[2025-10-25] - AI 주식 분석 요약: SK하이닉스(000660), 삼성SDI(006400), 에코프로(086520)

📊 종목 요약

삼성전자 (005930)

💰 현재가: 98,800.00

📈 변동률: +2.38%

🔄 거래량 비율: 0.91배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 510,000.00

📈 변동률: +6.58%

🔄 거래량 비율: 1.04배

🏷️ 태그: 급등/급락

에코프로 (086520)

💰 현재가: 88,300.00

📈 변동률: +8.34%

🔄 거래량 비율: 2.16배

🏷️ 태그: 급등/급락, 거래량 급증

한화오션 (042660)

💰 현재가: 135,200.00

📈 변동률: +0.22%

🔄 거래량 비율: 0.7배

🏷️ 태그: 없음

삼성SDI (006400)

💰 현재가: 293,000.00

📈 변동률: +13.57%

🔄 거래량 비율: 3.52배

🏷️ 태그: 급등/급락, 거래량 급증

Wellgistics Health, Inc. (WGRX)

💰 현재가: 1.15

📈 변동률: +185.36%

🔄 거래량 비율: 119.65배

🏷️ 태그: 급등/급락, 거래량 급증

Datavault AI Inc. (DVLT)

💰 현재가: 3.42

📈 변동률: +52.00%

🔄 거래량 비율: 16.8배

🏷️ 태그: 급등/급락, 거래량 급증

Advanced Micro Devices, Inc. (AMD)

