[2025-09-22] - AI 주식 분석 요약: 현대차(005380), Costco Wholesale Corporation(COST)

📊 종목 요약

삼성전자 (005930)

💰 현재가: 79,700.00

📈 변동률: -0.99%

🔄 거래량 비율: 0.97배

🏷️ 태그: 없음

알테오젠 (196170)

💰 현재가: 472,500.00

📈 변동률: -0.21%

🔄 거래량 비율: 0.49배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 60,800.00

📈 변동률: +0.33%

🔄 거래량 비율: 0.54배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 353,000.00

📈 변동률: +0.00%

🔄 거래량 비율: 0.96배

🏷️ 태그: 없음

현대차 (005380)

💰 현재가: 214,000.00

📈 변동률: -2.06%

🔄 거래량 비율: 1.66배

🏷️ 태그: 거래량 급증

Centrus Energy Corp. (LEU)

💰 현재가: 294.49

📈 변동률: +12.12%

🔄 거래량 비율: 3.91배

🏷️ 태그: 급등/급락, 거래량 급증

Turning Point Brands, Inc. (TPB)

💰 현재가: 102.20

📈 변동률: +0.19%

🔄 거래량 비율: 4.0배

🏷️ 태그: 거래량 급증

Costco Wholesale Corporation (COST)

💰 현재가: 951.16

📈 변동률: -0.13%

🔄 거래량 비율: 2.25배

🏷️ 태그: 거래량 급증

Firefly Aerospace Inc. (FLY)

💰 현재가: 45.20

📈 변동률: -0.04%

🔄 거래량 비율: 0.96배

🏷️ 태그: 없음

Uranium Energy Corp. (UEC)

💰 현재가: 12.35

📈 변동률: +0.73%

🔄 거래량 비율: 3.67배

🏷️ 태그: 거래량 급증

🔹 삼성전자 (005930)

현재가: 79700.00 | 변동률: -0.99% | 거래량 비율: 0.97배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 알테오젠 (196170)

현재가: 472500.00 | 변동률: -0.21% | 거래량 비율: 0.49배

설명:

동사는 2008년 설립된 바이오의약품 연구개발 기업으로 히알루로니다제 단백질 공학 기술, NexP™ 융합, NexMab™ ADC 기술 등의 플랫폼 기술을 보유하고 있음.

The company was founded in 2008 as a biopharmaceutical research and development company with platform technologies such as hyaluronidase protein engineering technology, NexP™ fusion, and NexMab™ ADC technology.

🔹 두산에너빌리티 (034020)

현재가: 60800.00 | 변동률: 0.33% | 거래량 비율: 0.54배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 SK하이닉스 (000660)

현재가: 353000.00 | 변동률: 0.0% | 거래량 비율: 0.96배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 현대차 (005380)

현재가: 214000.00 | 변동률: -2.06% | 거래량 비율: 1.66배

설명:

동사는 1967년 설립됐으며, 자동차 및 부품 제조·판매, 금융, 철도차량 제작을 하는 기업임.

The company was founded in 1967 and is a company that manufactures and sells automobiles and parts, finance, and railway vehicles.

🔹 Centrus Energy Corp. (LEU)

현재가: 294.49 | 변동률: 12.12% | 거래량 비율: 3.91배

설명:

Centrus Energy Corp. (LEU), headquartered in Bethesda, Maryland, is a leading supplier of nuclear fuel and services, specializing in the development and commercialization of advanced nuclear technologies. The company plays a critical role in the global energy landscape by providing innovative solutions to enhance the safety and efficiency of nuclear power production. With a focus on addressing the growing demand for low-carbon energy sources, Centrus is uniquely positioned to support the transition to a sustainable energy future through its strategic partnerships and cutting-edge advancements in uranium enrichment technology.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Turning Point Brands, Inc. (TPB)

현재가: 102.20 | 변동률: 0.19% | 거래량 비율: 4.0배

설명:

Turning Point Brands, Inc. is a leading manufacturer and distributor of innovative consumer products, specializing in the tobacco and alternative nicotine category. Headquartered in Louisville, Kentucky, the company focuses on developing and selling unconventional products that cater to adult consumers, including vaping, smoking accessories, and premium cigars. With a strong commitment to brand development and market expansion, Turning Point Brands leverages strategic acquisitions and partnerships to enhance its portfolio and strengthen its position within the evolving tobacco landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Costco Wholesale Corporation (COST)

현재가: 951.16 | 변동률: -0.13% | 거래량 비율: 2.25배

설명:

Costco Wholesale Corporation is a leading American multinational retail giant known for its membership-based warehouse stores, offering a wide range of products including groceries, electronics, and household goods. As of 2020, it ranked as the fifth largest retailer globally and has established itself as the top retailer of choice beef, organic foods, rotisserie chicken, and wine. With a strong focus on value and customer loyalty, Costco continues to expand its market presence, leveraging its bulk purchasing strategy to maintain competitive pricing while delivering a high-quality shopping experience. The company's robust financial health and commitment to sustainable sourcing further underscore its attractiveness to institutional investors.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Firefly Aerospace Inc. (FLY)

현재가: 45.20 | 변동률: -0.04% | 거래량 비율: 0.96배

설명:

Fly Leasing Limited (ticker: FLY) is a leading global company specializing in the acquisition and leasing of commercial aircraft to airlines on long-term agreements. Headquartered in Dun Laoghaire, Ireland, Fly Leasing strategically manages a diverse portfolio of aircraft, thereby catering to various airlines around the globe and adapting to the dynamic needs of the aviation sector. The company is positioned to capitalize on the recovery of air travel demand, making it a compelling investment opportunity for institutional investors seeking exposure to the aerospace industry's growth potential.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Uranium Energy Corp. (UEC)

현재가: 12.35 | 변동률: 0.73% | 거래량 비율: 3.67배

설명:

Uranium Energy Corp. (UEC) is a leading uranium mining and exploration company based in Corpus Christi, Texas, specializing in the production of uranium through innovative in-situ recovery techniques. The company holds a diverse portfolio of uranium projects across the United States, including several fully licensed and operational facilities. With a strong commitment to sustainable mining and environmental stewardship, UEC is strategically positioned to capitalize on the growing demand for clean energy and nuclear fuel, making it an integral player in the global uranium market.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

📈 시장 요약

S&P500

미국 대형주 대표 지수

📈 +0.22%

Nasdaq

미국 기술주 중심 지수

📈 +0.68%

Dow Jones

30개 전통 우량주 지수

📈 +0.07%

10Y Treasury

미국 10년 만기 국채 수익률

📉 -0.04%

🔹 현대차 (005380)

⏱️ 1D 분석

💰 현재가: $214,000.00

📊 거래량: 1,268,729

📈 RSI: 37.74

📉 MACD: 13.52

📌 예측:

- 3 기간 → Hold (신뢰도 69.86%)

- 5 기간 → Hold (신뢰도 69.51%)

- 10 기간 → Hold (신뢰도 69.73%)

⏱️ 1WK 분석

💰 현재가: $214,000.00

📊 거래량: 4,539,266

📈 RSI: 62.1

📉 MACD: 4332.97

📌 예측:

- 3 기간 → Hold (신뢰도 58.08%)

- 5 기간 → Hold (신뢰도 57.89%)

- 10 기간 → Hold (신뢰도 55.42%)

⏱️ 1MO 분석

💰 현재가: $214,000.00

📊 거래량: 8,817,153

📈 RSI: 36.82

📉 MACD: 261.72

📌 예측:

- 3 기간 → Hold (신뢰도 63.19%)

- 5 기간 → Hold (신뢰도 65.65%)

- 10 기간 → Hold (신뢰도 65.64%)

