[2025-12-09] - AI Stock Analysis Summary: SK하이닉스(000660), 현대차(005380), 에코프로(086520)

Stock Summary

SK하이닉스 (000660)

💰 현재가: 577,000.00

📈 변동률: +6.07%

🔄 거래량 비율: 1.04배

🏷️ 태그: 급등/급락

에코프로 (086520)

💰 현재가: 117,500.00

📈 변동률: +21.26%

🔄 거래량 비율: 14.68배

🏷️ 태그: 급등/급락, 거래량 급증

삼성전자 (005930)

💰 현재가: 109,500.00

📈 변동률: +1.01%

🔄 거래량 비율: 0.75배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 76,800.00

📈 변동률: -4.48%

🔄 거래량 비율: 0.67배

🏷️ 태그: 없음

현대차 (005380)

💰 현재가: 315,500.00

📈 변동률: +0.16%

🔄 거래량 비율: 2.37배

🏷️ 태그: 거래량 급증

NVIDIA Corporation (NVDA)

💰 현재가: 184.55

📈 변동률: +1.18%

🔄 거래량 비율: 0.57배

🏷️ 태그: 없음

Carvana Co. (CVNA)

💰 현재가: 452.08

📈 변동률: +13.09%

🔄 거래량 비율: 3.09배

🏷️ 태그: 급등/급락, 거래량 급증

Cemtrex, Inc. (CETX)

💰 현재가: 7.17

📈 변동률: +133.54%

🔄 거래량 비율: 344.08배

🏷️ 태그: 급등/급락, 거래량 급증

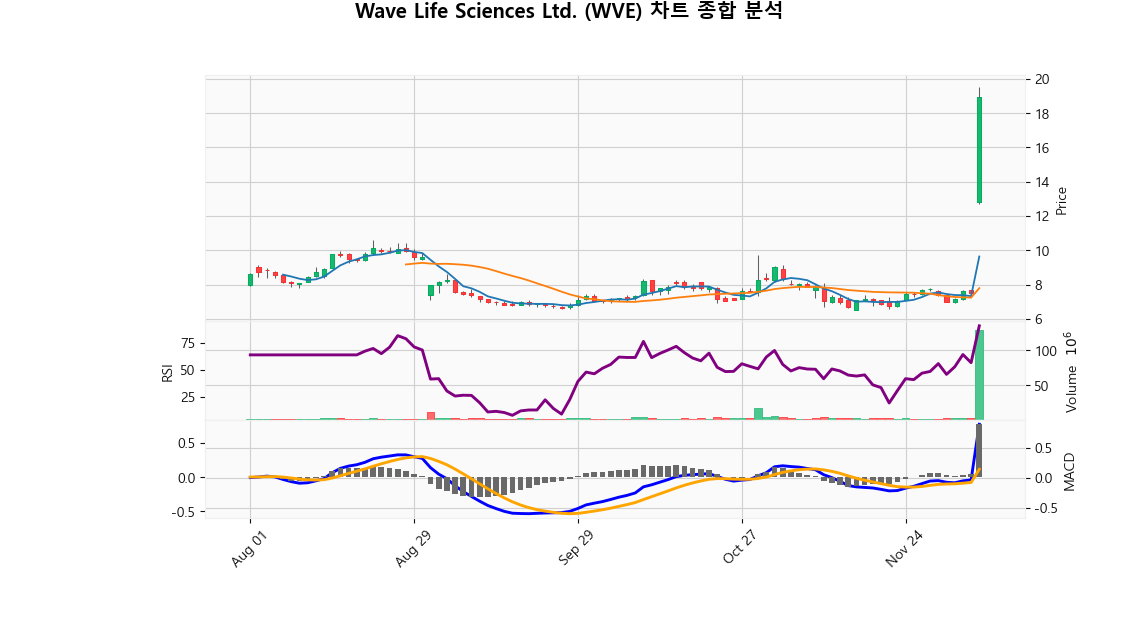

Wave Life Sciences Ltd. (WVE)

