[2025-12-15] AI Stock Analysis & Market Summary

Stock Summary

삼성전자 (005930)

💰 현재가: 108,900.00

📈 변동률: +1.49%

🔄 거래량 비율: 0.65배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 571,000.00

📈 변동률: +1.06%

🔄 거래량 비율: 0.64배

🏷️ 태그: 없음

클로봇 (466100)

💰 현재가: 65,200.00

📈 변동률: +26.85%

🔄 거래량 비율: 3.59배

🏷️ 태그: 급등/급락, 거래량 급증

두산에너빌리티 (034020)

💰 현재가: 79,700.00

📈 변동률: +3.10%

🔄 거래량 비율: 0.63배

🏷️ 태그: 없음

알테오젠 (196170)

💰 현재가: 433,000.00

📈 변동률: -4.52%

🔄 거래량 비율: 0.99배

🏷️ 태그: 없음

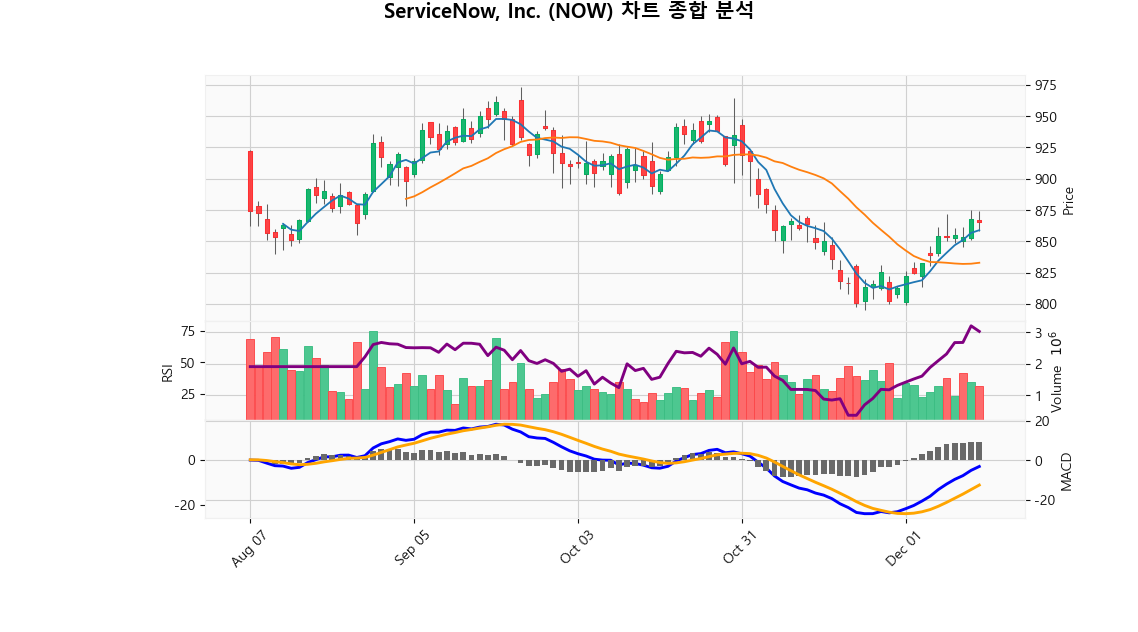

ServiceNow, Inc. (NOW)

💰 현재가: 865.06

📈 변동률: -0.28%

🔄 거래량 비율: 0.86배

🏷️ 태그: 없음

Strategy Inc (MSTR)

