[2025-11-13] - AI 주식 분석 요약: 에이비엘바이오(298380)

📊 종목 요약

삼성전자 (005930)

💰 현재가: 103,100.00

📈 변동률: -0.39%

🔄 거래량 비율: 0.93배

🏷️ 태그: 없음

에이비엘바이오 (298380)

💰 현재가: 126,700.00

📈 변동률: +29.95%

🔄 거래량 비율: 0.57배

🏷️ 태그: 급등/급락

SK하이닉스 (000660)

💰 현재가: 617,000.00

📈 변동률: -0.32%

🔄 거래량 비율: 0.68배

🏷️ 태그: 없음

하이브 (352820)

💰 현재가: 291,000.00

📈 변동률: +1.93%

🔄 거래량 비율: 1.35배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 78,400.00

📈 변동률: +0.26%

🔄 거래량 비율: 0.33배

🏷️ 태그: 없음

Leap Therapeutics, Inc. (LPTX)

💰 현재가: 2.08

📈 변동률: +374.89%

🔄 거래량 비율: 216.17배

🏷️ 태그: 급등/급락, 거래량 급증

Advanced Micro Devices, Inc. (AMD)

💰 현재가: 255.14

📈 변동률: +7.42%

🔄 거래량 비율: 1.96배

🏷️ 태그: 급등/급락, 거래량 급증

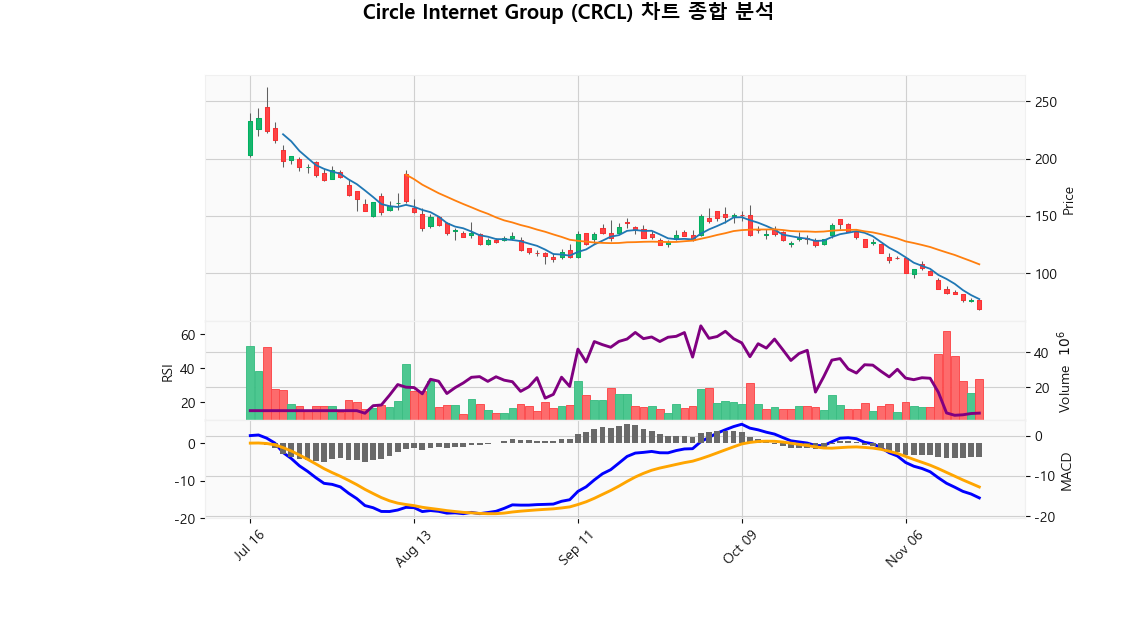

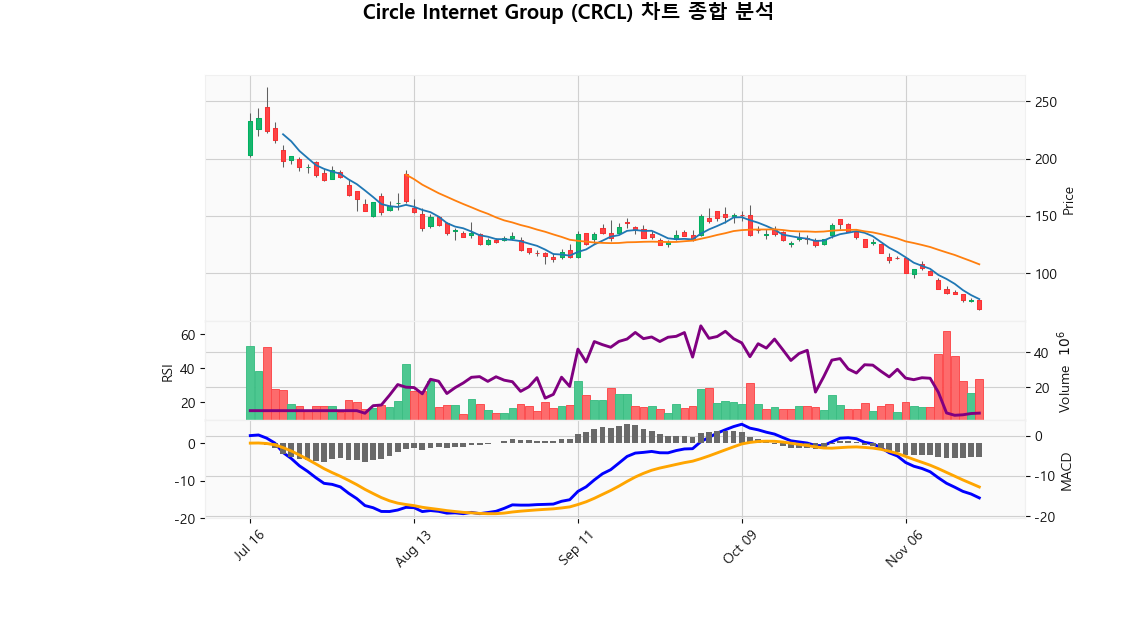

Circle Internet Group (CRCL)

💰 현재가: 87.04

📈 변동률: -11.45%

🔄 거래량 비율: 1.59배

🏷️ 태그: 급등/급락, 거래량 급증

On Holding AG (ONON)

💰 현재가: 41.98

📈 변동률: +19.33%

🔄 거래량 비율: 7.95배

🏷️ 태그: 급등/급락, 거래량 급증

Cambium Networks Corporation (CMBM)

💰 현재가: 3.10

