[2025-12-11] - AI Stock Analysis Summary: 에코프로(086520), 에이비엘바이오(298380)

Stock Summary

SK하이닉스 (000660)

💰 현재가: 587,000.00

📈 변동률: +3.71%

🔄 거래량 비율: 0.97배

🏷️ 태그: 없음

삼성전자 (005930)

💰 현재가: 108,000.00

📈 변동률: -0.37%

🔄 거래량 비율: 0.59배

🏷️ 태그: 없음

에이비엘바이오 (298380)

💰 현재가: 203,000.00

📈 변동률: +9.02%

🔄 거래량 비율: 1.18배

🏷️ 태그: 급등/급락

에코프로 (086520)

💰 현재가: 116,800.00

📈 변동률: -0.85%

🔄 거래량 비율: 4.26배

🏷️ 태그: 거래량 급증

두산에너빌리티 (034020)

💰 현재가: 76,800.00

📈 변동률: +0.13%

🔄 거래량 비율: 0.29배

🏷️ 태그: 없음

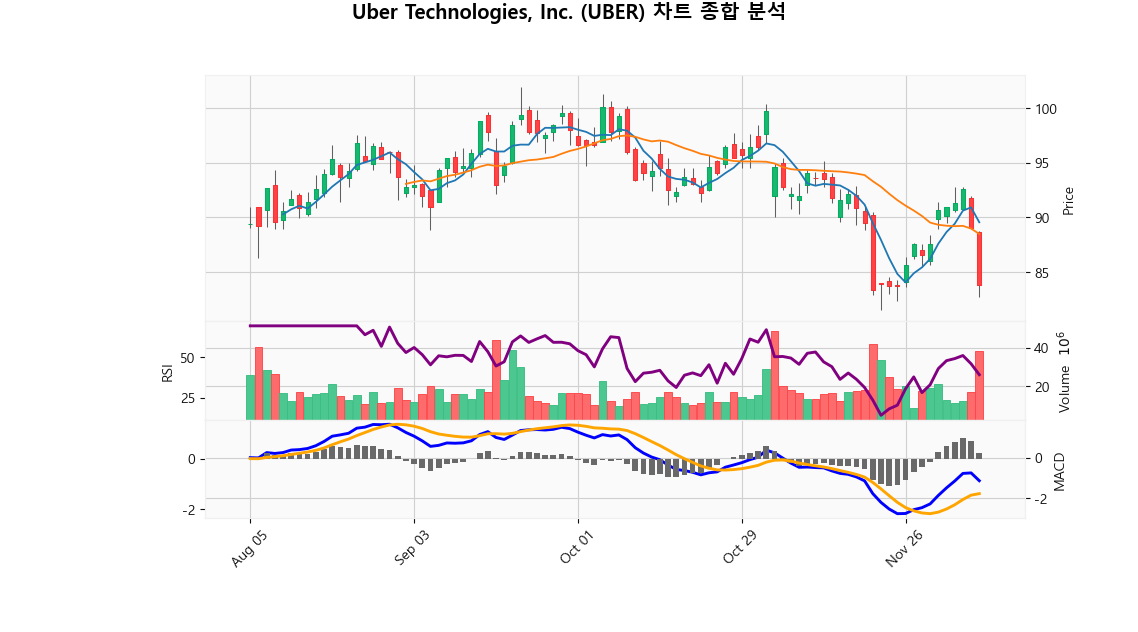

Uber Technologies, Inc. (UBER)

💰 현재가: 83.86

📈 변동률: -5.85%

🔄 거래량 비율: 1.92배

🏷️ 태그: 급등/급락, 거래량 급증

Novo Nordisk A/S (NVO)

💰 현재가: 49.12

📈 변동률: +5.94%

🔄 거래량 비율: 1.19배

🏷️ 태그: 급등/급락

GE Vernova Inc. (GEV)

