[2025-11-16] - AI Stock Analysis Summary: SK하이닉스(000660), 삼성전자(005930), 두산에너빌리티(034020)

Stock Summary

SK하이닉스 (000660)

💰 현재가: 560,000.00

📈 변동률: -8.50%

🔄 거래량 비율: 1.4배

🏷️ 태그: 급등/급락

삼성전자 (005930)

💰 현재가: 97,200.00

📈 변동률: -5.45%

🔄 거래량 비율: 1.05배

🏷️ 태그: 급등/급락

에이비엘바이오 (298380)

💰 현재가: 174,200.00

📈 변동률: +6.54%

🔄 거래량 비율: 4.69배

🏷️ 태그: 급등/급락, 거래량 급증

한화오션 (042660)

💰 현재가: 129,100.00

📈 변동률: -1.07%

🔄 거래량 비율: 0.78배

🏷️ 태그: 없음

두산에너빌리티 (034020)

💰 현재가: 78,400.00

📈 변동률: -5.66%

🔄 거래량 비율: 0.69배

🏷️ 태그: 급등/급락

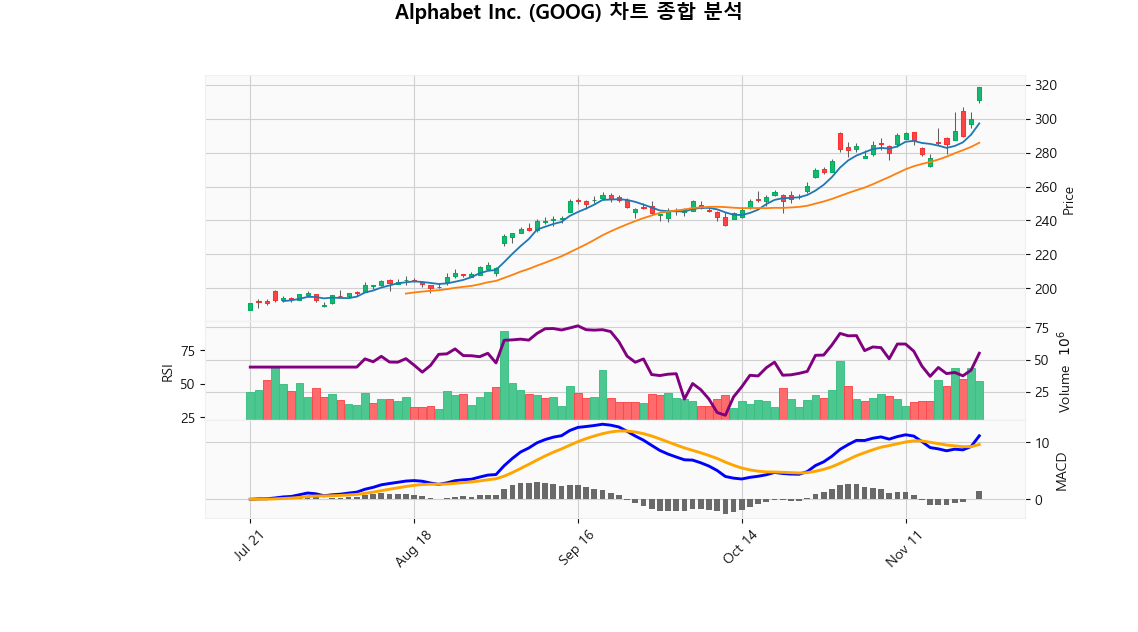

Alphabet Inc. (GOOG)

💰 현재가: 276.98

📈 변동률: -0.77%

🔄 거래량 비율: 0.85배

🏷️ 태그: 없음

Alphabet Inc. (GOOGL)

💰 현재가: 276.41

📈 변동률: -0.78%

🔄 거래량 비율: 0.99배

🏷️ 태그: 없음

Chubb Limited (CB)

💰 현재가: 295.49

📈 변동률: -0.25%

🔄 거래량 비율: 0.83배

🏷️ 태그: 없음

Genius Group Limited (GNS)

💰 현재가: 0.86

📈 변동률: +2.86%

🔄 거래량 비율: 0.19배

🏷️ 태그: 없음

Quantum Computing Inc. (QUBT)

💰 현재가: 10.60

📈 변동률: +5.68%

🔄 거래량 비율: 1.67배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 SK하이닉스 (000660)

현재가: 560000.00 | 변동률: -8.5% | 거래량 비율: 1.4배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.**Description:**

Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 삼성전자 (005930)

현재가: 97200.00 | 변동률: -5.45% | 거래량 비율: 1.05배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.