📈 변동률: +37.69%

🔄 거래량 비율: 5.51배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 삼성전자 (005930)

현재가: 103100.00 | 변동률: -0.39% | 거래량 비율: 0.93배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 에이비엘바이오 (298380)

현재가: 126700.00 | 변동률: 29.95% | 거래량 비율: 0.57배

설명:

동사는 2016년 설립, 2018년 코스닥 상장한 바이오의약품 연구개발 전문기업으로 이중항체 기술 기반의 항체치료제를 개발하고 사업화를 진행하고 있음.

The company is a biopharmaceutical research and development company established in 2016 and listed on KOSDAQ in 2018. It is developing and commercializing antibody therapeutics based on dual antibody technology.

🔹 SK하이닉스 (000660)

현재가: 617000.00 | 변동률: -0.32% | 거래량 비율: 0.68배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 하이브 (352820)

현재가: 291000.00 | 변동률: 1.93% | 거래량 비율: 1.35배

설명:

동사는 2005년 설립된 글로벌 엔터테인먼트 기업으로, 한국, 일본, 미국 등 12개 독립 레이블을 운영하며 아티스트를 지속 배출하고 있음.

The company is a global entertainment company founded in 2005, and operates 12 independent labels including Korea, Japan, and the United States, and continues to produce artists.