💰 현재가: 728.65

📈 변동률: +16.53%

🔄 거래량 비율: 2.94배

🏷️ 태그: 급등/급락, 거래량 급증

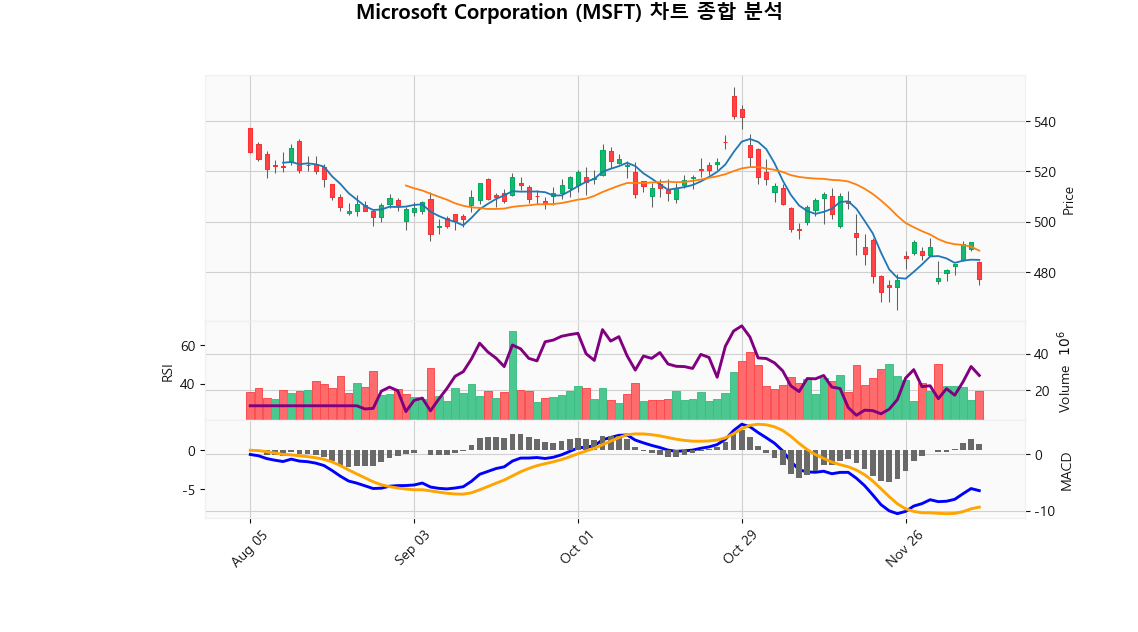

Microsoft Corporation (MSFT)

💰 현재가: 477.32

📈 변동률: -2.99%

🔄 거래량 비율: 0.93배

🏷️ 태그: 없음

Lyft, Inc. (LYFT)

💰 현재가: 20.10

📈 변동률: -7.71%

🔄 거래량 비율: 0.89배

🏷️ 태그: 급등/급락

🔹 SK하이닉스 (000660)

현재가: 587000.00 | 변동률: 3.71% | 거래량 비율: 0.97배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.**Description:**

Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 삼성전자 (005930)

현재가: 108000.00 | 변동률: -0.37% | 거래량 비율: 0.59배

설명:

동사는 1969년 설립되어 1975년 유가증권시장에 상장하였으며, 2017년 Harman 인수로 전장부품 사업을 확장함.

→ **English Translation**: The company was founded in 1969 and listed on the securities market in 1975, and expanded its electronic parts business with the acquisition of Harman in 2017.

🔹 에이비엘바이오 (298380)

현재가: 203000.00 | 변동률: 9.02% | 거래량 비율: 1.18배

설명:

동사는 2016년 설립돼 2018년 코스닥에 상장한 바이오의약품 연구개발 전문기업임.

→ **English Translation**: The company was founded in 2016 and listed on KOSDAQ in 2018, specializing in biopharmaceutical research and development.

🔹 에코프로 (086520)

현재가: 116800.00 | 변동률: -0.85% | 거래량 비율: 4.26배

설명:

동사는 1998년 설립 후 2007년 코스닥에 상장하고, 2016년 이차전지소재 사업을 분할하여 에코프로비엠을, 2021년 환경사업을 분할하여 에코프로에이치엔을 설립하며 지주회사 체제를 구축함.

→ **English Translation**: Since its establishment in 1998, the company was listed on KOSDAQ in 2007, and in 2016, it divided its secondary battery material business to form EcoProBM, and in 2021, it divided its environmental business to form EcoProHEN, establishing a holding company system.

🔹 두산에너빌리티 (034020)

현재가: 76800.00 | 변동률: 0.13% | 거래량 비율: 0.29배

설명:

동사는 1962년 현대양행으로 설립되어 1980년 한국중공업으로 변경 후 2001년 두산그룹에 인수되어 2022년 두산에너빌리티로 상호를 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962, changed to Hankook Heavy Industries in 1980, and was acquired by Doosan Group in 2001, changing its name to Doosan Energy Company in 2022.

🔹 Uber Technologies, Inc. (UBER)

현재가: 83.86 | 변동률: -5.85% | 거래량 비율: 1.92배

설명:

Uber Technologies, Inc. is a leading American technology company transforming the transportation and logistics sectors through its innovative digital platform. Founded in San Francisco, Uber operates in multiple segments, including ride-hailing, food delivery via Uber Eats, and freight services, positioning itself at the forefront of the mobility revolution. The company is committed to sustainability, expanding into urban mobility with electric bicycles and scooters, while leveraging cutting-edge technology to improve user experience and operational efficiency. As a key player in the dynamic global mobility ecosystem, Uber continues to shape the future of urban transportation.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Novo Nordisk A/S (NVO)

현재가: 49.12 | 변동률: 5.94% | 거래량 비율: 1.19배

설명:

Novo Nordisk A/S (NVO) is a premier global healthcare company headquartered in Bagsvaerd, Denmark, renowned for its expertise in diabetes care, obesity treatment, and hormone replacement therapies. The company stands at the forefront of innovation, utilizing advanced biotechnology and rigorous scientific research to develop and manufacture high-quality pharmaceutical products aimed at chronic disease management. As a leader in the biopharmaceutical sector, Novo Nordisk is dedicated to enhancing patient outcomes and promoting sustainability, while upholding a strong commitment to ethical business practices and corporate responsibility.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 GE Vernova Inc. (GEV)

현재가: 728.65 | 변동률: 16.53% | 거래량 비율: 2.94배

설명:

GE Vernova LLC is a prominent energy enterprise at the forefront of sustainable electricity solutions, leveraging innovative technologies and a diverse portfolio of renewable assets in wind, solar, and hydroelectric power. The company plays a strategic role in the global transition to a low-carbon economy, focusing on efficiency and reliability in its operations. With a steadfast commitment to decarbonization and sustainable development goals, GE Vernova is poised to reshape the energy landscape, driving progress toward a cleaner, more sustainable future.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Microsoft Corporation (MSFT)

현재가: 477.32 | 변동률: -2.99% | 거래량 비율: 0.93배

설명:

Microsoft Corporation is a leading American multinational technology firm, celebrated for its diverse portfolio that encompasses operating systems, productivity software, and hardware solutions. Renowned for its Windows OS and Office suite, Microsoft also maintains a strong footprint in the gaming sector with the Xbox brand and in hardware through its Surface devices. A key player in digital transformation, the company capitalizes on its Azure cloud computing services to boost productivity and foster innovation across various industries. With a solid market position and a steadfast commitment to research and development, Microsoft continues to play a crucial role in advancing the global technology landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Lyft, Inc. (LYFT)

현재가: 20.10 | 변동률: -7.71% | 거래량 비율: 0.89배

설명:

Lyft, Inc. is a leading transportation network company that operates a peer-to-peer ridesharing platform across North America, fostering urban mobility solutions tailored to contemporary consumer needs. Based in San Francisco, Lyft is committed to environmentally sustainable practices and community engagement, positioning itself as a key player in the evolution of urban transit. With a focus on diversifying its service portfolio, including electric scooters and bikesharing, Lyft aims to redefine mobility while adapting to the dynamics of a rapidly changing market landscape. Its innovative approach not only enhances customer experience but also addresses emerging trends in urban transportation and sustainability.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📉 -0.09%

Nasdaq

미국 기술주 중심 지수

📈 +0.12%

Dow Jones

30개 전통 우량주 지수

📉 -0.36%

10Y Treasury

미국 10년 만기 국채 수익률

📉 -0.15%

🔹 에코프로 (086520)

⏱️ 1D 분석

💰 현재가: $116,800.00

📊 거래량: 5,755,687

📈 RSI: 78.13

📉 MACD: 8098.04

📌 예측:

- 3 기간 → Hold (신뢰도 63.38%)

- 5 기간 → Hold (신뢰도 63.26%)

- 10 기간 → Hold (신뢰도 62.98%)

⏱️ 1WK 분석

💰 현재가: $116,800.00

📊 거래량: 33,000,094

📈 RSI: 83.77

📉 MACD: 12293.02

📌 예측:

- 3 기간 → Hold (신뢰도 60.75%)

- 5 기간 → Hold (신뢰도 59.44%)

- 10 기간 → Hold (신뢰도 61.9%)

⏱️ 1MO 분석

💰 현재가: $116,800.00

📊 거래량: 58,594,992

📈 RSI: 64.42

📉 MACD: -1541.4

📌 예측:

- 3 기간 → Hold (신뢰도 73.17%)

- 5 기간 → Hold (신뢰도 70.71%)

- 10 기간 → Hold (신뢰도 67.78%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 에이비엘바이오 (298380)

⏱️ 1D 분석

💰 현재가: $203,000.00

📊 거래량: 1,576,353

📈 RSI: 65.88

📉 MACD: 19496.0

📌 예측:

- 3 기간 → Hold (신뢰도 55.6%)

- 5 기간 → Hold (신뢰도 56.13%)

- 10 기간 → Hold (신뢰도 59.4%)

⏱️ 1WK 분석

💰 현재가: $203,000.00

📊 거래량: 3,389,810

📈 RSI: 82.59

📉 MACD: 30897.32

📌 예측:

- 3 기간 → Hold (신뢰도 60.49%)

- 5 기간 → Hold (신뢰도 63.19%)

- 10 기간 → Hold (신뢰도 57.61%)

⏱️ 1MO 분석

💰 현재가: $203,000.00

📊 거래량: 10,255,197

📈 RSI: 86.83

📉 MACD: 33126.4

📌 예측:

- 3 기간 → Hold (신뢰도 66.98%)

- 5 기간 → Hold (신뢰도 64.26%)

- 10 기간 → Hold (신뢰도 62.78%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00