[2025-11-19] - AI Stock Analysis Summary: SK하이닉스(000660), 에이비엘바이오(298380)

Stock Summary

SK하이닉스 (000660)

💰 현재가: 570,000.00

📈 변동률: -5.94%

🔄 거래량 비율: 0.86배

🏷️ 태그: 급등/급락

삼성전자 (005930)

💰 현재가: 97,800.00

📈 변동률: -2.78%

🔄 거래량 비율: 0.9배

🏷️ 태그: 없음

레인보우로보틱스 (277810)

💰 현재가: 375,500.00

📈 변동률: -0.92%

🔄 거래량 비율: 0.85배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 75,400.00

📈 변동률: -4.31%

🔄 거래량 비율: 0.51배

🏷️ 태그: 없음

에이비엘바이오 (298380)

💰 현재가: 166,600.00

📈 변동률: -5.34%

🔄 거래량 비율: 1.27배

🏷️ 태그: 급등/급락

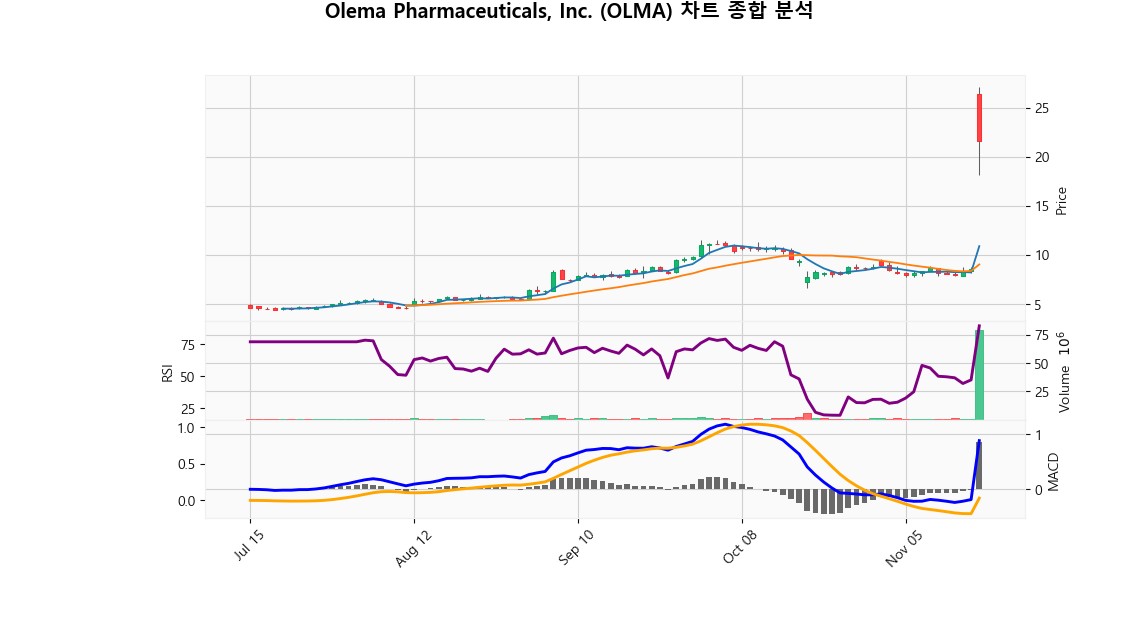

Olema Pharmaceuticals, Inc. (OLMA)