🔹 두산에너빌리티 (034020)

현재가: 78400.00 | 변동률: 0.26% | 거래량 비율: 0.33배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 Leap Therapeutics, Inc. (LPTX)

현재가: 2.08 | 변동률: 374.89% | 거래량 비율: 216.17배

설명:

Leap Therapeutics, Inc. is a biopharmaceutical company headquartered in Cambridge, Massachusetts, dedicated to the development of groundbreaking cancer therapies. The company specializes in precision medicine, with a robust pipeline of innovative treatments targeting specific oncogenic pathways to address significant unmet medical needs in oncology. By leveraging its expertise and commitment to advancing cancer care, Leap Therapeutics aims to improve patient outcomes and position itself as a key player in the evolving healthcare landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Advanced Micro Devices, Inc. (AMD)

현재가: 255.14 | 변동률: 7.42% | 거래량 비율: 1.96배

설명:

Advanced Micro Devices, Inc. (AMD) is a prominent American semiconductor company based in Santa Clara, California, renowned for its innovative microprocessors, graphics processors, and motherboard chipsets. Catering to diverse markets, including data centers, enterprise solutions, and consumer electronics, AMD's commitment to high-performance computing has positioned it as a significant force in the rapidly evolving semiconductor industry. The company's strategic focus on advancing technology to meet the dynamic needs of both businesses and consumers underscores its potential for continued growth and leadership in the sector.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Circle Internet Group (CRCL)

현재가: 87.04 | 변동률: -11.45% | 거래량 비율: 1.59배

설명:

Circle Internet Group, Inc. is a prominent platform and market infrastructure provider specializing in stablecoins and blockchain applications, making significant strides in the digital currency revolution. Based in New York, the company leverages cutting-edge technology to facilitate secure and efficient financial transactions, enabling both businesses and consumers to fully embrace the advantages of blockchain solutions. As a leader in the burgeoning cryptocurrency space, Circle is committed to promoting global economic empowerment while prioritizing regulatory compliance and security in its operational framework.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 On Holding AG (ONON)

현재가: 41.98 | 변동률: 19.33% | 거래량 비율: 7.95배

설명:

On Holding Ltd (ONON) is an innovative leader in the global athletic footwear and apparel sector, headquartered in Zurich, Switzerland. The company is renowned for its cutting-edge technology that enhances athletic performance while prioritizing sustainable practices, appealing to a growing demographic of eco-conscious consumers. With a diverse and stylish product portfolio, ONON is well-positioned within a competitive market, supported by a strong commitment to research and development and an expanding retail network that underscores its potential for continued growth and global market expansion.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Cambium Networks Corporation (CMBM)

현재가: 3.10 | 변동률: 37.69% | 거래량 비율: 5.51배

설명:

Cambium Networks Corporation (CMBM) is a prominent provider of wireless broadband infrastructure solutions, focused on empowering network operators around the globe to achieve superior connectivity and performance. Based in Rolling Meadows, Illinois, the company excels in delivering cutting-edge fixed, mobile, and satellite connectivity technologies, including point-to-point and point-to-multipoint systems. Through its innovative approach, Cambium Networks addresses the increasing demand for high-speed internet access across various environments, positioning itself as a vital player in the evolving telecommunications landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

📈 시장 요약

S&P500

미국 대형주 대표 지수

📈 +0.23%

Nasdaq

미국 기술주 중심 지수

📉 -0.27%

Dow Jones

30개 전통 우량주 지수

📈 +1.18%

10Y Treasury

미국 10년 만기 국채 수익률

📈 +0.31%

🔹 에이비엘바이오 (298380)

⏱️ 1D 분석

💰 현재가: $126,700.00

📊 거래량: 748,516

📈 RSI: 77.54

📉 MACD: 4403.41

📌 예측:

- 3 기간 → Hold (신뢰도 46.88%)

- 5 기간 → Hold (신뢰도 46.08%)

- 10 기간 → Hold (신뢰도 49.16%)

⏱️ 1WK 분석

💰 현재가: $126,700.00

📊 거래량: 1,994,050

📈 RSI: 72.35

📉 MACD: 11684.46

📌 예측:

- 3 기간 → Sell (신뢰도 52.1%)

- 5 기간 → Sell (신뢰도 48.91%)

- 10 기간 → Sell (신뢰도 49.47%)