💰 현재가: 252.92

📈 변동률: +7.63%

🔄 거래량 비율: 1.48배

🏷️ 태그: 급등/급락

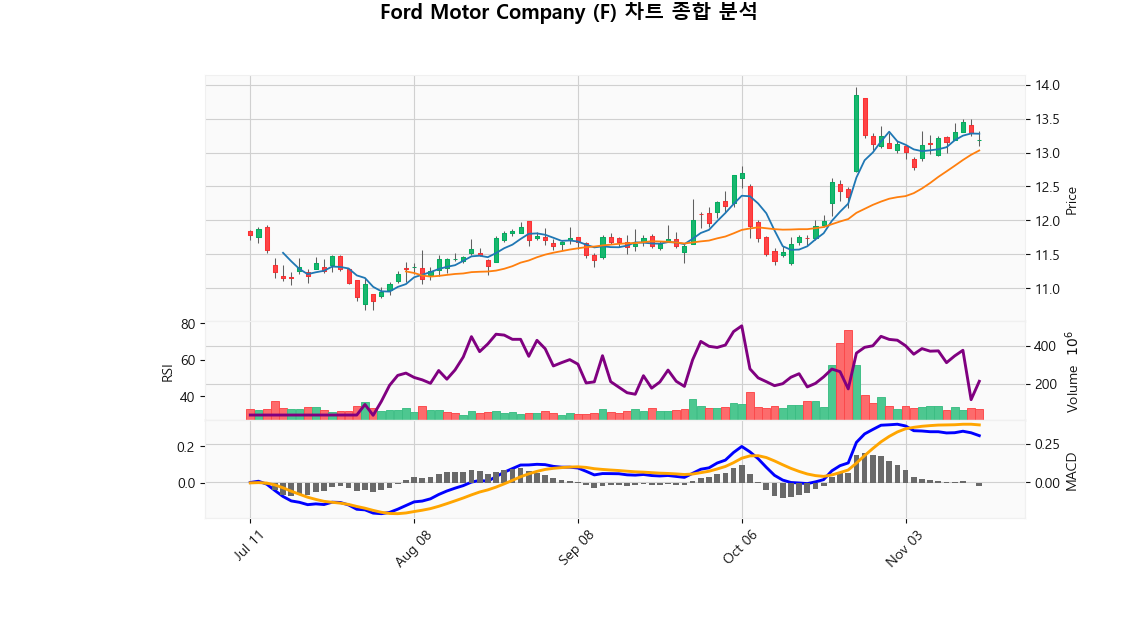

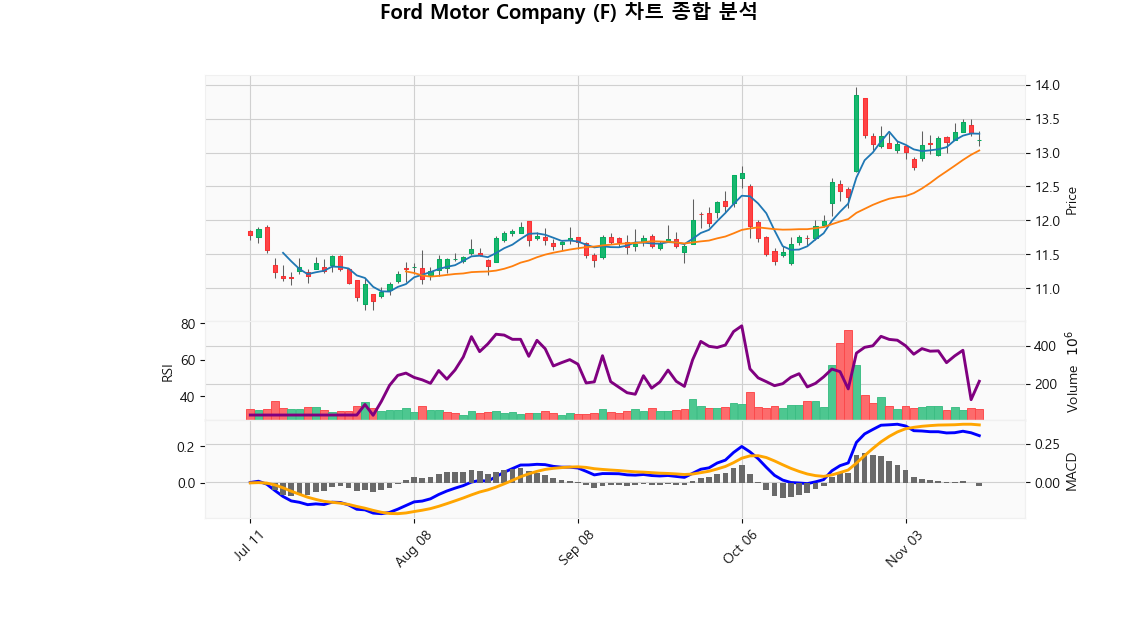

Ford Motor Company (F)

💰 현재가: 13.83

📈 변동률: +12.07%

🔄 거래량 비율: 3.72배

🏷️ 태그: 급등/급락, 거래량 급증

Coinbase Global, Inc. (COIN)

💰 현재가: 354.46

📈 변동률: +9.82%

🔄 거래량 비율: 1.3배

🏷️ 태그: 급등/급락

🔹 삼성전자 (005930)

현재가: 98800.00 | 변동률: 2.38% | 거래량 비율: 0.91배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 SK하이닉스 (000660)

현재가: 510000.00 | 변동률: 6.58% | 거래량 비율: 1.04배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 에코프로 (086520)

현재가: 88300.00 | 변동률: 8.34% | 거래량 비율: 2.16배

설명:

동사는 1998년 설립, 2007년 코스닥 상장 후 2021년 지주회사 체제를 구축하였음.

The company was established in 1998 and established a holding company system in 2021 after being listed on KOSDAQ in 2007.

🔹 한화오션 (042660)

현재가: 135200.00 | 변동률: 0.22% | 거래량 비율: 0.7배

설명:

동사는 2000년 대우중공업 분할로 설립되어 2001년 상장되었으며, 2024년 한화로부터 플랜트·풍력 사업을 양수하고 한화오션디지털을 합병했음.

The company was founded in 2000 as a division of Daewoo Heavy Industries and went public in 2001. In 2024, it acquired the plant and wind power business from Hanwha and merged Hanwha Ocean Digital.

🔹 삼성SDI (006400)

현재가: 293000.00 | 변동률: 13.57% | 거래량 비율: 3.52배

설명:

동사는 1970년 삼성-NEC로 설립되어 기업공개를 했으며, 헝가리, 미국, 말레이시아, 중국에 23개의 종속기업 보유하고 있음.

The company was founded in 1970 as Samsung-NEC and has 23 subsidiaries in Hungary, the United States, Malaysia, and China.

