[2025-12-06] - AI Stock Analysis Summary: 현대차(005380), 알테오젠(196170)

Stock Summary

삼성전자 (005930)

💰 현재가: 108,400.00

📈 변동률: +3.14%

🔄 거래량 비율: 0.95배

🏷️ 태그: 없음

현대차 (005380)

💰 현재가: 315,000.00

📈 변동률: +11.11%

🔄 거래량 비율: 4.96배

🏷️ 태그: 급등/급락, 거래량 급증

알테오젠 (196170)

💰 현재가: 456,500.00

📈 변동률: -12.04%

🔄 거래량 비율: 3.98배

🏷️ 태그: 급등/급락, 거래량 급증

두산에너빌리티 (034020)

💰 현재가: 80,400.00

📈 변동률: +1.52%

🔄 거래량 비율: 0.44배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 544,000.00

📈 변동률: +0.37%

🔄 거래량 비율: 0.74배

🏷️ 태그: 없음

Netflix, Inc. (NFLX)

💰 현재가: 100.77

📈 변동률: -2.37%

🔄 거래량 비율: 2.93배

🏷️ 태그: 거래량 급증

Warner Bros. Discovery, Inc. (WBD)

💰 현재가: 25.92

📈 변동률: +5.64%

🔄 거래량 비율: 4.16배

🏷️ 태그: 급등/급락, 거래량 급증

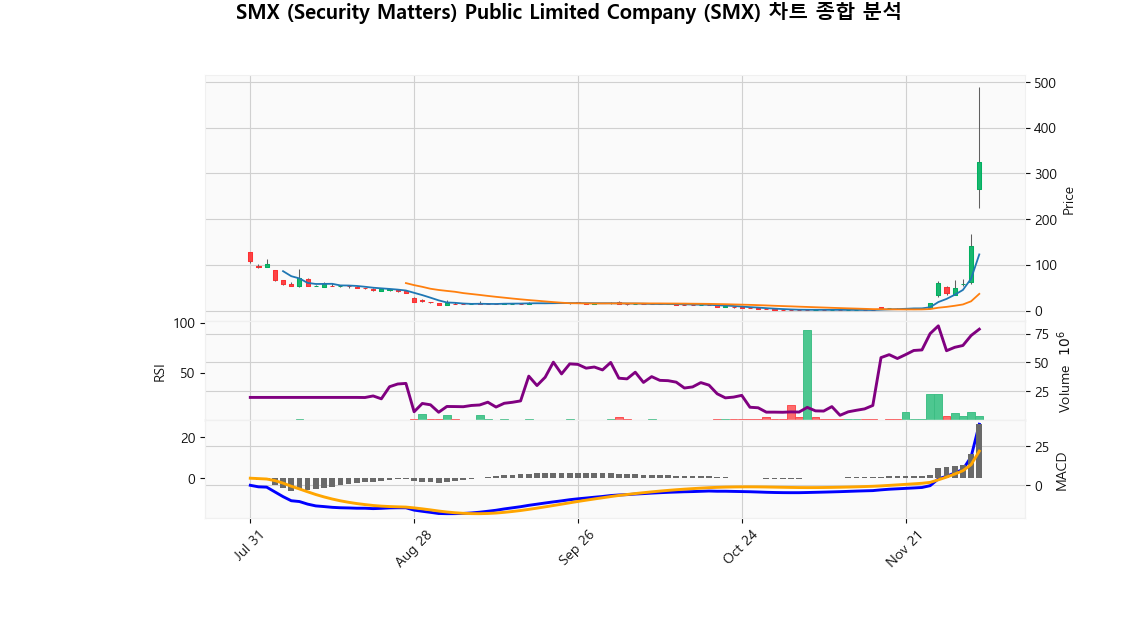

SMX (Security Matters) Public Limited Company (SMX)

💰 현재가: 326.00

📈 변동률: +131.21%

🔄 거래량 비율: 6.94배

🏷️ 태그: 급등/급락, 거래량 급증

SoFi Technologies, Inc. (SOFI)

