[2025-12-05] - AI Stock Analysis Summary: 천일고속(000650), Oklo Inc.(OKLO)

Stock Summary

삼성전자 (005930)

💰 현재가: 105,100.00

📈 변동률: +0.57%

🔄 거래량 비율: 0.57배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 542,000.00

📈 변동률: -1.81%

🔄 거래량 비율: 0.69배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 79,200.00

📈 변동률: +1.02%

🔄 거래량 비율: 0.45배

🏷️ 태그: 없음

에이비엘바이오 (298380)

💰 현재가: 201,000.00

📈 변동률: +0.00%

🔄 거래량 비율: 0.52배

🏷️ 태그: 없음

천일고속 (000650)

💰 현재가: 376,500.00

📈 변동률: -5.64%

🔄 거래량 비율: 133.47배

🏷️ 태그: 급등/급락, 거래량 급증

Meta Platforms, Inc. (META)

💰 현재가: 662.56

📈 변동률: +3.59%

🔄 거래량 비율: 1.76배

🏷️ 태그: 거래량 급증

Oklo Inc. (OKLO)

💰 현재가: 113.80

📈 변동률: +17.82%

🔄 거래량 비율: 1.13배

🏷️ 태그: 급등/급락

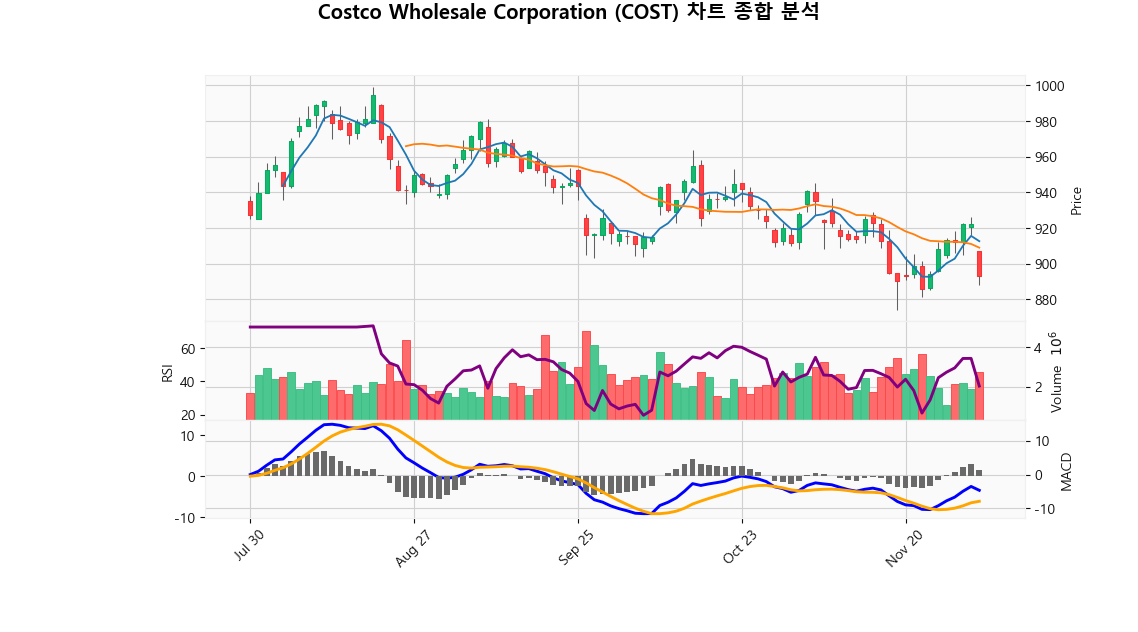

Costco Wholesale Corporation (COST)