💰 현재가: 21.58

📈 변동률: +153.35%

🔄 거래량 비율: 72.57배

🏷️ 태그: 급등/급락, 거래량 급증

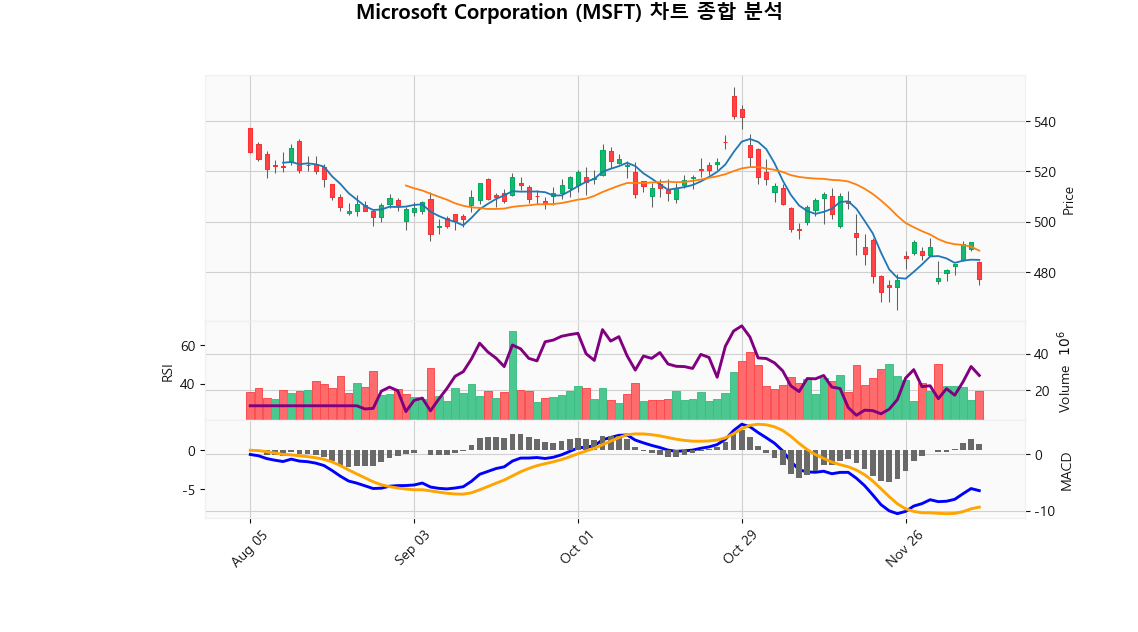

Microsoft Corporation (MSFT)

💰 현재가: 494.70

📈 변동률: -2.52%

🔄 거래량 비율: 1.04배

🏷️ 태그: 없음

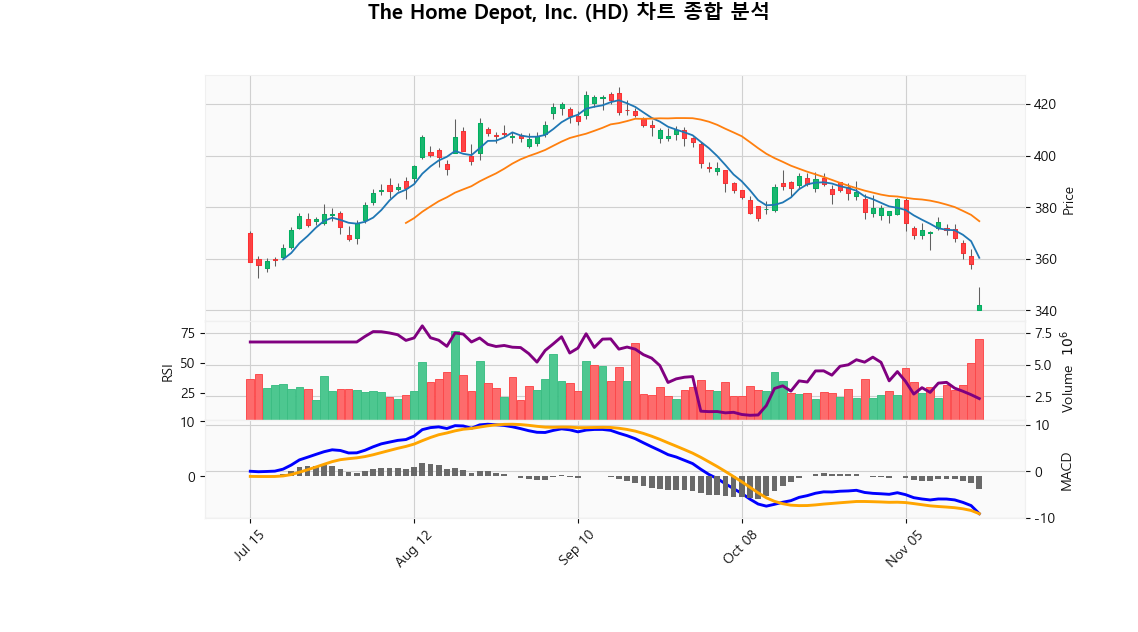

The Home Depot, Inc. (HD)

💰 현재가: 341.95

📈 변동률: -4.49%

🔄 거래량 비율: 2.04배

🏷️ 태그: 거래량 급증

Warner Bros. Discovery, Inc. (WBD)