⏱️ 1MO 분석

💰 현재가: $126,700.00

📊 거래량: 7,812,564

📈 RSI: 80.89

📉 MACD: 20883.52

📌 예측:

- 3 기간 → Hold (신뢰도 59.22%)

- 5 기간 → Hold (신뢰도 62.56%)

- 10 기간 → Hold (신뢰도 61.11%)

✅ 최종 판단: Sell

📌 판단 근거: 매도 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 150.48

Stock Summary

삼성전자 (005930)

💰 현재가: 103,100.00

📈 변동률: -0.39%

🔄 거래량 비율: 0.93배

🏷️ 태그: 없음

에이비엘바이오 (298380)

💰 현재가: 126,700.00

📈 변동률: +29.95%

🔄 거래량 비율: 0.57배

🏷️ 태그: 급등/급락

SK하이닉스 (000660)

💰 현재가: 617,000.00

📈 변동률: -0.32%

🔄 거래량 비율: 0.68배

🏷️ 태그: 없음

하이브 (352820)

💰 현재가: 291,000.00

📈 변동률: +1.93%

🔄 거래량 비율: 1.35배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 78,400.00

📈 변동률: +0.26%

🔄 거래량 비율: 0.33배

🏷️ 태그: 없음

Leap Therapeutics, Inc. (LPTX)

💰 현재가: 2.08

📈 변동률: +374.89%

🔄 거래량 비율: 216.17배

🏷️ 태그: 급등/급락, 거래량 급증

Advanced Micro Devices, Inc. (AMD)

💰 현재가: 255.14

📈 변동률: +7.42%

🔄 거래량 비율: 1.96배

🏷️ 태그: 급등/급락, 거래량 급증

Circle Internet Group (CRCL)

💰 현재가: 87.04

📈 변동률: -11.45%

🔄 거래량 비율: 1.59배

🏷️ 태그: 급등/급락, 거래량 급증

On Holding AG (ONON)

💰 현재가: 41.98

📈 변동률: +19.33%

🔄 거래량 비율: 7.95배

🏷️ 태그: 급등/급락, 거래량 급증

Cambium Networks Corporation (CMBM)

💰 현재가: 3.10

📈 변동률: +37.69%

🔄 거래량 비율: 5.51배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 삼성전자 (005930)

현재가: 103100.00 | 변동률: -0.39% | 거래량 비율: 0.93배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.**Description:**

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 에이비엘바이오 (298380)

현재가: 126700.00 | 변동률: 29.95% | 거래량 비율: 0.57배

설명:

동사는 2016년 설립, 2018년 코스닥 상장한 바이오의약품 연구개발 전문기업으로 이중항체 기술 기반의 항체치료제를 개발하고 사업화를 진행하고 있음.

→ **English Translation**: The company is a biopharmaceutical research and development company established in 2016 and listed on KOSDAQ in 2018. It is developing and commercializing antibody therapeutics based on dual antibody technology.

🔹 SK하이닉스 (000660)

현재가: 617000.00 | 변동률: -0.32% | 거래량 비율: 0.68배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 하이브 (352820)

현재가: 291000.00 | 변동률: 1.93% | 거래량 비율: 1.35배

설명:

동사는 2005년 설립된 글로벌 엔터테인먼트 기업으로, 한국, 일본, 미국 등 12개 독립 레이블을 운영하며 아티스트를 지속 배출하고 있음.

→ **English Translation**: The company is a global entertainment company founded in 2005, and operates 12 independent labels including Korea, Japan, and the United States, and continues to produce artists.

