[2025-10-22] - AI Stock Analysis Summary: 현대차(005380), 한화오션(042660), Oklo Inc.(OKLO)

Stock Summary

삼성전자 (005930)

💰 현재가: 97,500.00

📈 변동률: -0.61%

🔄 거래량 비율: 1.11배

🏷️ 태그: 없음

SK하이닉스 (000660)

💰 현재가: 479,000.00

📈 변동률: -1.34%

🔄 거래량 비율: 1.01배

🏷️ 태그: 없음

한화오션 (042660)

💰 현재가: 120,700.00

📈 변동률: +6.16%

🔄 거래량 비율: 1.22배

🏷️ 태그: 급등/급락

현대차 (005380)

💰 현재가: 256,500.00

📈 변동률: +3.43%

🔄 거래량 비율: 2.62배

🏷️ 태그: 거래량 급증

두산에너빌리티 (034020)

💰 현재가: 80,000.00

📈 변동률: -0.37%

🔄 거래량 비율: 0.78배

🏷️ 태그: 없음

General Motors Company (GM)

💰 현재가: 66.61

📈 변동률: +14.84%

🔄 거래량 비율: 3.43배

🏷️ 태그: 급등/급락, 거래량 급증

Minerva Neurosciences, Inc. (NERV)

💰 현재가: 6.41

📈 변동률: +140.98%

🔄 거래량 비율: 325.81배

🏷️ 태그: 급등/급락, 거래량 급증

Warner Bros. Discovery, Inc. (WBD)

💰 현재가: 20.33

📈 변동률: +10.97%

🔄 거래량 비율: 1.7배

🏷️ 태그: 급등/급락, 거래량 급증

Oklo Inc. (OKLO)

💰 현재가: 139.30

📈 변동률: -12.42%

🔄 거래량 비율: 1.32배

🏷️ 태그: 급등/급락

NuScale Power Corporation (SMR)

💰 현재가: 38.37

📈 변동률: -13.21%

🔄 거래량 비율: 2.61배

🏷️ 태그: 급등/급락, 거래량 급증

🔹 삼성전자 (005930)

현재가: 97500.00 | 변동률: -0.61% | 거래량 비율: 1.11배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.**Description:**

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 SK하이닉스 (000660)

현재가: 479000.00 | 변동률: -1.34% | 거래량 비율: 1.01배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 한화오션 (042660)

현재가: 120700.00 | 변동률: 6.16% | 거래량 비율: 1.22배

설명:

동사는 2000년 대우중공업 분할로 설립되어 2001년 상장되었으며, 2024년 한화로부터 플랜트·풍력 사업을 양수하고 한화오션디지털을 합병했음.

→ **English Translation**: The company was founded in 2000 as a division of Daewoo Heavy Industries and went public in 2001. In 2024, it acquired the plant and wind power business from Hanwha and merged Hanwha Ocean Digital.

🔹 현대차 (005380)

현재가: 256500.00 | 변동률: 3.43% | 거래량 비율: 2.62배

설명:

동사는 1967년 설립됐으며, 자동차 및 부품 제조·판매, 금융, 철도차량 제작을 하는 기업임.

→ **English Translation**: The company was founded in 1967 and is a company that manufactures and sells automobiles and parts, finance, and railway vehicles.

🔹 두산에너빌리티 (034020)

현재가: 80000.00 | 변동률: -0.37% | 거래량 비율: 0.78배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 General Motors Company (GM)

현재가: 66.61 | 변동률: 14.84% | 거래량 비율: 3.43배

설명:

General Motors Company (NYSE: GM) is a prominent American multinational automotive manufacturer headquartered in Detroit, Michigan, with a diverse portfolio that includes iconic brands such as Chevrolet, Cadillac, GMC, and Buick. The company is at the forefront of the automotive industry's transition towards electric and autonomous vehicles, bolstering its commitment to sustainability and innovation in transportation solutions. GM's strategic initiatives focus on enhancing mobility through cutting-edge technologies while maintaining its leadership in traditional vehicle markets. With a strong global presence and a robust financial services division, GM is well-positioned to adapt to changing consumer preferences and capitalize on emerging market opportunities in the evolving automotive landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Minerva Neurosciences, Inc. (NERV)

현재가: 6.41 | 변동률: 140.98% | 거래량 비율: 325.81배

설명:

Minerva Neurosciences, Inc. is a clinical-stage biopharmaceutical company headquartered in Waltham, Massachusetts, specializing in the development of innovative therapies for central nervous system disorders. The company’s robust pipeline targets significant unmet medical needs in neuropsychiatric conditions, emphasizing its commitment to research and development. By leveraging cutting-edge science, Minerva aims to transform treatment paradigms and improve quality of life for patients facing these challenging disorders. With its dedicated team and strategic focus, the company is well-positioned to make a meaningful impact in the field of neuroscience.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Warner Bros. Discovery, Inc. (WBD)