→ **English Translation**: The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 에이비엘바이오 (298380)

현재가: 174200.00 | 변동률: 6.54% | 거래량 비율: 4.69배

설명:

동사는 2016년 설립, 2018년 코스닥 상장한 바이오의약품 연구개발 전문기업으로 이중항체 기술 기반의 항체치료제를 개발하고 사업화를 진행하고 있음.

→ **English Translation**: The company is a biopharmaceutical research and development company established in 2016 and listed on KOSDAQ in 2018. It is developing and commercializing antibody therapeutics based on dual antibody technology.

🔹 한화오션 (042660)

현재가: 129100.00 | 변동률: -1.07% | 거래량 비율: 0.78배

설명:

동사는 2000년 대우중공업 분할로 설립되어 2001년 상장되었으며, 2024년 한화로부터 플랜트·풍력 사업을 양수하고 한화오션디지털을 합병했음.

→ **English Translation**: The company was founded in 2000 as a division of Daewoo Heavy Industries and went public in 2001. In 2024, it acquired the plant and wind power business from Hanwha and merged Hanwha Ocean Digital.

🔹 두산에너빌리티 (034020)

현재가: 78400.00 | 변동률: -5.66% | 거래량 비율: 0.69배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 Alphabet Inc. (GOOG)

현재가: 276.98 | 변동률: -0.77% | 거래량 비율: 0.85배

설명:

Alphabet Inc. (GOOG) is a leading American multinational conglomerate, headquartered in Mountain View, California, that emerged from Google's corporate restructuring in October 2015. As the parent company of Google and a wide range of subsidiaries, Alphabet excels in technology sectors such as search services, digital advertising, cloud computing, consumer electronics, and artificial intelligence. With robust revenue generation, the company significantly contributes to the global digital economy's evolution. Under visionary leadership from its co-founders, Alphabet is strategically positioned to spearhead innovation and expand its footprint in rapidly growing technology markets.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Alphabet Inc. (GOOGL)

현재가: 276.41 | 변동률: -0.78% | 거래량 비율: 0.99배

설명:

Alphabet Inc. (GOOGL) is a leading American multinational conglomerate based in Mountain View, California, established as the parent company of Google and its subsidiaries following a strategic restructuring in October 2015. As one of the world's largest technology companies by revenue, it operates in diverse segments including online advertising, cloud computing, consumer electronics, and artificial intelligence. Co-founders Larry Page and Sergey Brin continue to influence the company's strategic direction as controlling shareholders and board members. With a robust portfolio and a commitment to innovation, Alphabet remains at the forefront of tech advancements, driving significant market value and growth potential for institutional investors.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Chubb Limited (CB)

현재가: 295.49 | 변동률: -0.25% | 거래량 비율: 0.83배

설명:

Chubb Limited, based in Zurich, Switzerland, is a foremost global provider of a wide range of insurance solutions, encompassing property and casualty, accident and health, reinsurance, and life insurance. As the largest publicly traded property and casualty insurer worldwide, Chubb harnesses its extensive industry expertise and a formidable international footprint to deliver tailored risk management and insurance products to its diverse clientele. Committed to innovation, exceptional customer service, and financial robustness, Chubb continues to strengthen its market position, ensuring it meets the evolving demands of the insurance landscape while maintaining a strong focus on sustainable growth.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Genius Group Limited (GNS)

현재가: 0.86 | 변동률: 2.86% | 거래량 비율: 0.19배

설명:

Genius Group Limited (GNS) is a forward-thinking education technology firm based in Singapore, dedicated to delivering innovative training and educational solutions. The company emphasizes enhancing the learning experience through a diverse portfolio of courses and services tailored for both personal and professional development. By integrating advanced technology, Genius Group is well-positioned to address the dynamic demands of global learners, reinforcing its leadership role in the expanding edtech market and its commitment to lifelong learning.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Quantum Computing Inc. (QUBT)

현재가: 10.60 | 변동률: 5.68% | 거래량 비율: 1.67배

설명:

Quantum Computing, Inc. is an innovative technology firm based in Leesburg, Virginia, focused on advancing the field of quantum computing through the development of sophisticated software applications and tools. The company aims to facilitate the widespread adoption of quantum technologies across diverse sectors such as finance, pharmaceuticals, and cybersecurity, addressing complex computational challenges with greater efficiency. With a robust commitment to research and development, Quantum Computing, Inc. is strategically positioned to emerge as a leader in delivering practical quantum solutions, thereby unlocking the transformative potential inherent in quantum systems.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📉 -0.02%