💰 현재가: 18.95

📈 변동률: +153.02%

🔄 거래량 비율: 69.82배

🏷️ 태그: 급등/급락, 거래량 급증

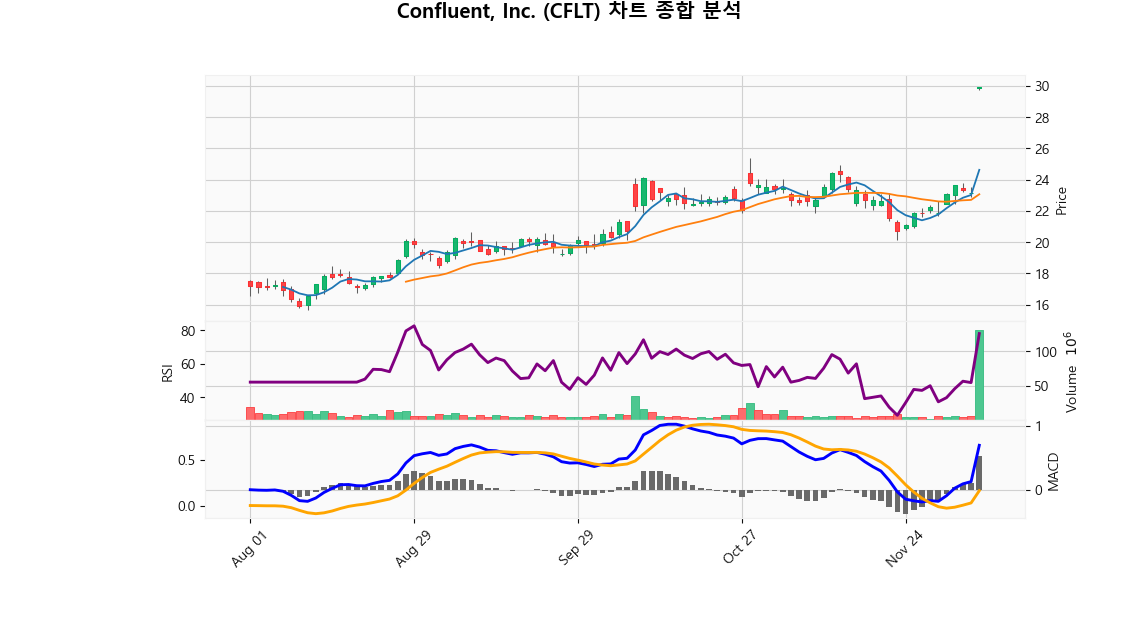

Confluent, Inc. (CFLT)

💰 현재가: 29.91

📈 변동률: +29.24%

🔄 거래량 비율: 21.73배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 SK하이닉스 (000660)

현재가: 577000.00 | 변동률: 6.07% | 거래량 비율: 1.04배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.**Description:**

Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 에코프로 (086520)

현재가: 117500.00 | 변동률: 21.26% | 거래량 비율: 14.68배

설명:

동사는 1998년 설립 후 2007년 코스닥에 상장하고, 2016년 이차전지소재 사업을 분할하여 에코프로비엠을, 2021년 환경사업을 분할하여 에코프로에이치엔을 설립하며 지주회사 체제를 구축함.

→ **English Translation**: Since its establishment in 1998, the company was listed on KOSDAQ in 2007, and in 2016, it divided its secondary battery material business to form EcoProBM, and in 2021, it divided its environmental business to form EcoProHEN, establishing a holding company system.

🔹 삼성전자 (005930)

현재가: 109500.00 | 변동률: 1.01% | 거래량 비율: 0.75배

설명:

동사는 1969년 설립되어 1975년 유가증권시장에 상장하였으며, 2017년 Harman 인수로 전장부품 사업을 확장함.

→ **English Translation**: The company was founded in 1969 and listed on the securities market in 1975, and expanded its electronic parts business with the acquisition of Harman in 2017.