💰 현재가: 176.45

📈 변동률: -3.74%

🔄 거래량 비율: 0.89배

🏷️ 태그: 없음

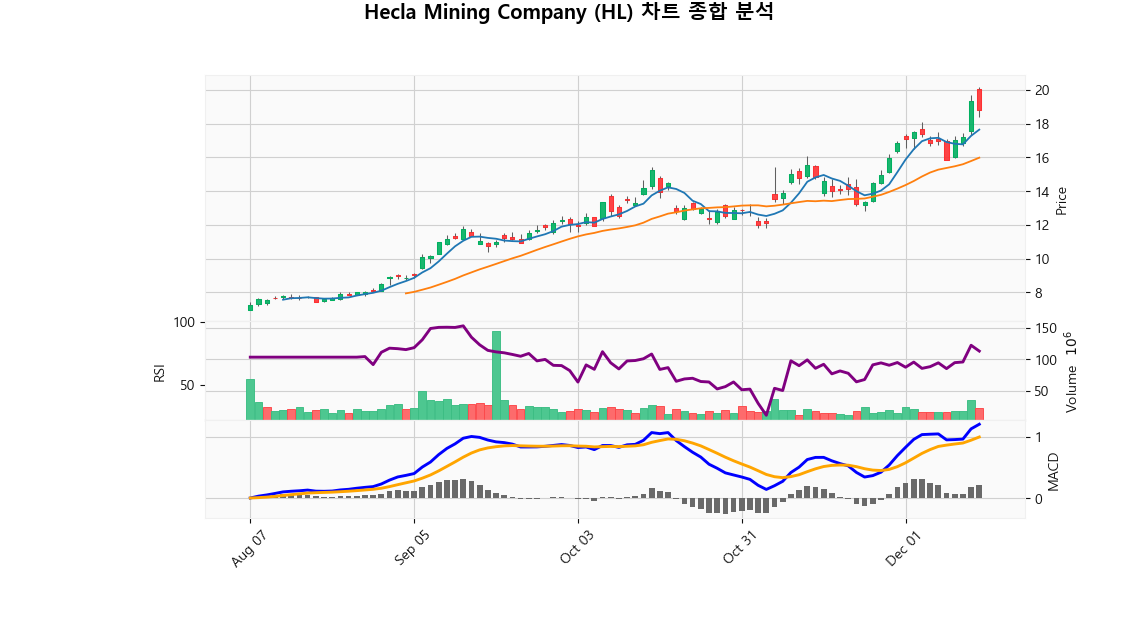

Hecla Mining Company (HL)

💰 현재가: 18.81

📈 변동률: -2.79%

🔄 거래량 비율: 1.34배

🏷️ 태그: 없음

NIKE, Inc. (NKE)

💰 현재가: 67.47

📈 변동률: -0.40%

🔄 거래량 비율: 1.01배

🏷️ 태그: 없음

Arm Holdings plc (ARM)

💰 현재가: 130.89

📈 변동률: -3.86%

🔄 거래량 비율: 0.49배

🏷️ 태그: 없음

🔹 삼성전자 (005930)

현재가: 108900.00 | 변동률: 1.49% | 거래량 비율: 0.65배

설명:

동사는 1969년 설립되어 1975년 유가증권시장에 상장하였으며, 2017년 Harman 인수로 전장부품 사업을 확장함.**Description:**

The company was founded in 1969 and listed on the securities market in 1975, and expanded its electronic parts business with the acquisition of Harman in 2017.

🔹 SK하이닉스 (000660)

현재가: 571000.00 | 변동률: 1.06% | 거래량 비율: 0.64배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 클로봇 (466100)

현재가: 65200.00 | 변동률: 26.85% | 거래량 비율: 3.59배

설명:

동사는 2024년 코스닥시장에 상장한 로봇 솔루션 전문기업임.

→ **English Translation**: The company is a robot solution specialist listed on the KOSDAQ market in 2024.

🔹 두산에너빌리티 (034020)

현재가: 79700.00 | 변동률: 3.1% | 거래량 비율: 0.63배

설명:

동사는 1962년 현대양행으로 설립되어 1980년 한국중공업으로 변경 후 2001년 두산그룹에 인수되어 2022년 두산에너빌리티로 상호를 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962, changed to Hankook Heavy Industries in 1980, and was acquired by Doosan Group in 2001, changing its name to Doosan Energy Company in 2022.

🔹 알테오젠 (196170)

현재가: 433000.00 | 변동률: -4.52% | 거래량 비율: 0.99배

설명:

동사는 2008년 설립된 바이오의약품 연구개발 및 판매 기업으로 2014년 코스닥시장에 상장함.

→ **English Translation**: The company is a biopharmaceutical R&D and sales company established in 2008 and listed on the KOSDAQ market in 2014.

