[2025-10-23] - AI Stock Analysis Summary: 한화오션(042660), 에코프로(086520)

Stock Summary

삼성전자 (005930)

💰 현재가: 98,600.00

📈 변동률: +1.13%

🔄 거래량 비율: 0.76배

🏷️ 태그: 없음

에코프로 (086520)

💰 현재가: 87,400.00

📈 변동률: +15.15%

🔄 거래량 비율: 6.86배

🏷️ 태그: 급등/급락, 거래량 급증

한화오션 (042660)

💰 현재가: 132,400.00

📈 변동률: +9.69%

🔄 거래량 비율: 1.81배

🏷️ 태그: 급등/급락, 거래량 급증

두산에너빌리티 (034020)

💰 현재가: 79,000.00

📈 변동률: -1.25%

🔄 거래량 비율: 0.55배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 481,500.00

📈 변동률: +0.52%

🔄 거래량 비율: 0.86배

🏷️ 태그: 없음

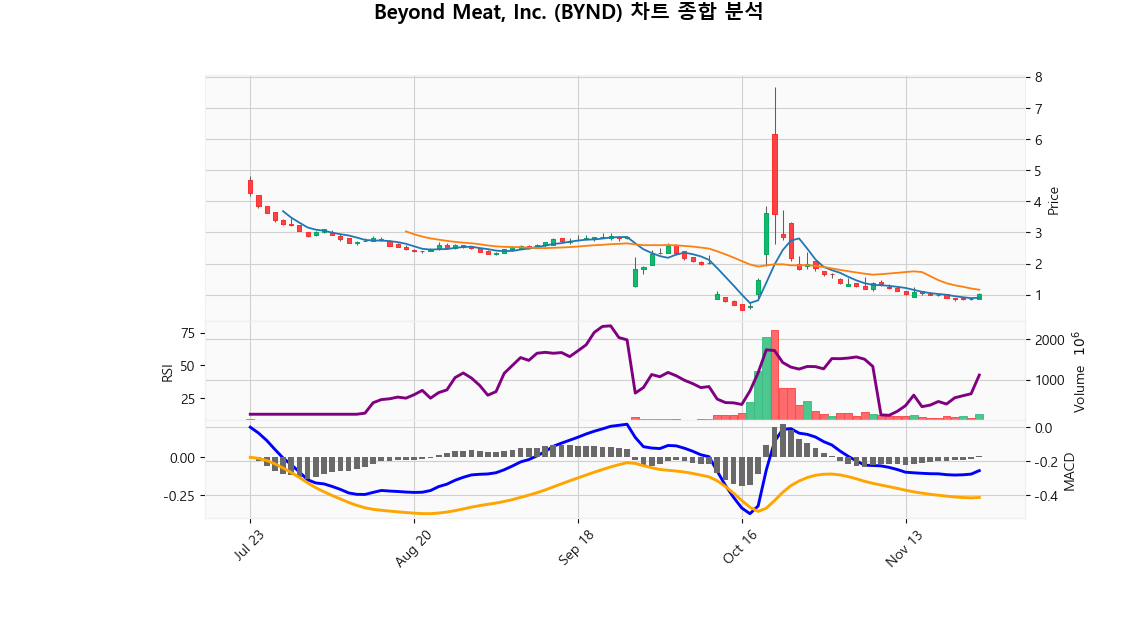

Beyond Meat, Inc. (BYND)

💰 현재가: 3.58

📈 변동률: -1.10%

🔄 거래량 비율: 104.24배

🏷️ 태그: 거래량 급증

Krispy Kreme, Inc. (DNUT)

💰 현재가: 4.03

📈 변동률: +8.63%

🔄 거래량 비율: 36.59배

🏷️ 태그: 급등/급락, 거래량 급증

Netflix, Inc. (NFLX)