Nasdaq

미국 기술주 중심 지수

📈 +0.08%

Dow Jones

30개 전통 우량주 지수

📉 -0.62%

10Y Treasury

미국 10년 만기 국채 수익률

📉 -0.17%

🔹 SK하이닉스 (000660)

⏱️ 1D 분석

💰 현재가: $560,000.00

📊 거래량: 5,746,779

📈 RSI: 54.21

📉 MACD: 49992.43

📌 예측:

- 3 기간 → Hold (신뢰도 63.0%)

- 5 기간 → Hold (신뢰도 62.65%)

- 10 기간 → Hold (신뢰도 62.84%)

⏱️ 1WK 분석

💰 현재가: $560,000.00

📊 거래량: 22,856,146

📈 RSI: 85.5

📉 MACD: 84382.34

📌 예측:

- 3 기간 → Hold (신뢰도 62.17%)

- 5 기간 → Hold (신뢰도 62.63%)

- 10 기간 → Hold (신뢰도 62.17%)

⏱️ 1MO 분석

💰 현재가: $560,000.00

📊 거래량: 53,699,836

📈 RSI: 86.45

📉 MACD: 79607.13

📌 예측:

- 3 기간 → Hold (신뢰도 62.27%)

- 5 기간 → Hold (신뢰도 57.19%)

- 10 기간 → Hold (신뢰도 53.75%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 삼성전자 (005930)

⏱️ 1D 분석

💰 현재가: $97,200.00

📊 거래량: 21,806,342

📈 RSI: 43.88

📉 MACD: 3053.93

📌 예측:

- 3 기간 → Hold (신뢰도 62.02%)

- 5 기간 → Hold (신뢰도 61.12%)

- 10 기간 → Hold (신뢰도 62.88%)

⏱️ 1WK 분석

💰 현재가: $97,200.00

📊 거래량: 113,643,449

📈 RSI: 75.1

📉 MACD: 10359.8

📌 예측:

- 3 기간 → Hold (신뢰도 61.31%)

- 5 기간 → Hold (신뢰도 61.8%)

- 10 기간 → Hold (신뢰도 62.21%)

⏱️ 1MO 분석

💰 현재가: $97,200.00

📊 거래량: 270,610,588

📈 RSI: 71.64

📉 MACD: 5191.66

📌 예측:

- 3 기간 → Hold (신뢰도 56.76%)

- 5 기간 → Hold (신뢰도 55.41%)

- 10 기간 → Hold (신뢰도 52.63%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 두산에너빌리티 (034020)

⏱️ 1D 분석

💰 현재가: $78,400.00

📊 거래량: 6,117,065

📈 RSI: 46.3

📉 MACD: 1709.48

📌 예측:

- 3 기간 → Hold (신뢰도 64.28%)

- 5 기간 → Hold (신뢰도 64.27%)

- 10 기간 → Hold (신뢰도 64.26%)

⏱️ 1WK 분석

💰 현재가: $78,400.00

📊 거래량: 26,606,746

📈 RSI: 63.33

📉 MACD: 9907.29

📌 예측:

- 3 기간 → Hold (신뢰도 58.52%)

- 5 기간 → Hold (신뢰도 58.25%)

- 10 기간 → Hold (신뢰도 58.3%)

⏱️ 1MO 분석

💰 현재가: $78,400.00

📊 거래량: 66,221,016

📈 RSI: 78.64

📉 MACD: 15146.55

📌 예측:

- 3 기간 → Hold (신뢰도 60.42%)

- 5 기간 → Hold (신뢰도 60.23%)

- 10 기간 → Hold (신뢰도 60.15%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00

🔹 에이비엘바이오 (298380)

⏱️ 1D 분석

💰 현재가: $174,200.00

📊 거래량: 6,248,155

📈 RSI: 85.19

📉 MACD: 13130.38

📌 예측:

- 3 기간 → Hold (신뢰도 51.73%)

- 5 기간 → Hold (신뢰도 47.46%)

- 10 기간 → Hold (신뢰도 42.19%)

⏱️ 1WK 분석

💰 현재가: $174,200.00

📊 거래량: 14,884,900

📈 RSI: 80.34

📉 MACD: 15473.64

📌 예측:

- 3 기간 → Hold (신뢰도 47.87%)

- 5 기간 → Hold (신뢰도 43.08%)

- 10 기간 → Hold (신뢰도 41.97%)

⏱️ 1MO 분석

💰 현재가: $174,200.00

📊 거래량: 20,703,414

📈 RSI: 85.38

📉 MACD: 24672.69

📌 예측:

- 3 기간 → Hold (신뢰도 61.12%)

- 5 기간 → Hold (신뢰도 63.42%)

- 10 기간 → Hold (신뢰도 63.16%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00