현재가: 20.33 | 변동률: 10.97% | 거래량 비율: 1.7배

설명:

Warner Bros. Discovery Inc. (WBD) is a preeminent global media and entertainment powerhouse, headquartered in New York City, formed from the merger of WarnerMedia and Discovery, Inc. The company boasts a diverse portfolio of iconic brands and franchises, providing high-quality content across television, film, and streaming platforms. WBD strategically harnesses its extensive content library and cutting-edge digital initiatives to cater to the dynamic needs of global audiences, positioning itself favorably within the rapidly evolving media landscape. Emphasizing premium storytelling and robust audience engagement, Warner Bros. Discovery is committed to driving sustainable long-term growth and enhancing shareholder value.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 Oklo Inc. (OKLO)

현재가: 139.30 | 변동률: -12.42% | 거래량 비율: 1.32배

설명:

Oklo Inc., headquartered in Santa Clara, California, is a pioneering energy company that specializes in the development of compact fission power plants designed to provide reliable, commercial-scale nuclear energy solutions. By harnessing advanced nuclear technology, Oklo is addressing the urgent demand for clean and sustainable energy while significantly minimizing dependence on fossil fuels. The company aims to lead the nuclear renaissance, offering a safe, efficient alternative to conventional energy sources for a diverse range of customers across the United States. With its strong commitment to sustainability and energy independence, Oklo is strategically positioned to be a transformative player in the future of energy generation.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

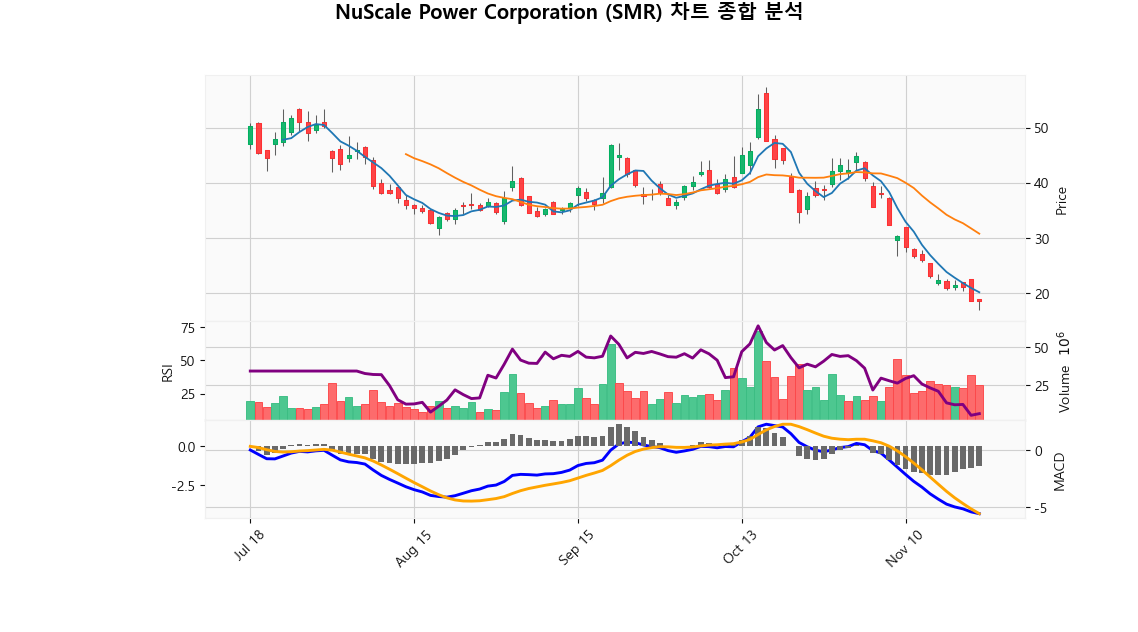

🔹 NuScale Power Corporation (SMR)

현재가: 38.37 | 변동률: -13.21% | 거래량 비율: 2.61배

설명:

NuScale Power Corporation (SMR) is at the forefront of the nuclear energy industry, developing advanced small modular reactor (SMR) technology that promises scalable, cost-effective, and environmentally friendly solutions for clean energy generation. Its innovative modular light water reactors are designed for various applications, including electricity generation, district heating, desalination, and hydrogen production, addressing the growing global demand for reliable and sustainable energy alternatives. With a strong emphasis on safety, efficiency, and regulatory compliance, NuScale is strategically positioned to contribute significantly to the transition towards low-carbon energy systems, making it a compelling investment opportunity in the evolving energy landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📈 +1.04%