🔹 Wellgistics Health, Inc. (WGRX)

현재가: 1.15 | 변동률: 185.36% | 거래량 비율: 119.65배

설명:

Wellgistics Health, Inc. (WGRX) is a prominent wholesaler and distributor of pharmaceutical products, primarily catering to pharmaceutical manufacturers and independent retail pharmacies throughout the United States. Headquartered in Tampa, Florida, the company is dedicated to improving the accessibility and distribution efficiency of critical medications, thereby reinforcing its essential position within the healthcare supply chain. Wellgistics Health prides itself on delivering high-quality service and fostering robust relationships within the industry, ultimately empowering pharmacies to enhance healthcare delivery in their communities.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Datavault AI Inc. (DVLT)

현재가: 3.42 | 변동률: 52.0% | 거래량 비율: 16.8배

설명:

Datavault AI Inc. is a forward-thinking technology company located in Beaverton, Oregon, that specializes in sophisticated data management solutions and supercomputing capabilities. By harnessing advanced artificial intelligence and machine learning technologies, Datavault AI empowers organizations to efficiently analyze and leverage large data sets, driving informed decision-making and improving operational efficiencies. Positioned at the forefront of the evolving data sciences landscape, the company serves a broad array of industries, making it a compelling player in the marketplace for data-driven innovation.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Advanced Micro Devices, Inc. (AMD)

현재가: 252.92 | 변동률: 7.63% | 거래량 비율: 1.48배

설명:

Advanced Micro Devices, Inc. (AMD) is a prominent American semiconductor company based in Santa Clara, California, renowned for its innovative microprocessors, graphics processors, and motherboard chipsets. Catering to diverse markets, including data centers, enterprise solutions, and consumer electronics, AMD's commitment to high-performance computing has positioned it as a significant force in the rapidly evolving semiconductor industry. The company's strategic focus on advancing technology to meet the dynamic needs of both businesses and consumers underscores its potential for continued growth and leadership in the sector.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Ford Motor Company (F)

현재가: 13.83 | 변동률: 12.07% | 거래량 비율: 3.72배

설명:

Ford Motor Company, a leading American multinational automaker headquartered in Dearborn, Michigan, has been a pioneer in the automotive industry since its founding in 1903. Renowned for its innovation in manufacturing and design, Ford has established itself as a key player in the global market, offering a diverse range of vehicles including trucks, SUVs, and electric models. The company is committed to advancing mobility solutions through sustainable practices and cutting-edge technology, positioning itself at the forefront of the industry’s transition towards electrification and digital connectivity. With a strong brand heritage and a focus on customer satisfaction, Ford is poised for continued growth and adaptation in an evolving automotive landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Coinbase Global, Inc. (COIN)

현재가: 354.46 | 변동률: 9.82% | 거래량 비율: 1.3배

설명:

Coinbase Global, Inc. (COIN) is a prominent cryptocurrency exchange and financial services platform headquartered in Wilmington, Delaware. It is a key player in the mainstream adoption of digital assets, providing a secure and user-friendly platform for both retail and institutional clients to buy, sell, and trade a diverse range of cryptocurrencies. With advanced technology and infrastructure, Coinbase fosters innovation in the crypto economy, enabling users to effectively manage their digital portfolios while advocating for the broader acceptance of blockchain technology. As a publicly traded entity, Coinbase continues to lead in the evolving landscape of financial services, bridging traditional finance with the burgeoning realm of cryptocurrency.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

📈 시장 요약

S&P500

미국 대형주 대표 지수

📈 +0.59%

Nasdaq

미국 기술주 중심 지수

📈 +0.84%

Dow Jones

30개 전통 우량주 지수

📈 +0.32%

10Y Treasury

미국 10년 만기 국채 수익률

📉 -0.33%

🔹 SK하이닉스 (000660)

⏱️ 1D 분석

💰 현재가: $510,000.00

📊 거래량: 4,227,217

📈 RSI: 87.27

📉 MACD: 46749.62

📌 예측:

- 3 기간 → Hold (신뢰도 62.22%)

- 5 기간 → Hold (신뢰도 62.38%)

- 10 기간 → Hold (신뢰도 62.98%)

⏱️ 1WK 분석

💰 현재가: $510,000.00

📊 거래량: 19,142,247

📈 RSI: 84.43

📉 MACD: 60324.51

📌 예측:

- 3 기간 → Hold (신뢰도 59.98%)

- 5 기간 → Hold (신뢰도 60.03%)

- 10 기간 → Hold (신뢰도 59.05%)

⏱️ 1MO 분석

💰 현재가: $510,000.00

📊 거래량: 56,146,644

📈 RSI: 85.07

📉 MACD: 58693.37

📌 예측:

- 3 기간 → Hold (신뢰도 56.72%)