🔹 두산에너빌리티 (034020)

현재가: 78400.00 | 변동률: 0.26% | 거래량 비율: 0.33배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 Leap Therapeutics, Inc. (LPTX)

현재가: 2.08 | 변동률: 374.89% | 거래량 비율: 216.17배

설명:

Leap Therapeutics, Inc. is a biopharmaceutical company headquartered in Cambridge, Massachusetts, dedicated to the development of groundbreaking cancer therapies. The company specializes in precision medicine, with a robust pipeline of innovative treatments targeting specific oncogenic pathways to address significant unmet medical needs in oncology. By leveraging its expertise and commitment to advancing cancer care, Leap Therapeutics aims to improve patient outcomes and position itself as a key player in the evolving healthcare landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Advanced Micro Devices, Inc. (AMD)

현재가: 255.14 | 변동률: 7.42% | 거래량 비율: 1.96배

설명:

Advanced Micro Devices, Inc. (AMD) is a prominent American semiconductor company based in Santa Clara, California, renowned for its innovative microprocessors, graphics processors, and motherboard chipsets. Catering to diverse markets, including data centers, enterprise solutions, and consumer electronics, AMD's commitment to high-performance computing has positioned it as a significant force in the rapidly evolving semiconductor industry. The company's strategic focus on advancing technology to meet the dynamic needs of both businesses and consumers underscores its potential for continued growth and leadership in the sector.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Circle Internet Group (CRCL)

현재가: 87.04 | 변동률: -11.45% | 거래량 비율: 1.59배

설명:

Circle Internet Group, Inc. is a prominent platform and market infrastructure provider specializing in stablecoins and blockchain applications, making significant strides in the digital currency revolution. Based in New York, the company leverages cutting-edge technology to facilitate secure and efficient financial transactions, enabling both businesses and consumers to fully embrace the advantages of blockchain solutions. As a leader in the burgeoning cryptocurrency space, Circle is committed to promoting global economic empowerment while prioritizing regulatory compliance and security in its operational framework.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 On Holding AG (ONON)

현재가: 41.98 | 변동률: 19.33% | 거래량 비율: 7.95배

설명:

On Holding Ltd (ONON) is an innovative leader in the global athletic footwear and apparel sector, headquartered in Zurich, Switzerland. The company is renowned for its cutting-edge technology that enhances athletic performance while prioritizing sustainable practices, appealing to a growing demographic of eco-conscious consumers. With a diverse and stylish product portfolio, ONON is well-positioned within a competitive market, supported by a strong commitment to research and development and an expanding retail network that underscores its potential for continued growth and global market expansion.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Cambium Networks Corporation (CMBM)

현재가: 3.10 | 변동률: 37.69% | 거래량 비율: 5.51배

설명:

Cambium Networks Corporation (CMBM) is a prominent provider of wireless broadband infrastructure solutions, focused on empowering network operators around the globe to achieve superior connectivity and performance. Based in Rolling Meadows, Illinois, the company excels in delivering cutting-edge fixed, mobile, and satellite connectivity technologies, including point-to-point and point-to-multipoint systems. Through its innovative approach, Cambium Networks addresses the increasing demand for high-speed internet access across various environments, positioning itself as a vital player in the evolving telecommunications landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📈 +0.23%

Nasdaq

미국 기술주 중심 지수

📉 -0.27%

Dow Jones

30개 전통 우량주 지수

📈 +1.18%

10Y Treasury

미국 10년 만기 국채 수익률

📈 +0.31%

🔹 에이비엘바이오 (298380)

⏱️ 1D 분석

💰 현재가: $126,700.00

📊 거래량: 748,516

📈 RSI: 77.54

📉 MACD: 4403.41

📌 예측:

- 3 기간 → Hold (신뢰도 46.88%)

- 5 기간 → Hold (신뢰도 46.08%)

- 10 기간 → Hold (신뢰도 49.16%)

⏱️ 1WK 분석

💰 현재가: $126,700.00

📊 거래량: 1,994,050

📈 RSI: 72.35

📉 MACD: 11684.46

📌 예측:

- 3 기간 → Sell (신뢰도 52.1%)

- 5 기간 → Sell (신뢰도 48.91%)

- 10 기간 → Sell (신뢰도 49.47%)

⏱️ 1MO 분석

💰 현재가: $126,700.00

📊 거래량: 7,812,564

📈 RSI: 80.89

📉 MACD: 20883.52

📌 예측:

- 3 기간 → Hold (신뢰도 59.22%)

- 5 기간 → Hold (신뢰도 62.56%)

- 10 기간 → Hold (신뢰도 61.11%)

✅ 최종 판단: Sell

📌 판단 근거: 매도 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 150.48