💰 현재가: 1,116.37

📈 변동률: -10.07%

🔄 거래량 비율: 4.03배

🏷️ 태그: 급등/급락, 거래량 급증

GoPro, Inc. (GPRO)

💰 현재가: 2.31

📈 변동률: +5.00%

🔄 거래량 비율: 8.89배

🏷️ 태그: 급등/급락, 거래량 급증

Palantir Technologies Inc. (PLTR)

💰 현재가: 175.49

📈 변동률: -3.32%

🔄 거래량 비율: 0.77배

🏷️ 태그: 없음

🔹 삼성전자 (005930)

현재가: 98600.00 | 변동률: 1.13% | 거래량 비율: 0.76배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.**Description:**

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 에코프로 (086520)

현재가: 87400.00 | 변동률: 15.15% | 거래량 비율: 6.86배

설명:

동사는 1998년 설립, 2007년 코스닥 상장 후 2021년 지주회사 체제를 구축하였음.

→ **English Translation**: The company was established in 1998 and established a holding company system in 2021 after being listed on KOSDAQ in 2007.

🔹 한화오션 (042660)

현재가: 132400.00 | 변동률: 9.69% | 거래량 비율: 1.81배

설명:

동사는 2000년 대우중공업 분할로 설립되어 2001년 상장되었으며, 2024년 한화로부터 플랜트·풍력 사업을 양수하고 한화오션디지털을 합병했음.

→ **English Translation**: The company was founded in 2000 as a division of Daewoo Heavy Industries and went public in 2001. In 2024, it acquired the plant and wind power business from Hanwha and merged Hanwha Ocean Digital.

🔹 두산에너빌리티 (034020)

현재가: 79000.00 | 변동률: -1.25% | 거래량 비율: 0.55배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 SK하이닉스 (000660)

현재가: 481500.00 | 변동률: 0.52% | 거래량 비율: 0.86배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 Beyond Meat, Inc. (BYND)

현재가: 3.58 | 변동률: -1.1% | 거래량 비율: 104.24배

설명:

Beyond Meat, Inc. is a pioneering company in the plant-based food industry, focused on creating innovative meat substitutes that prioritize sustainability and health. Headquartered in El Segundo, California, the firm utilizes high-quality, responsibly sourced ingredients to develop a range of products, including ground beef, sausages, and burgers that effectively mimic the taste and texture of conventional meat. As consumer preferences shift towards plant-based diets driven by environmental and health concerns, Beyond Meat is strategically positioned to capture significant market opportunities in the rapidly growing alternative protein sector.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Krispy Kreme, Inc. (DNUT)

현재가: 4.03 | 변동률: 8.63% | 거래량 비율: 36.59배

설명:

Krispy Kreme, Inc. (DNUT) is a prominent player in the food and beverage sector, celebrated for its iconic donut offerings and a diverse range of coffee and complementary beverages. Headquartered in Winston-Salem, North Carolina, the company has successfully cultivated a loyal customer base through its extensive network of retail locations and a burgeoning e-commerce platform. With a steadfast dedication to quality, innovation, and brand excellence, Krispy Kreme is strategically positioned for growth, making it a compelling investment opportunity for institutional investors looking to tap into the dynamics of the baked goods market.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Netflix, Inc. (NFLX)

현재가: 1116.37 | 변동률: -10.07% | 거래량 비율: 4.03배

설명:

Netflix, Inc. is a premier American over-the-top content platform and production company, headquartered in Los Gatos, California. Since its inception in 1997, Netflix has transformed the entertainment landscape with its subscription-based streaming service, offering an expansive library of films and television series, including a diverse array of critically acclaimed original programming. As a trailblazer in the streaming industry, Netflix is strategically expanding its global footprint, employing innovative distribution methods and investing heavily in original content to enhance viewer engagement and drive subscriber growth. With a steadfast commitment to shaping the future of media consumption, Netflix continues to lead the way in the digital entertainment revolution.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 GoPro, Inc. (GPRO)