💰 현재가: 27.77

📈 변동률: -6.18%

🔄 거래량 비율: 2.02배

🏷️ 태그: 급등/급락, 거래량 급증

Treasure Global Inc. (TGL)

💰 현재가: 28.25

📈 변동률: +318.02%

🔄 거래량 비율: 144.39배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 삼성전자 (005930)

현재가: 108400.00 | 변동률: 3.14% | 거래량 비율: 0.95배

설명:

동사는 1969년 설립되어 1975년 유가증권시장에 상장하였으며, 2017년 Harman 인수로 전장부품 사업을 확장함.**Description:**

The company was founded in 1969 and listed on the securities market in 1975, and expanded its electronic parts business with the acquisition of Harman in 2017.

🔹 현대차 (005380)

현재가: 315000.00 | 변동률: 11.11% | 거래량 비율: 4.96배

설명:

동사는 1967년 설립된 글로벌 자동차 제조기업으로, 2021년 현대자동차그룹 직할경영체제로 전환하여 계열사 간 시너지를 강화하고 있음.

→ **English Translation**: The company is a global automobile manufacturer established in 1967 and is strengthening synergies between affiliates by switching to the Hyundai Motor Group's management system in 2021.

🔹 알테오젠 (196170)

현재가: 456500.00 | 변동률: -12.04% | 거래량 비율: 3.98배

설명:

동사는 2008년 설립된 바이오의약품 연구개발 기업으로 히알루로니다제 단백질 공학 기술, NexP™ 융합, NexMab™ ADC 기술 등의 플랫폼 기술을 보유하고 있음.

→ **English Translation**: The company was founded in 2008 as a biopharmaceutical research and development company with platform technologies such as hyaluronidase protein engineering technology, NexP™ fusion, and NexMab™ ADC technology.

🔹 두산에너빌리티 (034020)

현재가: 80400.00 | 변동률: 1.52% | 거래량 비율: 0.44배

설명:

동사는 1962년 현대양행으로 설립되어 1980년 한국중공업으로 변경 후 2001년 두산그룹에 인수되어 2022년 두산에너빌리티로 상호를 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962, changed to Hankook Heavy Industries in 1980, and was acquired by Doosan Group in 2001, changing its name to Doosan Energy Company in 2022.

🔹 SK하이닉스 (000660)

현재가: 544000.00 | 변동률: 0.37% | 거래량 비율: 0.74배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 Netflix, Inc. (NFLX)

현재가: 100.77 | 변동률: -2.37% | 거래량 비율: 2.93배

설명:

Netflix, Inc. is a leading American over-the-top content platform and production company based in Los Gatos, California. Established in 1997, Netflix has redefined the entertainment industry through its subscription-based streaming service, which boasts a vast library of films and television series, including award-winning original content. As a pioneering force in the streaming sector, the company is actively expanding its global presence while leveraging innovative distribution strategies and substantial investments in original programming to boost subscriber growth and enhance viewer engagement. With a firm commitment to revolutionizing media consumption, Netflix remains at the forefront of the digital entertainment landscape, navigating the ongoing shifts and evolving consumer demands within the industry.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Warner Bros. Discovery, Inc. (WBD)

현재가: 25.92 | 변동률: 5.64% | 거래량 비율: 4.16배

설명:

Warner Bros. Discovery Inc. (WBD) is a leading global media and entertainment conglomerate, born from the merger of WarnerMedia and Discovery, Inc., and headquartered in New York City. With its rich portfolio of beloved brands and franchises, WBD excels in delivering premium content across multiple platforms, including television, film, and streaming services. The company strategically leverages its vast content library and innovative digital strategies to meet the ever-changing demands of global consumers. By prioritizing compelling storytelling and audience engagement, Warner Bros. Discovery aims to achieve sustained long-term growth while maximizing shareholder value in the competitive media landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 SMX (Security Matters) Public Limited Company (SMX)

현재가: 326.00 | 변동률: 131.21% | 거래량 비율: 6.94배

설명:

SMX (Security Matters) Public Limited Company, headquartered in Melbourne, Australia, specializes in the development and commercialization of innovative track and trace technologies that enhance supply chain transparency across various industries. By leveraging proprietary technology, SMX aims to improve product authenticity and prevent counterfeiting, catering to sectors such as pharmaceuticals, food, and consumer goods. With a strategic focus on expanding its technological applications and partnerships, the company positions itself as a key player in driving sustainability and safety standards within global markets.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 SoFi Technologies, Inc. (SOFI)

현재가: 27.77 | 변동률: -6.18% | 거래량 비율: 2.02배

설명:

SoFi Technologies, Inc. is a prominent digital financial services provider based in San Francisco, California, focusing on a diverse range of offerings, including personal loans, student and home refinancing, investment management, and insurance solutions. By leveraging cutting-edge technology, SoFi aims to empower individuals on their journey to financial independence while enhancing the accessibility and efficiency of financial services. The company has established a comprehensive platform that integrates borrowing, investing, and community engagement, making it a holistic financial partner for its members and differentiating it in the competitive fintech landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Treasure Global Inc. (TGL)

현재가: 28.25 | 변동률: 318.02% | 거래량 비율: 144.39배

설명:

None

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: 해당 없음

Market Summary

S&P500

미국 대형주 대표 지수

📈 +0.07%

Nasdaq

미국 기술주 중심 지수

📉 -0.09%

Dow Jones

30개 전통 우량주 지수

📉 -0.07%

10Y Treasury

미국 10년 만기 국채 수익률

📉 -0.31%

🔹 현대차 (005380)

⏱️ 1D 분석

💰 현재가: $315,000.00

📊 거래량: 3,892,799

📈 RSI: 75.44

📉 MACD: 7171.62

📌 예측:

- 3 기간 → Hold (신뢰도 62.35%)

- 5 기간 → Hold (신뢰도 61.91%)

- 10 기간 → Hold (신뢰도 59.82%)

⏱️ 1WK 분석

💰 현재가: $315,000.00

📊 거래량: 8,011,344

📈 RSI: 73.99

📉 MACD: 19865.63

📌 예측:

- 3 기간 → Hold (신뢰도 55.93%)

- 5 기간 → Hold (신뢰도 56.99%)

- 10 기간 → Hold (신뢰도 59.9%)

⏱️ 1MO 분석

💰 현재가: $315,000.00

📊 거래량: 8,011,344

📈 RSI: 70.68

📉 MACD: 15366.85

📌 예측:

- 3 기간 → Hold (신뢰도 64.8%)

- 5 기간 → Hold (신뢰도 59.06%)

- 10 기간 → Hold (신뢰도 56.37%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 알테오젠 (196170)

⏱️ 1D 분석

💰 현재가: $456,500.00

📊 거래량: 2,815,855

📈 RSI: 25.86

📉 MACD: 580.97

📌 예측:

- 3 기간 → Hold (신뢰도 62.79%)

- 5 기간 → Hold (신뢰도 62.58%)

- 10 기간 → Hold (신뢰도 62.74%)

⏱️ 1WK 분석

💰 현재가: $456,500.00

📊 거래량: 4,039,157

📈 RSI: 52.37

📉 MACD: 30570.71

📌 예측:

- 3 기간 → Hold (신뢰도 63.01%)

- 5 기간 → Hold (신뢰도 63.35%)

- 10 기간 → Hold (신뢰도 58.75%)

⏱️ 1MO 분석

💰 현재가: $456,500.00

📊 거래량: 4,039,157

📈 RSI: 57.01

📉 MACD: 86795.82

📌 예측:

- 3 기간 → Hold (신뢰도 53.38%)

- 5 기간 → Hold (신뢰도 52.5%)

- 10 기간 → Hold (신뢰도 52.08%)

✅ 최종 판단: Immediate

📌 판단 근거: 강력한 매수 신호 (RSI 과매도 + MACD 상승)

💹 매수 점수: 10.00 | 매도 점수: 5.00