✅ 최종 판단: Sell

📌 판단 근거: 매도 신호가 우세

💹 매수 점수: 5.00 | 매도 점수: 10.00

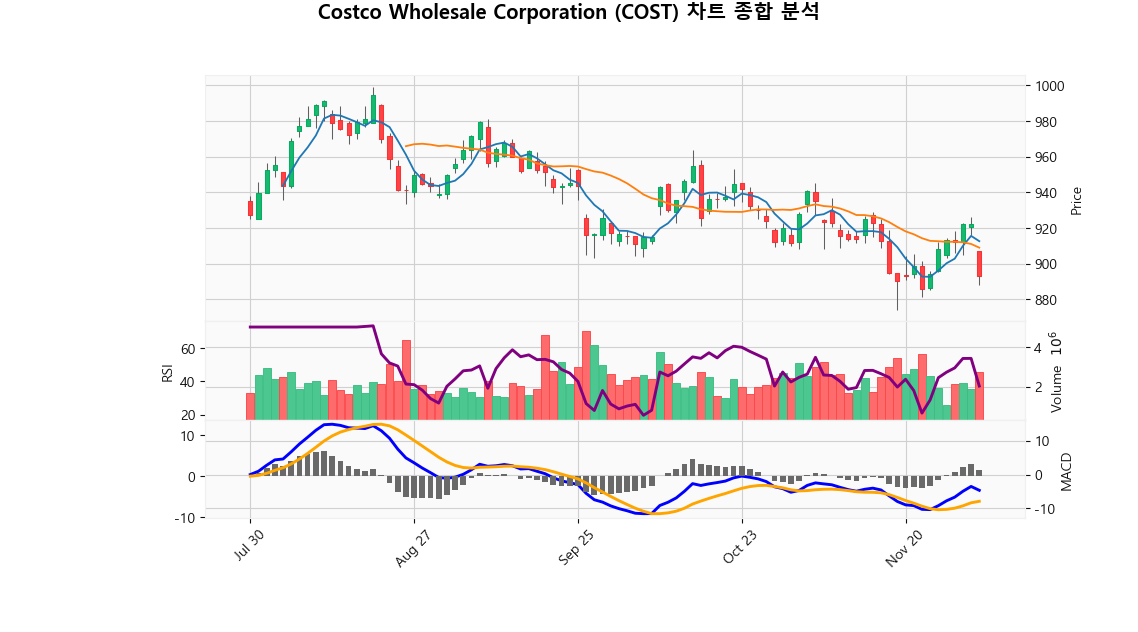

🔹 Costco Wholesale Corporation (COST)

⏱️ 1D 분석

💰 현재가: $1,040.18

📊 거래량: 5,247,947

📈 RSI: 60.28

📉 MACD: 11.01

📌 예측:

- 3 기간 → Hold (신뢰도 51.46%)

- 5 기간 → Hold (신뢰도 50.24%)

- 10 기간 → Hold (신뢰도 53.93%)

⏱️ 1WK 분석

💰 현재가: $951.16

📊 거래량: 12,235,763

📈 RSI: 39.87

📉 MACD: -2.72

📌 예측:

- 3 기간 → Hold (신뢰도 85.04%)

- 5 기간 → Hold (신뢰도 84.04%)

- 10 기간 → Hold (신뢰도 84.77%)

⏱️ 1MO 분석

💰 현재가: $951.16

📊 거래량: 27,591,398

📈 RSI: 59.45

📉 MACD: 93.58

📌 예측:

- 3 기간 → Hold (신뢰도 58.08%)

- 5 기간 → Hold (신뢰도 57.98%)

- 10 기간 → Hold (신뢰도 58.51%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00

Stock Summary

삼성전자 (005930)

💰 현재가: 79,700.00

📈 변동률: -0.99%

🔄 거래량 비율: 0.97배

🏷️ 태그: 없음

알테오젠 (196170)

💰 현재가: 472,500.00

📈 변동률: -0.21%

🔄 거래량 비율: 0.49배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 60,800.00

📈 변동률: +0.33%

🔄 거래량 비율: 0.54배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 353,000.00

📈 변동률: +0.00%

🔄 거래량 비율: 0.96배

🏷️ 태그: 없음

현대차 (005380)

💰 현재가: 214,000.00

📈 변동률: -2.06%

🔄 거래량 비율: 1.66배

🏷️ 태그: 거래량 급증

Centrus Energy Corp. (LEU)

💰 현재가: 294.49

📈 변동률: +12.12%

🔄 거래량 비율: 3.91배

🏷️ 태그: 급등/급락, 거래량 급증

Turning Point Brands, Inc. (TPB)

💰 현재가: 102.20

📈 변동률: +0.19%

🔄 거래량 비율: 4.0배

🏷️ 태그: 거래량 급증

Costco Wholesale Corporation (COST)

💰 현재가: 951.16

📈 변동률: -0.13%

🔄 거래량 비율: 2.25배

🏷️ 태그: 거래량 급증

Firefly Aerospace Inc. (FLY)

💰 현재가: 45.20

📈 변동률: -0.04%

🔄 거래량 비율: 0.96배

🏷️ 태그: 없음

Uranium Energy Corp. (UEC)

💰 현재가: 12.35

📈 변동률: +0.73%

🔄 거래량 비율: 3.67배

🏷️ 태그: 거래량 급증

🔹 삼성전자 (005930)

현재가: 79700.00 | 변동률: -0.99% | 거래량 비율: 0.97배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.**Description:**

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 알테오젠 (196170)

현재가: 472500.00 | 변동률: -0.21% | 거래량 비율: 0.49배

설명:

동사는 2008년 설립된 바이오의약품 연구개발 기업으로 히알루로니다제 단백질 공학 기술, NexP™ 융합, NexMab™ ADC 기술 등의 플랫폼 기술을 보유하고 있음.