💰 현재가: 23.80

📈 변동률: +4.66%

🔄 거래량 비율: 1.18배

🏷️ 태그: 없음

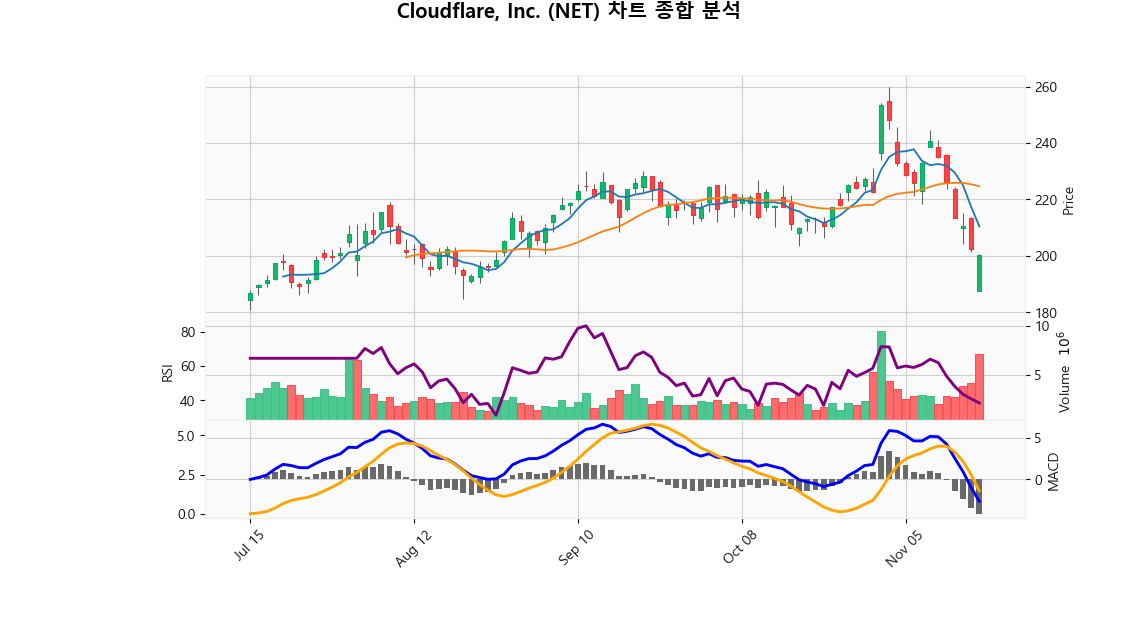

Cloudflare, Inc. (NET)

💰 현재가: 200.13

📈 변동률: -1.05%

🔄 거래량 비율: 2.27배

🏷️ 태그: 거래량 급증

🔹 SK하이닉스 (000660)

현재가: 570000.00 | 변동률: -5.94% | 거래량 비율: 0.86배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.**Description:**

Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 삼성전자 (005930)

현재가: 97800.00 | 변동률: -2.78% | 거래량 비율: 0.9배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.

→ **English Translation**: The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 레인보우로보틱스 (277810)

현재가: 375500.00 | 변동률: -0.92% | 거래량 비율: 0.85배

설명:

동사는 2011년 한국과학기술원 연구원들이 창업한 벤처기업으로, 2025년 삼성전자가 최대주주로 변경되었음.

→ **English Translation**: The company is a venture company founded by researchers at the Korea Institute of Science and Technology in 2011, and Samsung Electronics has changed to the largest shareholder in 2025.

🔹 두산에너빌리티 (034020)

현재가: 75400.00 | 변동률: -4.31% | 거래량 비율: 0.51배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 에이비엘바이오 (298380)

현재가: 166600.00 | 변동률: -5.34% | 거래량 비율: 1.27배

설명:

동사는 2016년 설립, 2018년 코스닥 상장한 바이오의약품 연구개발 전문기업으로 이중항체 기술 기반의 항체치료제를 개발하고 사업화를 진행하고 있음.

→ **English Translation**: The company is a biopharmaceutical research and development company established in 2016 and listed on KOSDAQ in 2018. It is developing and commercializing antibody therapeutics based on dual antibody technology.

🔹 Olema Pharmaceuticals, Inc. (OLMA)

현재가: 21.58 | 변동률: 153.35% | 거래량 비율: 72.57배

설명:

Olema Pharmaceuticals, Inc. is an innovative clinical-stage biopharmaceutical company based in San Francisco, California, focused on developing targeted therapies for women's cancers. With a strong commitment to addressing significant unmet medical needs within this historically underrepresented patient population, Olema is advancing a promising pipeline of novel compounds designed to enhance patient outcomes. Positioned strategically within the oncology landscape, the company is currently navigating pivotal clinical trials, leveraging its scientific acumen to potentially reshape standard care practices in women's health. As it evolves, Olema remains dedicated to providing transformative treatment solutions that hold the potential to redefine the therapeutic landscape in this vital area of medicine.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Microsoft Corporation (MSFT)

현재가: 494.70 | 변동률: -2.52% | 거래량 비율: 1.04배

설명:

Microsoft Corporation is a leading American multinational technology firm, celebrated for its diverse portfolio that encompasses operating systems, productivity software, and hardware solutions. Renowned for its Windows OS and Office suite, Microsoft also maintains a strong footprint in the gaming sector with the Xbox brand and in hardware through its Surface devices. A key player in digital transformation, the company capitalizes on its Azure cloud computing services to boost productivity and foster innovation across various industries. With a solid market position and a steadfast commitment to research and development, Microsoft continues to play a crucial role in advancing the global technology landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 The Home Depot, Inc. (HD)