🔹 ServiceNow, Inc. (NOW)

현재가: 865.06 | 변동률: -0.28% | 거래량 비율: 0.86배

설명:

ServiceNow Inc. (NOW), headquartered in Santa Clara, California, is a leading provider of cloud-based software solutions that streamline and automate enterprise workflows. By leveraging innovative technology and data analytics, ServiceNow enhances operational efficiency, drives service excellence, and improves customer experiences across diverse industries. A pivotal player in the enterprise service management arena, the company is committed to continuous innovation, offering customized solutions that empower organizations to thrive in their digital transformation journeys and adapt to evolving market needs.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Strategy Inc (MSTR)

현재가: 176.45 | 변동률: -3.74% | 거래량 비율: 0.89배

설명:

MicroStrategy Incorporated (MSTR), based in Tysons Corner, Virginia, is a prominent player in enterprise analytics and business intelligence software solutions, offering a robust platform that enables organizations to harness data for strategic decision-making. The company is distinguished not only for its advanced analytics capabilities but also for its substantial investment in Bitcoin, positioning itself as a pioneer at the intersection of technology and cryptocurrency. This dual focus on analytics and digital assets enhances MicroStrategy's business model, providing a unique value proposition for institutional investors seeking exposure to innovative technology and digital currency markets. As the company continues to evolve, it remains committed to empowering businesses with critical insights while exploring new financial avenues.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Hecla Mining Company (HL)

현재가: 18.81 | 변동률: -2.79% | 거래량 비율: 1.34배

설명:

Hecla Mining Company (HL) is a prominent player in the precious and base metals sector, dedicated to the exploration, acquisition, development, and production of mineral properties both domestically and internationally. Headquartered in Coeur d'Alene, Idaho, the company is recognized as one of the largest silver producers in North America while also engaging significantly in gold mining, positioning it as a critical participant in the commodities market. Hecla's commitment to sustainable mining practices and operational excellence reinforces its reputation and appeal to institutional investors seeking exposure to essential metals in an evolving economic landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 NIKE, Inc. (NKE)

현재가: 67.47 | 변동률: -0.4% | 거래량 비율: 1.01배

설명:

Nike, Inc. is the premier global athletic brand based in Beaverton, Oregon, renowned for its cutting-edge footwear, apparel, and sporting equipment. As the largest supplier in its category, Nike harnesses a potent combination of brand equity and innovative marketing to uphold its market leadership. The company is dedicated to sustainability and technological innovation, consistently improving its product line and enhancing customer loyalty across a wide range of demographics. With a strong global supply chain and a focus on expanding digital sales, Nike is strategically poised to leverage emerging trends in both the athletic and lifestyle markets, ensuring continued growth and dominance in the industry.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Arm Holdings plc (ARM)

현재가: 130.89 | 변동률: -3.86% | 거래량 비율: 0.49배

설명:

Arm Holdings plc is a premier technology firm renowned for its pioneering design and licensing of CPU architecture, which serves as a critical foundation for semiconductor manufacturers and original equipment manufacturers (OEMs) across diverse electronic products. Leveraging a rich portfolio of cutting-edge designs, Arm empowers its partners to develop energy-efficient, high-performance processors that drive innovations in smartphones, servers, and beyond. As an integral player in the semiconductor landscape, Arm's intellectual property is instrumental in advancing technologies related to artificial intelligence, the Internet of Things (IoT), and automotive solutions, positioning the company for substantial growth in an era of heightened connectivity.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📉 -1.08%

Nasdaq

미국 기술주 중심 지수

📉 -1.91%

Dow Jones

30개 전통 우량주 지수

📉 -0.51%

10Y Treasury

미국 10년 만기 국채 수익률

데이터 부족

🔹 클로봇 (466100)

⏱️ 1D 분석

💰 현재가: N/A

📊 거래량: N/A

📈 RSI: N/A

📉 MACD: N/A

⚠️ 예측 정보 없음

⏱️ 1WK 분석

💰 현재가: N/A

📊 거래량: N/A

📈 RSI: N/A

📉 MACD: N/A

⚠️ 예측 정보 없음

✅ 최종 판단: N/A

📌 판단 근거: 정보 없음

💹 매수 점수: 0.00 | 매도 점수: 0.00