💰 현재가: 893.39

📈 변동률: -3.13%

🔄 거래량 비율: 1.3배

🏷️ 태그: 없음

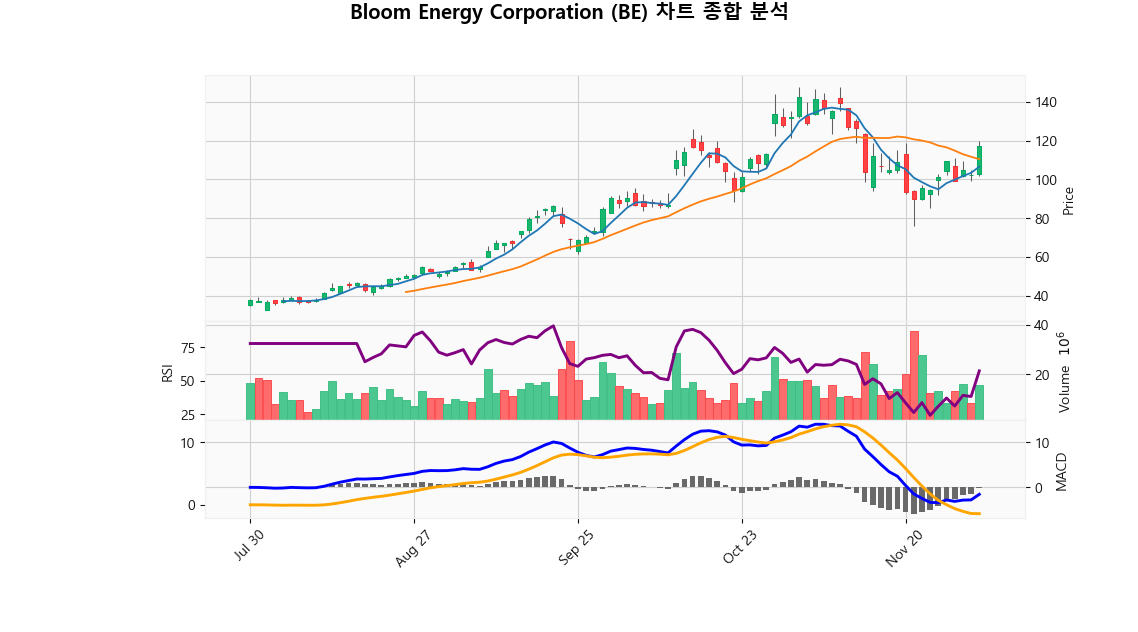

Bloom Energy Corporation (BE)

💰 현재가: 117.05

📈 변동률: +14.20%

🔄 거래량 비율: 1.82배

🏷️ 태그: 급등/급락, 거래량 급증

BigBear.ai Holdings, Inc. (BBAI)

💰 현재가: 7.11

📈 변동률: +16.48%

🔄 거래량 비율: 2.28배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 삼성전자 (005930)

현재가: 105100.00 | 변동률: 0.57% | 거래량 비율: 0.57배

설명:

동사는 1969년 설립되어 1975년 유가증권시장에 상장하였으며, 2017년 Harman 인수로 전장부품 사업을 확장함.**Description:**

The company was founded in 1969 and listed on the securities market in 1975, and expanded its electronic parts business with the acquisition of Harman in 2017.

🔹 SK하이닉스 (000660)

현재가: 542000.00 | 변동률: -1.81% | 거래량 비율: 0.69배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 두산에너빌리티 (034020)

현재가: 79200.00 | 변동률: 1.02% | 거래량 비율: 0.45배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 에이비엘바이오 (298380)

현재가: 201000.00 | 변동률: 0.0% | 거래량 비율: 0.52배

설명:

동사는 2016년 설립돼 2018년 코스닥에 상장한 바이오의약품 연구개발 전문기업임.

→ **English Translation**: The company was founded in 2016 and listed on KOSDAQ in 2018, specializing in biopharmaceutical research and development.

🔹 천일고속 (000650)

현재가: 376500.00 | 변동률: -5.64% | 거래량 비율: 133.47배

설명:

동사는 1949년 설립되어 1977년 유가증권시장에 상장된 고속버스 운송업체임.

→ **English Translation**: The company is a high-speed bus carrier established in 1949 and listed on the securities market in 1977.

🔹 Meta Platforms, Inc. (META)

현재가: 662.56 | 변동률: 3.59% | 거래량 비율: 1.76배

설명:

Meta Platforms, Inc. is a leading technology firm based in Menlo Park, California, renowned for transforming social connectivity through its flagship platforms, including Facebook, Instagram, and WhatsApp. Pioneering developments in virtual and augmented reality via its Reality Labs division, Meta is at the forefront of the metaverse, exploring innovative consumer engagement avenues. By significantly investing in immersive technologies, the company not only attracts a large, diverse user base but also enhances its advertising revenue, thereby reinforcing its position as a dominant force in the rapidly evolving digital landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Oklo Inc. (OKLO)

현재가: 113.80 | 변동률: 17.82% | 거래량 비율: 1.13배

설명:

Oklo Inc., based in Santa Clara, California, is a trailblazer in the nuclear energy sector, focused on the design and development of compact fission power plants that deliver reliable, commercial-scale nuclear solutions. Leveraging cutting-edge nuclear technology, Oklo strives to meet the increasing demand for clean energy while reducing reliance on fossil fuels. With a commitment to safety and sustainability, the company is poised to spearhead the nuclear renaissance in the United States, catering to a diverse clientele and playing a crucial role in the transition to a more sustainable energy future.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Costco Wholesale Corporation (COST)

현재가: 893.39 | 변동률: -3.13% | 거래량 비율: 1.3배

설명:

Costco Wholesale Corporation (COST) stands as a leading player in the global retail sector, renowned for its unique membership-based warehouse model that delivers an extensive array of products, including groceries, electronics, and household essentials. With a robust focus on high-quality offerings, such as organic groceries and premium meats, Costco has fostered a loyal customer base through impeccable value and service. The company's effective bulk purchasing strategy not only allows for competitive pricing but also enhances overall customer satisfaction. Backed by a strong financial track record and a commitment to sustainability and responsible sourcing, Costco represents a prudent investment opportunity for institutional investors seeking long-term stability and growth potential.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Bloom Energy Corporation (BE)

현재가: 117.05 | 변동률: 14.2% | 거래량 비율: 1.82배

설명:

Bloom Energy Corporation is a leader in solid oxide fuel cell technology, providing innovative on-site power generation solutions that cater to a wide range of markets, including the U.S., Japan, China, India, and South Korea. Headquartered in San Jose, California, the company is at the forefront of the global energy transition, delivering sustainable energy systems that significantly reduce reliance on fossil fuels and enhance operational efficiency. With its strong focus on innovation and commitment to environmental sustainability, Bloom Energy is well-positioned to capitalize on the growing demand for renewable energy technologies, making it an attractive investment opportunity for institutional investors looking to diversify their portfolios in the clean energy landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 BigBear.ai Holdings, Inc. (BBAI)

현재가: 7.11 | 변동률: 16.48% | 거래량 비율: 2.28배

설명:

None

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: 해당 없음

Market Summary

S&P500

미국 대형주 대표 지수

📈 +0.35%

Nasdaq

미국 기술주 중심 지수

📈 +0.24%

Dow Jones

30개 전통 우량주 지수

📈 +0.87%

10Y Treasury

미국 10년 만기 국채 수익률

📈 +0.21%

🔹 천일고속 (000650)

⏱️ 1D 분석

💰 현재가: $376,500.00

📊 거래량: 584,831

📈 RSI: 94.02

📉 MACD: 76821.71

📌 예측:

- 3 기간 → Hold (신뢰도 61.09%)

- 5 기간 → Hold (신뢰도 63.16%)

- 10 기간 → Hold (신뢰도 58.8%)

⏱️ 1WK 분석

💰 현재가: $376,500.00

📊 거래량: 853,584

📈 RSI: 98.66

📉 MACD: 40536.63

📌 예측:

- 3 기간 → Hold (신뢰도 78.55%)

- 5 기간 → Hold (신뢰도 71.84%)

- 10 기간 → Hold (신뢰도 62.33%)

⏱️ 1MO 분석

💰 현재가: $376,500.00

📊 거래량: 853,584

📈 RSI: 97.16

📉 MACD: 35923.05

📌 예측:

- 3 기간 → Sell (신뢰도 47.47%)

- 5 기간 → Sell (신뢰도 43.89%)

- 10 기간 → Sell (신뢰도 40.45%)

✅ 최종 판단: Sell

📌 판단 근거: 매도 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 131.81

🔹 Oklo Inc. (OKLO)

⏱️ 1D 분석

💰 현재가: $49.17

📊 거래량: 63,131,634

📈 RSI: 84.45

📉 MACD: 4.64

📌 예측:

- 3 기간 → Hold (신뢰도 55.44%)

- 5 기간 → Hold (신뢰도 52.88%)

- 10 기간 → Hold (신뢰도 56.87%)

⏱️ 1WK 분석

💰 현재가: $96.59

📊 거래량: 25,624,968

📈 RSI: 54.98

📉 MACD: 12.61

📌 예측:

- 3 기간 → Hold (신뢰도 59.06%)

- 5 기간 → Hold (신뢰도 58.77%)

- 10 기간 → Hold (신뢰도 58.65%)

⏱️ 1MO 분석

💰 현재가: $96.59

📊 거래량: 25,624,968

📈 RSI: 67.87

📉 MACD: 23.69

📌 예측:

- 3 기간 → Hold (신뢰도 66.66%)

- 5 기간 → Hold (신뢰도 67.34%)

- 10 기간 → Hold (신뢰도 66.93%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00