현재가: 341.95 | 변동률: -4.49% | 거래량 비율: 2.04배

설명:

The Home Depot, Inc. (HD) is the leading home improvement retailer in the United States, with a robust presence across more than 2,200 stores in North America. Headquartered in Cobb County, Georgia, the company serves a diverse customer base, including professional contractors and DIY enthusiasts, through a comprehensive range of tools, construction products, and services. Home Depot distinguishes itself in the market with its strong supply chain capabilities and a rapidly expanding e-commerce platform, enhancing customer accessibility and engagement. Committed to innovation and exceptional customer service, Home Depot focuses on driving sustainable growth and delivering long-term shareholder value.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Warner Bros. Discovery, Inc. (WBD)

현재가: 23.80 | 변동률: 4.66% | 거래량 비율: 1.18배

설명:

Warner Bros. Discovery Inc. (WBD) is a leading global media and entertainment conglomerate, born from the merger of WarnerMedia and Discovery, Inc., and headquartered in New York City. With its rich portfolio of beloved brands and franchises, WBD excels in delivering premium content across multiple platforms, including television, film, and streaming services. The company strategically leverages its vast content library and innovative digital strategies to meet the ever-changing demands of global consumers. By prioritizing compelling storytelling and audience engagement, Warner Bros. Discovery aims to achieve sustained long-term growth while maximizing shareholder value in the competitive media landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Cloudflare, Inc. (NET)

현재가: 200.13 | 변동률: -1.05% | 거래량 비율: 2.27배

설명:

Cloudflare Inc. (ticker: NET) is a leading global cloud services provider based in San Francisco, California, dedicated to enhancing the security, performance, and reliability of websites and applications. The company offers a comprehensive suite of services, including content delivery networks (CDN), DDoS mitigation, and advanced internet security solutions, catering to millions of clients across various industries. With its commitment to innovation and scalability, Cloudflare is well-positioned to meet the surging demand for secure and efficient internet infrastructure, further solidifying its status as a key player in the digital landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📉 -0.93%

Nasdaq

미국 기술주 중심 지수

📉 -0.85%

Dow Jones

30개 전통 우량주 지수

📉 -1.16%

10Y Treasury

미국 10년 만기 국채 수익률

📈 +0.11%

🔹 SK하이닉스 (000660)

⏱️ 1D 분석

💰 현재가: $570,000.00

📊 거래량: 3,542,598

📈 RSI: 51.83

📉 MACD: 43706.46

📌 예측:

- 3 기간 → Hold (신뢰도 65.04%)

- 5 기간 → Hold (신뢰도 65.24%)

- 10 기간 → Hold (신뢰도 65.18%)

⏱️ 1WK 분석

💰 현재가: $570,000.00

📊 거래량: 8,013,545

📈 RSI: 85.15

📉 MACD: 87807.15

📌 예측:

- 3 기간 → Hold (신뢰도 61.55%)

- 5 기간 → Hold (신뢰도 62.13%)

- 10 기간 → Hold (신뢰도 61.57%)

⏱️ 1MO 분석

💰 현재가: $570,000.00

📊 거래량: 61,744,976

📈 RSI: 86.71

📉 MACD: 80404.85

📌 예측:

- 3 기간 → Hold (신뢰도 61.97%)

- 5 기간 → Hold (신뢰도 57.27%)

- 10 기간 → Hold (신뢰도 54.03%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 에이비엘바이오 (298380)

⏱️ 1D 분석

💰 현재가: $166,600.00

📊 거래량: 1,693,353

📈 RSI: 80.41

📉 MACD: 18128.6

📌 예측:

- 3 기간 → Hold (신뢰도 49.89%)

- 5 기간 → Hold (신뢰도 51.65%)

- 10 기간 → Hold (신뢰도 48.86%)

⏱️ 1WK 분석

💰 현재가: $166,600.00

📊 거래량: 3,907,163

📈 RSI: 74.91

📉 MACD: 19249.89

📌 예측:

- 3 기간 → Hold (신뢰도 53.49%)

- 5 기간 → Hold (신뢰도 49.79%)

- 10 기간 → Hold (신뢰도 44.64%)

⏱️ 1MO 분석

💰 현재가: $166,600.00

📊 거래량: 24,610,577

📈 RSI: 84.8

📉 MACD: 24066.42

📌 예측:

- 3 기간 → Hold (신뢰도 64.33%)

- 5 기간 → Hold (신뢰도 66.91%)

- 10 기간 → Hold (신뢰도 66.76%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00