[2025-12-13] - AI Stock Analysis Summary: 한올바이오파마(009420), 클로봇(466100)

Stock Summary

삼성전자 (005930)

💰 현재가: 108,900.00

📈 변동률: +1.49%

🔄 거래량 비율: 0.65배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 571,000.00

📈 변동률: +1.06%

🔄 거래량 비율: 0.64배

🏷️ 태그: 없음

클로봇 (466100)

💰 현재가: 65,200.00

📈 변동률: +26.85%

🔄 거래량 비율: 3.59배

🏷️ 태그: 급등/급락, 거래량 급증

두산에너빌리티 (034020)

💰 현재가: 79,700.00

📈 변동률: +3.10%

🔄 거래량 비율: 0.63배

🏷️ 태그: 없음

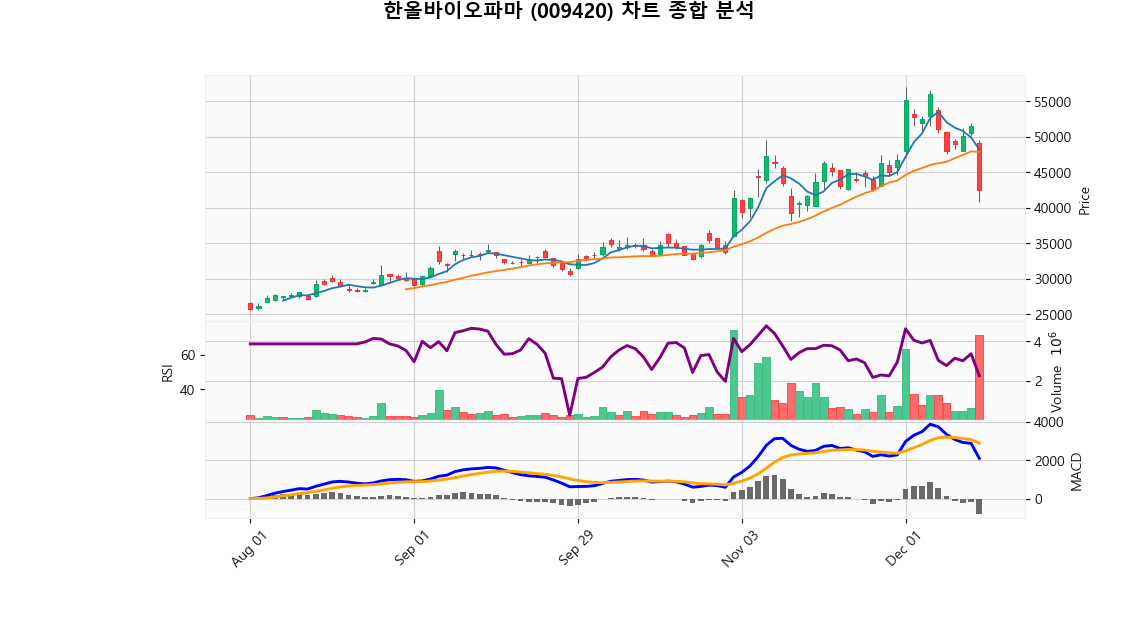

한올바이오파마 (009420)

💰 현재가: 42,550.00

📈 변동률: -17.38%

🔄 거래량 비율: 7.55배

🏷️ 태그: 급등/급락, 거래량 급증

Broadcom Inc. (AVGO)

💰 현재가: 358.33

📈 변동률: -11.82%

🔄 거래량 비율: 2.51배

🏷️ 태그: 급등/급락, 거래량 급증

Tilray Brands, Inc. (TLRY)

💰 현재가: 11.80

📈 변동률: +39.98%

🔄 거래량 비율: 16.68배

🏷️ 태그: 급등/급락, 거래량 급증

Canopy Growth Corporation (CGC)

💰 현재가: 1.67

📈 변동률: +47.85%

🔄 거래량 비율: 11.52배

🏷️ 태그: 급등/급락, 거래량 급증

Fermi Inc. (FRMI)