현재가: 2.31 | 변동률: 5.0% | 거래량 비율: 8.89배

설명:

GoPro, Inc. is a prominent player in the action camera industry, renowned for its innovative mountable and portable cameras, drones, and extensive accessory offerings. Based in San Mateo, California, the company serves a global market comprising adventure enthusiasts, athletes, and content creators. GoPro is dedicated to enhancing the user experience by providing cutting-edge technology that enables customers to capture, edit, and share their adventures, solidifying its position as a leader in consumer electronics and digital storytelling. As the landscape of content creation evolves, GoPro's strategic focus on innovation and community engagement continues to drive its growth and relevance in the sector.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Palantir Technologies Inc. (PLTR)

현재가: 175.49 | 변동률: -3.32% | 거래량 비율: 0.77배

설명:

Palantir Technologies Inc. (PLTR) is a premier software provider specializing in data integration and analytics, serving a diverse range of clients across government and commercial sectors. Renowned for its platforms, Palantir Gotham and Palantir Foundry, the company enables organizations to efficiently aggregate, analyze, and visualize extensive datasets, driving critical decision-making and operational efficiency. Headquartered in Denver, Colorado, Palantir is recognized for its innovative use of advanced artificial intelligence and machine learning technologies, positioning itself as a key player in addressing complex challenges across global industries and presenting appealing investment opportunities for institutional investors.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📈 -0.00%

Nasdaq

미국 기술주 중심 지수

📉 -0.03%

Dow Jones

30개 전통 우량주 지수

📈 +0.47%

10Y Treasury

미국 10년 만기 국채 수익률

📈 +0.18%

🔹 한화오션 (042660)

⏱️ 1D 분석

💰 현재가: $132,400.00

📊 거래량: 6,520,651

📈 RSI: 73.36

📉 MACD: 2372.46

📌 예측:

- 3 기간 → Hold (신뢰도 62.92%)

- 5 기간 → Hold (신뢰도 61.99%)

- 10 기간 → Hold (신뢰도 62.0%)

⏱️ 1WK 분석

💰 현재가: $132,400.00

📊 거래량: 14,141,061

📈 RSI: 76.21

📉 MACD: 11566.69

📌 예측:

- 3 기간 → Hold (신뢰도 51.28%)

- 5 기간 → Hold (신뢰도 49.65%)

- 10 기간 → Hold (신뢰도 51.36%)

⏱️ 1MO 분석

💰 현재가: $132,400.00

📊 거래량: 30,434,329

📈 RSI: 86.83

📉 MACD: 23203.58

📌 예측:

- 3 기간 → Hold (신뢰도 63.76%)

- 5 기간 → Hold (신뢰도 66.27%)

- 10 기간 → Hold (신뢰도 65.77%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 에코프로 (086520)

⏱️ 1D 분석

💰 현재가: $87,400.00

📊 거래량: 7,354,068

📈 RSI: 88.14

📉 MACD: 6808.86

📌 예측:

- 3 기간 → Hold (신뢰도 61.91%)

- 5 기간 → Hold (신뢰도 63.06%)

- 10 기간 → Hold (신뢰도 59.27%)

⏱️ 1WK 분석

💰 현재가: $87,400.00

📊 거래량: 19,857,574

📈 RSI: 77.6

📉 MACD: 2950.4

📌 예측:

- 3 기간 → Hold (신뢰도 59.86%)

- 5 기간 → Hold (신뢰도 55.77%)

- 10 기간 → Hold (신뢰도 51.81%)

⏱️ 1MO 분석

💰 현재가: $87,400.00

📊 거래량: 37,513,475

📈 RSI: 51.53

📉 MACD: -8412.97

📌 예측:

- 3 기간 → Hold (신뢰도 57.85%)

- 5 기간 → Hold (신뢰도 57.14%)

- 10 기간 → Hold (신뢰도 59.91%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00