- 5 기간 → Hold (신뢰도 56.65%)

- 10 기간 → Hold (신뢰도 52.11%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 삼성SDI (006400)

⏱️ 1D 분석

💰 현재가: $293,000.00

📊 거래량: 1,641,056

📈 RSI: 92.23

📉 MACD: 17228.0

📌 예측:

- 3 기간 → Hold (신뢰도 54.54%)

- 5 기간 → Hold (신뢰도 58.2%)

- 10 기간 → Hold (신뢰도 62.89%)

⏱️ 1WK 분석

💰 현재가: $293,000.00

📊 거래량: 4,657,998

📈 RSI: 84.0

📉 MACD: 10648.0

📌 예측:

- 3 기간 → Hold (신뢰도 54.79%)

- 5 기간 → Hold (신뢰도 51.2%)

- 10 기간 → Hold (신뢰도 48.75%)

⏱️ 1MO 분석

💰 현재가: $293,000.00

📊 거래량: 11,382,220

📈 RSI: 42.51

📉 MACD: -71644.21

📌 예측:

- 3 기간 → Sell (신뢰도 59.84%)

- 5 기간 → Sell (신뢰도 59.87%)

- 10 기간 → Sell (신뢰도 60.24%)

✅ 최종 판단: Sell

📌 판단 근거: 매도 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 184.95

🔹 에코프로 (086520)

⏱️ 1D 분석

💰 현재가: $88,300.00

📊 거래량: 2,332,887

📈 RSI: 83.64

📉 MACD: 8785.01

📌 예측:

- 3 기간 → Hold (신뢰도 59.96%)

- 5 기간 → Hold (신뢰도 59.95%)

- 10 기간 → Hold (신뢰도 59.2%)

⏱️ 1WK 분석

💰 현재가: $88,300.00

📊 거래량: 24,297,422

📈 RSI: 77.89

📉 MACD: 3022.19

📌 예측:

- 3 기간 → Hold (신뢰도 61.16%)

- 5 기간 → Hold (신뢰도 57.37%)

- 10 기간 → Hold (신뢰도 53.97%)

⏱️ 1MO 분석

💰 현재가: $88,300.00

📊 거래량: 41,953,323

📈 RSI: 51.91

📉 MACD: -8341.18

📌 예측:

- 3 기간 → Hold (신뢰도 59.28%)

- 5 기간 → Hold (신뢰도 58.51%)

- 10 기간 → Hold (신뢰도 61.59%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00

Stock Summary

삼성전자 (005930)

💰 현재가: 98,800.00

📈 변동률: +2.38%

🔄 거래량 비율: 0.91배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 510,000.00

📈 변동률: +6.58%

🔄 거래량 비율: 1.04배

🏷️ 태그: 급등/급락

에코프로 (086520)

💰 현재가: 88,300.00

📈 변동률: +8.34%

🔄 거래량 비율: 2.16배

🏷️ 태그: 급등/급락, 거래량 급증

한화오션 (042660)

💰 현재가: 135,200.00

📈 변동률: +0.22%

🔄 거래량 비율: 0.7배

🏷️ 태그: 없음

삼성SDI (006400)

💰 현재가: 293,000.00

📈 변동률: +13.57%

🔄 거래량 비율: 3.52배

🏷️ 태그: 급등/급락, 거래량 급증

Wellgistics Health, Inc. (WGRX)

💰 현재가: 1.15

📈 변동률: +185.36%

🔄 거래량 비율: 119.65배

🏷️ 태그: 급등/급락, 거래량 급증

Datavault AI Inc. (DVLT)

💰 현재가: 3.42

📈 변동률: +52.00%

🔄 거래량 비율: 16.8배

🏷️ 태그: 급등/급락, 거래량 급증

Advanced Micro Devices, Inc. (AMD)

💰 현재가: 252.92

📈 변동률: +7.63%

🔄 거래량 비율: 1.48배

🏷️ 태그: 급등/급락

Ford Motor Company (F)

💰 현재가: 13.83

📈 변동률: +12.07%

🔄 거래량 비율: 3.72배

🏷️ 태그: 급등/급락, 거래량 급증

Coinbase Global, Inc. (COIN)

💰 현재가: 354.46

📈 변동률: +9.82%

🔄 거래량 비율: 1.3배

🏷️ 태그: 급등/급락

🔹 삼성전자 (005930)

현재가: 98800.00 | 변동률: 2.38% | 거래량 비율: 0.91배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.**Description:**

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 SK하이닉스 (000660)

현재가: 510000.00 | 변동률: 6.58% | 거래량 비율: 1.04배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 에코프로 (086520)

현재가: 88300.00 | 변동률: 8.34% | 거래량 비율: 2.16배

설명:

동사는 1998년 설립, 2007년 코스닥 상장 후 2021년 지주회사 체제를 구축하였음.