💰 현재가: 10.10

📈 변동률: -33.77%

🔄 거래량 비율: 8.51배

🏷️ 태그: 급등/급락, 거래량 급증

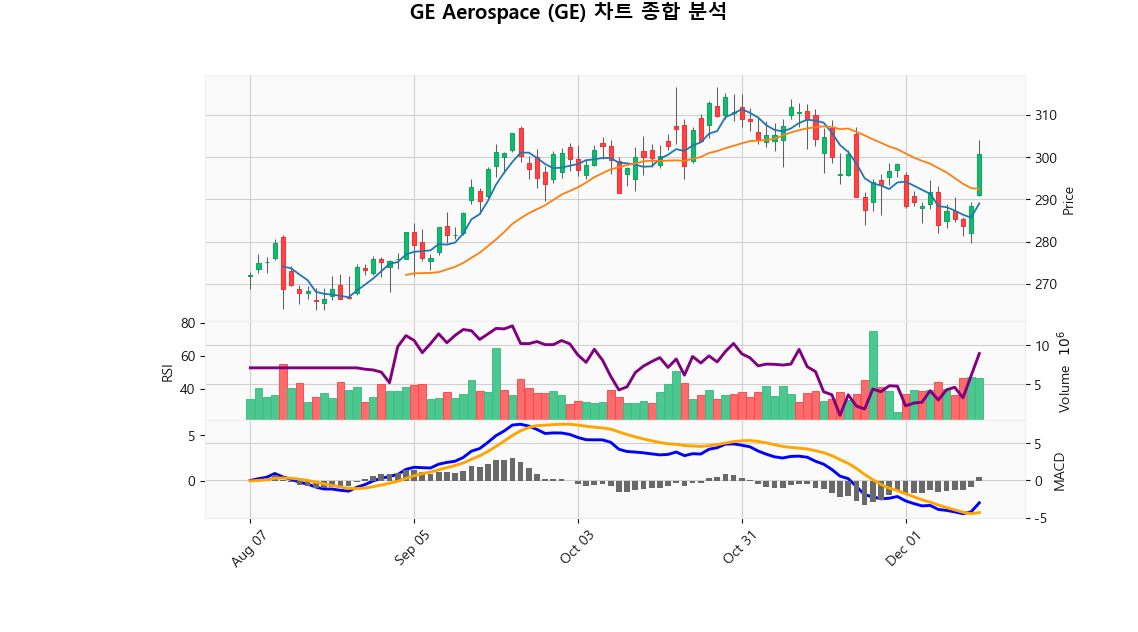

GE Aerospace (GE)

💰 현재가: 300.75

📈 변동률: +4.28%

🔄 거래량 비율: 1.1배

🏷️ 태그: 없음

🔹 삼성전자 (005930)

현재가: 108900.00 | 변동률: 1.49% | 거래량 비율: 0.65배

설명:

동사는 1969년 설립되어 1975년 유가증권시장에 상장하였으며, 2017년 Harman 인수로 전장부품 사업을 확장함.**Description:**

The company was founded in 1969 and listed on the securities market in 1975, and expanded its electronic parts business with the acquisition of Harman in 2017.

🔹 SK하이닉스 (000660)

현재가: 571000.00 | 변동률: 1.06% | 거래량 비율: 0.64배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 클로봇 (466100)

현재가: 65200.00 | 변동률: 26.85% | 거래량 비율: 3.59배

설명:

동사는 2024년 코스닥시장에 상장한 로봇 솔루션 전문기업임.

→ **English Translation**: The company is a robot solution specialist listed on the KOSDAQ market in 2024.

🔹 두산에너빌리티 (034020)

현재가: 79700.00 | 변동률: 3.1% | 거래량 비율: 0.63배

설명:

동사는 1962년 현대양행으로 설립되어 1980년 한국중공업으로 변경 후 2001년 두산그룹에 인수되어 2022년 두산에너빌리티로 상호를 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962, changed to Hankook Heavy Industries in 1980, and was acquired by Doosan Group in 2001, changing its name to Doosan Energy Company in 2022.

🔹 한올바이오파마 (009420)

현재가: 42550.00 | 변동률: -17.38% | 거래량 비율: 7.55배

설명:

동사는 1973년 설립 후 1989년 한국거래소에 상장된 제약회사로, 미국 법인 HPI를 통해 신약 해외임상과 라이선스 업무를 맡고 있음.

→ **English Translation**: The company is a pharmaceutical company that was listed on the Korea Exchange in 1989 after its establishment in 1973, and is in charge of oversea clinical trials and licensing of new drugs through HPI, a U.S. corporation.

