital transformation to enhance operational efficiency and expand its market presence, while also contributing significantly to the U.S. economy.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 MercadoLibre, Inc. (MELI)

현재가: 1922.34 | 변동률: -7.45% | 거래량 비율: 1.77배

설명:

MercadoLibre, Inc. is a leading player in Latin America's e-commerce and fintech sectors, based in Buenos Aires, Argentina. The company boasts a comprehensive ecosystem that includes online marketplaces, payment solutions via Mercado Pago, and digital credit offerings, effectively bridging millions of buyers and sellers across the region. By harnessing advanced technology and data analytics, MercadoLibre not only optimizes user experiences and transaction efficiency but also plays a crucial role in driving trade facilitation and enhancing financial inclusion. Given its strategic positioning and the robust growth of the digital economy in Latin America, MercadoLibre represents a compelling investment opportunity within the expanding e-commerce landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Palo Alto Networks, Inc. (PANW)

현재가: 184.92 | 변동률: -7.49% | 거래량 비율: 1.89배

설명:

Palo Alto Networks, Inc. (PANW) is a premier player in the cybersecurity sector, headquartered in Santa Clara, California, renowned for its cutting-edge platform that safeguards organizations from a diverse range of cyber threats through advanced firewall technologies, cloud security solutions, and AI-enhanced threat intelligence. The company serves a varied global clientele and maintains a strong commitment to enterprise security, risk management, and continuous innovation. As the cybersecurity landscape evolves and the demand for comprehensive protection intensifies, Palo Alto Networks is poised for growth, driving expansion of its product portfolio and reinforcing its status as an essential partner for organizations seeking to navigate today’s complex security challenges.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Bath & Body Works, Inc. (BBWI)

현재가: 15.59 | 변동률: -25.91% | 거래량 비율: 6.28배

설명:

None

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: 해당 없음

🔹 Uber Technologies, Inc. (UBER)

현재가: 83.76 | 변동률: -6.44% | 거래량 비율: 1.6배

설명:

Uber Technologies, Inc. is a leading American technology company transforming the transportation and logistics sectors through its innovative digital platform. Founded in San Francisco, Uber operates in multiple segments, including ride-hailing, food delivery via Uber Eats, and freight services, positioning itself at the forefront of the mobility revolution. The company is committed to sustainability, expanding into urban mobility with electric bicycles and scooters, while leveraging cutting-edge technology to improve user experience and operational efficiency. As a key player in the dynamic global mobility ecosystem, Uber continues to shape the future of urban transportation.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📈 +0.39%

Nasdaq

미국 기술주 중심 지수

📈 +0.60%

Dow Jones

30개 전통 우량주 지수

📈 +0.10%

10Y Treasury

미국 10년 만기 국채 수익률

📉 -0.07%

🔹 엔씨소프트 (036570)

⏱️ 1D 분석

💰 현재가: $187,000.00

📊 거래량: 544,116

📈 RSI: 32.64

📉 MACD: -1430.71

📌 예측:

- 3 기간 → Hold (신뢰도 61.36%)

- 5 기간 → Hold (신뢰도 61.64%)

- 10 기간 → Hold (신뢰도 61.76%)

⏱️ 1WK 분석

💰 현재가: $187,000.00

📊 거래량: 1,807,780

📈 RSI: 43.52

📉 MACD: 7493.35

📌 예측:

- 3 기간 → Hold (신뢰도 77.03%)

- 5 기간 → Hold (신뢰도 76.32%)

- 10 기간 → Hold (신뢰도 76.7%)

⏱️ 1MO 분석

💰 현재가: $187,000.00

📊 거래량: 3,256,660

📈 RSI: 49.26

📉 MACD: -28776.15

📌 예측:

- 3 기간 → Hold (신뢰도 66.05%)

- 5 기간 → Hold (신뢰도 64.73%)

- 10 기간 → Hold (신뢰도 65.33%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00