🔹 두산에너빌리티 (034020)

현재가: 76800.00 | 변동률: -4.48% | 거래량 비율: 0.67배

설명:

동사는 1962년 현대양행으로 설립되어 1980년 한국중공업으로 변경 후 2001년 두산그룹에 인수되어 2022년 두산에너빌리티로 상호를 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962, changed to Hankook Heavy Industries in 1980, and was acquired by Doosan Group in 2001, changing its name to Doosan Energy Company in 2022.

🔹 현대차 (005380)

현재가: 315500.00 | 변동률: 0.16% | 거래량 비율: 2.37배

설명:

동사는 1967년 설립된 글로벌 자동차 제조기업으로, 2021년 현대자동차그룹 직할경영체제로 전환하여 계열사 간 시너지를 강화하고 있음.

→ **English Translation**: The company is a global automobile manufacturer established in 1967 and is strengthening synergies between affiliates by switching to the Hyundai Motor Group's management system in 2021.

🔹 NVIDIA Corporation (NVDA)

현재가: 184.55 | 변동률: 1.18% | 거래량 비율: 0.57배

설명:

NVIDIA Corporation is a prominent American multinational technology firm based in Santa Clara, California, recognized for its leadership in the design and manufacturing of advanced graphics processing units (GPUs) for gaming and professional markets. The company is at the cutting edge of AI and visual computing technologies, developing critical solutions such as System on a Chip (SoC) products that enhance mobile computing and automotive applications, particularly in the expanding field of autonomous driving. With a diverse portfolio that encompasses gaming, data centers, and AI infrastructure, NVIDIA is committed to delivering innovative products and services that meet the demands of a dynamic technology landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Carvana Co. (CVNA)

현재가: 452.08 | 변동률: 13.09% | 거래량 비율: 3.09배

설명:

Carvana Co. is a leading e-commerce platform transforming the used car marketplace in the United States, headquartered in Tempe, Arizona. Utilizing advanced technology, Carvana enhances the vehicle buying and selling experience by offering convenience, transparency, and a broad selection of competitively priced vehicles, along with features such as home delivery and a seven-day return policy. As the automotive retail landscape rapidly evolves, Carvana's innovative approach and commitment to customer satisfaction position it for significant growth opportunities in the digital automotive sector.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Cemtrex, Inc. (CETX)

현재가: 7.17 | 변동률: 133.54% | 거래량 비율: 344.08배

설명:

Cemtrex Inc. is a diversified technology company headquartered in Brooklyn, New York, that integrates advanced technologies across industrial, environmental, and electronics sectors. Committed to innovation and sustainability, Cemtrex delivers groundbreaking solutions aimed at enhancing operational efficiency while minimizing environmental impact. Its diverse portfolio caters to a global client base, solidifying its position as a pivotal entity in the dynamic tech industry. By leveraging strategic initiatives, Cemtrex is well-positioned to capitalize on emerging market trends, thereby driving growth and creating shareholder value.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Wave Life Sciences Ltd. (WVE)

현재가: 18.95 | 변동률: 153.02% | 거래량 비율: 69.82배

설명:

Wave Life Sciences Ltd. is a pioneering clinical-stage biotechnology firm based in Singapore, dedicated to developing cutting-edge oligonucleotide therapeutics for severe genetic disorders. Leveraging its proprietary PRISM platform, the company creates stereopure oligonucleotides that significantly enhance the specificity and efficacy of genetic interventions. With a strong pipeline of innovative therapies aimed at addressing critical unmet medical needs, Wave Life Sciences is positioned as a transformative leader in genetic medicine, striving to improve patient outcomes around the world.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Confluent, Inc. (CFLT)

현재가: 29.91 | 변동률: 29.24% | 거래량 비율: 21.73배

설명:

Confluent, Inc. (CFLT) stands at the forefront of the data infrastructure industry, specializing in a cloud-native platform that facilitates real-time data streaming for enterprises. Utilizing its advanced solutions powered by Apache Kafka, Confluent empowers organizations to efficiently connect, monitor, and process data in transit, thereby enhancing operational efficiency and enabling data-driven decision-making. Based in Mountain View, California, Confluent addresses a wide spectrum of industries, positioning itself as an essential player amid the expanding demand for real-time analytics and seamless data integration solutions. With a strategic focus on evolving data ecosystems, Confluent is poised to capitalize on significant market opportunities driven by ongoing digital transformation initiatives.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📈 +0.19%

Nasdaq

미국 기술주 중심 지수

📈 +0.41%

Dow Jones

30개 전통 우량주 지수

📈 +0.20%

10Y Treasury

미국 10년 만기 국채 수익률

📉 -0.21%

🔹 SK하이닉스 (000660)

⏱️ 1D 분석

💰 현재가: $577,000.00

📊 거래량: 4,288,433

📈 RSI: 51.87

📉 MACD: 8568.96

📌 예측:

- 3 기간 → Hold (신뢰도 64.03%)

- 5 기간 → Hold (신뢰도 64.3%)

- 10 기간 → Hold (신뢰도 64.87%)

⏱️ 1WK 분석

💰 현재가: $577,000.00

📊 거래량: 4,288,433

📈 RSI: 83.39

📉 MACD: 84404.44

📌 예측:

- 3 기간 → Hold (신뢰도 61.55%)

- 5 기간 → Hold (신뢰도 60.06%)

- 10 기간 → Hold (신뢰도 61.39%)

⏱️ 1MO 분석

💰 현재가: $577,000.00

📊 거래량: 18,759,574

📈 RSI: 83.0

📉 MACD: 91531.26

📌 예측:

- 3 기간 → Hold (신뢰도 65.27%)

- 5 기간 → Hold (신뢰도 63.14%)

- 10 기간 → Hold (신뢰도 59.49%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00

🔹 현대차 (005380)

⏱️ 1D 분석

💰 현재가: $315,500.00

📊 거래량: 1,867,237

📈 RSI: 82.28

📉 MACD: 9982.79

📌 예측:

- 3 기간 → Hold (신뢰도 63.27%)

- 5 기간 → Hold (신뢰도 62.92%)

- 10 기간 → Hold (신뢰도 61.39%)

⏱️ 1WK 분석

💰 현재가: $315,500.00

📊 거래량: 1,867,237

📈 RSI: 74.06

📉 MACD: 22890.23

📌 예측:

- 3 기간 → Hold (신뢰도 61.76%)

- 5 기간 → Hold (신뢰도 59.46%)

- 10 기간 → Hold (신뢰도 61.28%)

⏱️ 1MO 분석

💰 현재가: $315,500.00

📊 거래량: 9,878,581

📈 RSI: 70.74

📉 MACD: 15406.74

📌 예측:

- 3 기간 → Hold (신뢰도 64.32%)

- 5 기간 → Hold (신뢰도 58.46%)

- 10 기간 → Hold (신뢰도 55.85%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 에코프로 (086520)

⏱️ 1D 분석

💰 현재가: $117,500.00

📊 거래량: 19,448,416

📈 RSI: 77.74

📉 MACD: 5533.7

📌 예측:

- 3 기간 → Hold (신뢰도 62.07%)

- 5 기간 → Hold (신뢰도 60.97%)

- 10 기간 → Hold (신뢰도 62.59%)

⏱️ 1WK 분석

💰 현재가: $117,500.00

📊 거래량: 19,448,416

📈 RSI: 83.88

📉 MACD: 12348.86

📌 예측:

- 3 기간 → Hold (신뢰도 60.12%)

- 5 기간 → Hold (신뢰도 58.97%)

- 10 기간 → Hold (신뢰도 61.08%)

⏱️ 1MO 분석

💰 현재가: $117,500.00

📊 거래량: 45,043,314

📈 RSI: 64.6

📉 MACD: -1485.56

📌 예측:

- 3 기간 → Hold (신뢰도 75.52%)

- 5 기간 → Hold (신뢰도 73.2%)

- 10 기간 → Hold (신뢰도 70.44%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00