→ **English Translation**: The company was established in 1998 and established a holding company system in 2021 after being listed on KOSDAQ in 2007.

🔹 한화오션 (042660)

현재가: 135200.00 | 변동률: 0.22% | 거래량 비율: 0.7배

설명:

동사는 2000년 대우중공업 분할로 설립되어 2001년 상장되었으며, 2024년 한화로부터 플랜트·풍력 사업을 양수하고 한화오션디지털을 합병했음.

→ **English Translation**: The company was founded in 2000 as a division of Daewoo Heavy Industries and went public in 2001. In 2024, it acquired the plant and wind power business from Hanwha and merged Hanwha Ocean Digital.

🔹 삼성SDI (006400)

현재가: 293000.00 | 변동률: 13.57% | 거래량 비율: 3.52배

설명:

동사는 1970년 삼성-NEC로 설립되어 기업공개를 했으며, 헝가리, 미국, 말레이시아, 중국에 23개의 종속기업 보유하고 있음.

→ **English Translation**: The company was founded in 1970 as Samsung-NEC and has 23 subsidiaries in Hungary, the United States, Malaysia, and China.

🔹 Wellgistics Health, Inc. (WGRX)

현재가: 1.15 | 변동률: 185.36% | 거래량 비율: 119.65배

설명:

Wellgistics Health, Inc. (WGRX) is a prominent wholesaler and distributor of pharmaceutical products, primarily catering to pharmaceutical manufacturers and independent retail pharmacies throughout the United States. Headquartered in Tampa, Florida, the company is dedicated to improving the accessibility and distribution efficiency of critical medications, thereby reinforcing its essential position within the healthcare supply chain. Wellgistics Health prides itself on delivering high-quality service and fostering robust relationships within the industry, ultimately empowering pharmacies to enhance healthcare delivery in their communities.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Datavault AI Inc. (DVLT)

현재가: 3.42 | 변동률: 52.0% | 거래량 비율: 16.8배

설명:

Datavault AI Inc. is a forward-thinking technology company located in Beaverton, Oregon, that specializes in sophisticated data management solutions and supercomputing capabilities. By harnessing advanced artificial intelligence and machine learning technologies, Datavault AI empowers organizations to efficiently analyze and leverage large data sets, driving informed decision-making and improving operational efficiencies. Positioned at the forefront of the evolving data sciences landscape, the company serves a broad array of industries, making it a compelling player in the marketplace for data-driven innovation.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Advanced Micro Devices, Inc. (AMD)

현재가: 252.92 | 변동률: 7.63% | 거래량 비율: 1.48배

설명:

Advanced Micro Devices, Inc. (AMD) is a prominent American semiconductor company based in Santa Clara, California, renowned for its innovative microprocessors, graphics processors, and motherboard chipsets. Catering to diverse markets, including data centers, enterprise solutions, and consumer electronics, AMD's commitment to high-performance computing has positioned it as a significant force in the rapidly evolving semiconductor industry. The company's strategic focus on advancing technology to meet the dynamic needs of both businesses and consumers underscores its potential for continued growth and leadership in the sector.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Ford Motor Company (F)

현재가: 13.83 | 변동률: 12.07% | 거래량 비율: 3.72배

설명:

Ford Motor Company, a leading American multinational automaker headquartered in Dearborn, Michigan, has been a pioneer in the automotive industry since its founding in 1903. Renowned for its innovation in manufacturing and design, Ford has established itself as a key player in the global market, offering a diverse range of vehicles including trucks, SUVs, and electric models. The company is committed to advancing mobility solutions through sustainable practices and cutting-edge technology, positioning itself at the forefront of the industry’s transition towards electrification and digital connectivity. With a strong brand heritage and a focus on customer satisfaction, Ford is poised for continued growth and adaptation in an evolving automotive landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Coinbase Global, Inc. (COIN)

현재가: 354.46 | 변동률: 9.82% | 거래량 비율: 1.3배

설명:

Coinbase Global, Inc. (COIN) is a prominent cryptocurrency exchange and financial services platform headquartered in Wilmington, Delaware. It is a key player in the mainstream adoption of digital assets, providing a secure and user-friendly platform for both retail and institutional clients to buy, sell, and trade a diverse range of cryptocurrencies. With advanced technology and infrastructure, Coinbase fosters innovation in the crypto economy, enabling users to effectively manage their digital portfolios while advocating for the broader acceptance of blockchain technology. As a publicly traded entity, Coinbase continues to lead in the evolving landscape of financial services, bridging traditional finance with the burgeoning realm of cryptocurrency.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📈 +0.59%

Nasdaq

미국 기술주 중심 지수

📈 +0.84%

Dow Jones

30개 전통 우량주 지수

📈 +0.32%

10Y Treasury

미국 10년 만기 국채 수익률

📉 -0.33%

🔹 SK하이닉스 (000660)

⏱️ 1D 분석

💰 현재가: $510,000.00

📊 거래량: 4,227,217

📈 RSI: 87.27

📉 MACD: 46749.62

📌 예측:

- 3 기간 → Hold (신뢰도 62.22%)

- 5 기간 → Hold (신뢰도 62.38%)

- 10 기간 → Hold (신뢰도 62.98%)

⏱️ 1WK 분석

💰 현재가: $510,000.00

📊 거래량: 19,142,247

📈 RSI: 84.43

📉 MACD: 60324.51

📌 예측:

- 3 기간 → Hold (신뢰도 59.98%)

- 5 기간 → Hold (신뢰도 60.03%)

- 10 기간 → Hold (신뢰도 59.05%)

⏱️ 1MO 분석

💰 현재가: $510,000.00

📊 거래량: 56,146,644

📈 RSI: 85.07

📉 MACD: 58693.37

📌 예측:

- 3 기간 → Hold (신뢰도 56.72%)

- 5 기간 → Hold (신뢰도 56.65%)

- 10 기간 → Hold (신뢰도 52.11%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 삼성SDI (006400)

⏱️ 1D 분석

💰 현재가: $293,000.00

📊 거래량: 1,641,056

📈 RSI: 92.23

📉 MACD: 17228.0

📌 예측:

- 3 기간 → Hold (신뢰도 54.54%)

- 5 기간 → Hold (신뢰도 58.2%)

- 10 기간 → Hold (신뢰도 62.89%)

⏱️ 1WK 분석

💰 현재가: $293,000.00

📊 거래량: 4,657,998

📈 RSI: 84.0

📉 MACD: 10648.0

📌 예측:

- 3 기간 → Hold (신뢰도 54.79%)

- 5 기간 → Hold (신뢰도 51.2%)

- 10 기간 → Hold (신뢰도 48.75%)

⏱️ 1MO 분석

💰 현재가: $293,000.00

📊 거래량: 11,382,220

📈 RSI: 42.51

📉 MACD: -71644.21

📌 예측:

- 3 기간 → Sell (신뢰도 59.84%)

- 5 기간 → Sell (신뢰도 59.87%)

- 10 기간 → Sell (신뢰도 60.24%)

✅ 최종 판단: Sell

📌 판단 근거: 매도 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 184.95

🔹 에코프로 (086520)

⏱️ 1D 분석

💰 현재가: $88,300.00

📊 거래량: 2,332,887

📈 RSI: 83.64

📉 MACD: 8785.01

📌 예측:

- 3 기간 → Hold (신뢰도 59.96%)

- 5 기간 → Hold (신뢰도 59.95%)

- 10 기간 → Hold (신뢰도 59.2%)

⏱️ 1WK 분석

💰 현재가: $88,300.00

📊 거래량: 24,297,422

📈 RSI: 77.89

📉 MACD: 3022.19

📌 예측:

- 3 기간 → Hold (신뢰도 61.16%)

- 5 기간 → Hold (신뢰도 57.37%)

- 10 기간 → Hold (신뢰도 53.97%)

⏱️ 1MO 분석

💰 현재가: $88,300.00

📊 거래량: 41,953,323

📈 RSI: 51.91

📉 MACD: -8341.18

📌 예측:

- 3 기간 → Hold (신뢰도 59.28%)

- 5 기간 → Hold (신뢰도 58.51%)

- 10 기간 → Hold (신뢰도 61.59%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00