→ **English Translation**: The company was founded in 2008 as a biopharmaceutical research and development company with platform technologies such as hyaluronidase protein engineering technology, NexP™ fusion, and NexMab™ ADC technology.

🔹 두산에너빌리티 (034020)

현재가: 60800.00 | 변동률: 0.33% | 거래량 비율: 0.54배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 SK하이닉스 (000660)

현재가: 353000.00 | 변동률: 0.0% | 거래량 비율: 0.96배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 현대차 (005380)

현재가: 214000.00 | 변동률: -2.06% | 거래량 비율: 1.66배

설명:

동사는 1967년 설립됐으며, 자동차 및 부품 제조·판매, 금융, 철도차량 제작을 하는 기업임.

→ **English Translation**: The company was founded in 1967 and is a company that manufactures and sells automobiles and parts, finance, and railway vehicles.

🔹 Centrus Energy Corp. (LEU)

현재가: 294.49 | 변동률: 12.12% | 거래량 비율: 3.91배

설명:

Centrus Energy Corp. (LEU), headquartered in Bethesda, Maryland, is a leading supplier of nuclear fuel and services, specializing in the development and commercialization of advanced nuclear technologies. The company plays a critical role in the global energy landscape by providing innovative solutions to enhance the safety and efficiency of nuclear power production. With a focus on addressing the growing demand for low-carbon energy sources, Centrus is uniquely positioned to support the transition to a sustainable energy future through its strategic partnerships and cutting-edge advancements in uranium enrichment technology.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Turning Point Brands, Inc. (TPB)

현재가: 102.20 | 변동률: 0.19% | 거래량 비율: 4.0배

설명:

Turning Point Brands, Inc. is a leading manufacturer and distributor of innovative consumer products, specializing in the tobacco and alternative nicotine category. Headquartered in Louisville, Kentucky, the company focuses on developing and selling unconventional products that cater to adult consumers, including vaping, smoking accessories, and premium cigars. With a strong commitment to brand development and market expansion, Turning Point Brands leverages strategic acquisitions and partnerships to enhance its portfolio and strengthen its position within the evolving tobacco landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Costco Wholesale Corporation (COST)

현재가: 951.16 | 변동률: -0.13% | 거래량 비율: 2.25배

설명:

Costco Wholesale Corporation is a leading American multinational retail giant known for its membership-based warehouse stores, offering a wide range of products including groceries, electronics, and household goods. As of 2020, it ranked as the fifth largest retailer globally and has established itself as the top retailer of choice beef, organic foods, rotisserie chicken, and wine. With a strong focus on value and customer loyalty, Costco continues to expand its market presence, leveraging its bulk purchasing strategy to maintain competitive pricing while delivering a high-quality shopping experience. The company's robust financial health and commitment to sustainable sourcing further underscore its attractiveness to institutional investors.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Firefly Aerospace Inc. (FLY)

현재가: 45.20 | 변동률: -0.04% | 거래량 비율: 0.96배

설명:

Fly Leasing Limited (ticker: FLY) is a leading global company specializing in the acquisition and leasing of commercial aircraft to airlines on long-term agreements. Headquartered in Dun Laoghaire, Ireland, Fly Leasing strategically manages a diverse portfolio of aircraft, thereby catering to various airlines around the globe and adapting to the dynamic needs of the aviation sector. The company is positioned to capitalize on the recovery of air travel demand, making it a compelling investment opportunity for institutional investors seeking exposure to the aerospace industry's growth potential.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Uranium Energy Corp. (UEC)

현재가: 12.35 | 변동률: 0.73% | 거래량 비율: 3.67배

설명:

Uranium Energy Corp. (UEC) is a leading uranium mining and exploration company based in Corpus Christi, Texas, specializing in the production of uranium through innovative in-situ recovery techniques. The company holds a diverse portfolio of uranium projects across the United States, including several fully licensed and operational facilities. With a strong commitment to sustainable mining and environmental stewardship, UEC is strategically positioned to capitalize on the growing demand for clean energy and nuclear fuel, making it an integral player in the global uranium market.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📈 +0.22%

Nasdaq

미국 기술주 중심 지수

📈 +0.68%

Dow Jones

30개 전통 우량주 지수

📈 +0.07%

10Y Treasury

미국 10년 만기 국채 수익률

📉 -0.04%

🔹 현대차 (005380)

⏱️ 1D 분석

💰 현재가: $214,000.00

📊 거래량: 1,268,729

📈 RSI: 37.74

📉 MACD: 13.52

📌 예측:

- 3 기간 → Hold (신뢰도 69.86%)

- 5 기간 → Hold (신뢰도 69.51%)

- 10 기간 → Hold (신뢰도 69.73%)

⏱️ 1WK 분석

💰 현재가: $214,000.00

📊 거래량: 4,539,266

📈 RSI: 62.1

📉 MACD: 4332.97

📌 예측:

- 3 기간 → Hold (신뢰도 58.08%)

- 5 기간 → Hold (신뢰도 57.89%)

- 10 기간 → Hold (신뢰도 55.42%)

⏱️ 1MO 분석

💰 현재가: $214,000.00

📊 거래량: 8,817,153

📈 RSI: 36.82

📉 MACD: 261.72

📌 예측:

- 3 기간 → Hold (신뢰도 63.19%)

- 5 기간 → Hold (신뢰도 65.65%)

- 10 기간 → Hold (신뢰도 65.64%)

✅ 최종 판단: Sell

📌 판단 근거: 매도 신호가 우세

💹 매수 점수: 5.00 | 매도 점수: 10.00

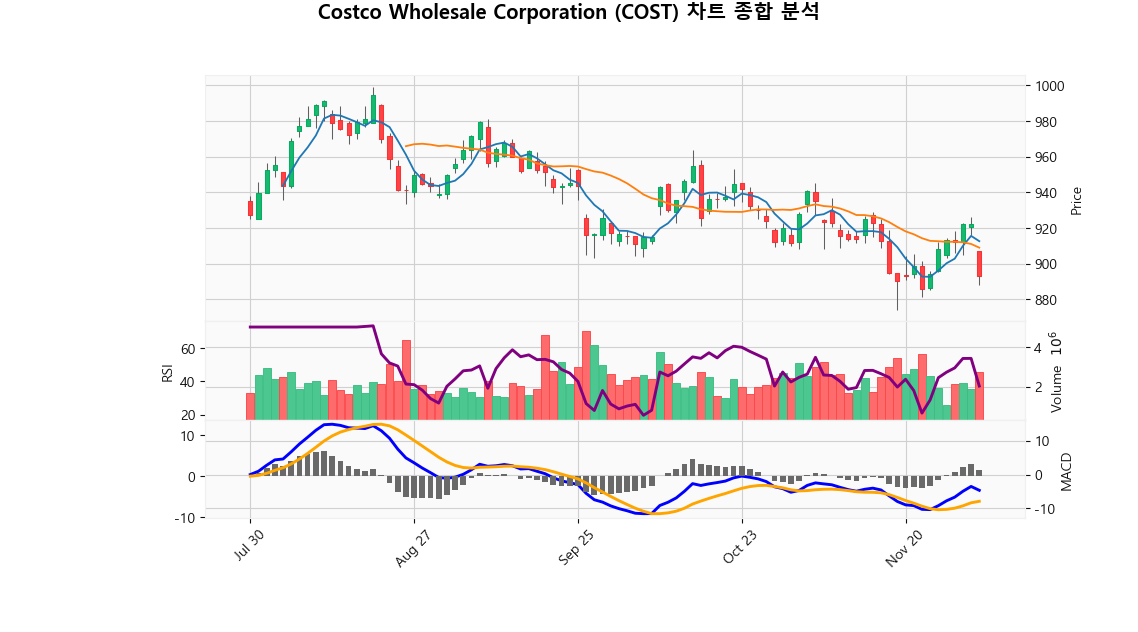

🔹 Costco Wholesale Corporation (COST)

⏱️ 1D 분석

💰 현재가: $1,040.18

📊 거래량: 5,247,947

📈 RSI: 60.28

📉 MACD: 11.01

📌 예측:

- 3 기간 → Hold (신뢰도 51.46%)

- 5 기간 → Hold (신뢰도 50.24%)

- 10 기간 → Hold (신뢰도 53.93%)

⏱️ 1WK 분석

💰 현재가: $951.16

📊 거래량: 12,235,763

📈 RSI: 39.87

📉 MACD: -2.72

📌 예측:

- 3 기간 → Hold (신뢰도 85.04%)

- 5 기간 → Hold (신뢰도 84.04%)

- 10 기간 → Hold (신뢰도 84.77%)

⏱️ 1MO 분석

💰 현재가: $951.16

📊 거래량: 27,591,398

📈 RSI: 59.45

📉 MACD: 93.58

📌 예측:

- 3 기간 → Hold (신뢰도 58.08%)

- 5 기간 → Hold (신뢰도 57.98%)

- 10 기간 → Hold (신뢰도 58.51%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00