🔹 Broadcom Inc. (AVGO)

현재가: 358.33 | 변동률: -11.82% | 거래량 비율: 2.51배

설명:

Broadcom Inc. is a premier American technology firm that excels in semiconductor and infrastructure software solutions, serving vital sectors including data centers, networking, broadband, wireless, and storage. The company is recognized for its cutting-edge products that enhance connectivity and data processing, thereby facilitating digital transformation across diverse industries. With a strategic focus on growth through acquisitions and substantial research and development investments, Broadcom is strategically positioned to leverage emerging technologies such as 5G, cloud computing, and the Internet of Things (IoT). As a dominant player in the global semiconductor market, Broadcom is poised for sustained growth in an increasingly interconnected landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Tilray Brands, Inc. (TLRY)

현재가: 11.80 | 변동률: 39.98% | 거래량 비율: 16.68배

설명:

Tilray Inc. is a leading global player in the cannabis industry, focusing on the research, cultivation, production, and distribution of medicinal cannabis and cannabinoids. Headquartered in Leamington, Canada, Tilray leverages its extensive expertise to innovate across various product categories, aiming to set new standards in quality and compliance. With a commitment to advancing the industry through scientific research and responsible operations, Tilray is well-positioned to capitalize on the growing demand for cannabis products in both medicinal and recreational markets worldwide.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Canopy Growth Corporation (CGC)

현재가: 1.67 | 변동률: 47.85% | 거래량 비율: 11.52배

설명:

Canopy Growth Corporation (CGC) is a prominent Canadian cannabis company specializing in the cultivation, distribution, and sale of a comprehensive portfolio of cannabis and hemp-based products for medicinal and recreational purposes. With a strong foothold in Canada, the United States, and Germany, Canopy Growth employs cutting-edge research and development to drive product innovation and enhance market presence in the rapidly evolving cannabis sector. Headquartered in Smiths Falls, Ontario, the company is well-positioned to leverage opportunities arising from the expanding legal cannabis landscape, making it an attractive proposition for institutional investors seeking exposure in this dynamic market.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Fermi Inc. (FRMI)

현재가: 10.10 | 변동률: -33.77% | 거래량 비율: 8.51배

설명:

None

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: 해당 없음

🔹 GE Aerospace (GE)

현재가: 300.75 | 변동률: 4.28% | 거래량 비율: 1.1배

설명:

General Electric Company (GE) is a leading American multinational conglomerate headquartered in Boston, recognized for its cutting-edge innovations across aerospace, healthcare, power generation, and renewable energy sectors. With a legacy of excellence in aviation manufacturing, GE is committed to pioneering digital technologies that improve operational efficiencies and drive sustainable growth. The company’s strategic investments in additive manufacturing and financial services enhance its competitive position and enable it to meet varied customer needs. Focused on transforming industries and advancing healthcare outcomes, GE is poised for long-term success and significant value creation in the global market.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📈 +0.23%

Nasdaq

미국 기술주 중심 지수

데이터 부족

Dow Jones

30개 전통 우량주 지수

데이터 부족

10Y Treasury

미국 10년 만기 국채 수익률

📈 +0.01%

🔹 한올바이오파마 (009420)

⏱️ 1D 분석

💰 현재가: N/A

📊 거래량: N/A

📈 RSI: N/A

📉 MACD: N/A

⚠️ 예측 정보 없음

⏱️ 1WK 분석

💰 현재가: N/A

📊 거래량: N/A

📈 RSI: N/A

📉 MACD: N/A

⚠️ 예측 정보 없음

⏱️ 1MO 분석

💰 현재가: N/A

📊 거래량: N/A

📈 RSI: N/A

📉 MACD: N/A

⚠️ 예측 정보 없음

✅ 최종 판단: N/A

📌 판단 근거: 정보 없음

💹 매수 점수: 0.00 | 매도 점수: 0.00

🔹 클로봇 (466100)

⏱️ 1D 분석

💰 현재가: N/A

📊 거래량: N/A

📈 RSI: N/A

📉 MACD: N/A

⚠️ 예측 정보 없음

⏱️ 1WK 분석

💰 현재가: N/A

📊 거래량: N/A

📈 RSI: N/A

📉 MACD: N/A

⚠️ 예측 정보 없음

✅ 최종 판단: N/A

📌 판단 근거: 정보 없음

💹 매수 점수: 0.00 | 매도 점수: 0.00