Nasdaq

미국 기술주 중심 지수

📈 +1.26%

Dow Jones

30개 전통 우량주 지수

📈 +1.13%

10Y Treasury

미국 10년 만기 국채 수익률

📈 +0.13%

🔹 현대차 (005380)

⏱️ 1D 분석

💰 현재가: $256,500.00

📊 거래량: 2,002,013

📈 RSI: 88.24

📉 MACD: 7228.58

📌 예측:

- 3 기간 → Hold (신뢰도 62.55%)

- 5 기간 → Hold (신뢰도 63.11%)

- 10 기간 → Hold (신뢰도 61.93%)

⏱️ 1WK 분석

💰 현재가: $256,500.00

📊 거래량: 3,157,436

📈 RSI: 77.38

📉 MACD: 8427.65

📌 예측:

- 3 기간 → Hold (신뢰도 59.02%)

- 5 기간 → Hold (신뢰도 54.68%)

- 10 기간 → Hold (신뢰도 51.46%)

⏱️ 1MO 분석

💰 현재가: $256,500.00

📊 거래량: 10,543,574

📈 RSI: 50.3

📉 MACD: 3947.73

📌 예측:

- 3 기간 → Hold (신뢰도 53.29%)

- 5 기간 → Hold (신뢰도 59.18%)

- 10 기간 → Hold (신뢰도 56.6%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00

🔹 한화오션 (042660)

⏱️ 1D 분석

💰 현재가: $120,700.00

📊 거래량: 4,392,565

📈 RSI: 63.25

📉 MACD: 708.78

📌 예측:

- 3 기간 → Hold (신뢰도 63.25%)

- 5 기간 → Hold (신뢰도 62.56%)

- 10 기간 → Hold (신뢰도 63.15%)

⏱️ 1WK 분석

💰 현재가: $120,700.00

📊 거래량: 7,618,726

📈 RSI: 73.03

📉 MACD: 10633.36

📌 예측:

- 3 기간 → Hold (신뢰도 56.26%)

- 5 기간 → Hold (신뢰도 55.51%)

- 10 기간 → Hold (신뢰도 56.39%)

⏱️ 1MO 분석

💰 현재가: $120,700.00

📊 거래량: 23,911,994

📈 RSI: 85.56

📉 MACD: 22270.25

📌 예측:

- 3 기간 → Hold (신뢰도 66.49%)

- 5 기간 → Hold (신뢰도 67.69%)

- 10 기간 → Hold (신뢰도 66.84%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 Oklo Inc. (OKLO)

⏱️ 1D 분석

💰 현재가: $49.17

📊 거래량: 63,131,634

📈 RSI: 84.45

📉 MACD: 4.64

📌 예측:

- 3 기간 → Hold (신뢰도 55.44%)

- 5 기간 → Hold (신뢰도 52.88%)

- 10 기간 → Hold (신뢰도 56.87%)

⏱️ 1WK 분석

💰 현재가: $139.30

📊 거래량: 39,287,607

📈 RSI: 68.17

📉 MACD: 26.67

📌 예측:

- 3 기간 → Hold (신뢰도 58.93%)

- 5 기간 → Hold (신뢰도 58.95%)

- 10 기간 → Hold (신뢰도 58.35%)

⏱️ 1MO 분석

💰 현재가: $139.30

📊 거래량: 352,768,488

📈 RSI: 86.27

📉 MACD: 23.49

📌 예측:

- 3 기간 → Hold (신뢰도 67.16%)

- 5 기간 → Hold (신뢰도 65.02%)

- 10 기간 → Hold (신뢰도 62.41%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 0.00

🔹 NuScale Power Corporation (SMR)

⏱️ 1D 분석

💰 현재가: $29.16

📊 거래량: 28,150,283

📈 RSI: 87.08

📉 MACD: 2.64

📌 예측:

- 3 기간 → Sell (신뢰도 67.48%)

- 5 기간 → Sell (신뢰도 63.87%)

- 10 기간 → Sell (신뢰도 68.63%)

⏱️ 1WK 분석

💰 현재가: $38.36

📊 거래량: 46,356,463

📈 RSI: 38.88

📉 MACD: 3.51

📌 예측:

- 3 기간 → Hold (신뢰도 79.34%)

- 5 기간 → Hold (신뢰도 80.61%)

- 10 기간 → Hold (신뢰도 81.39%)

⏱️ 1MO 분석

💰 현재가: $38.36

📊 거래량: 394,168,164

📈 RSI: 64.48

📉 MACD: 7.78

📌 예측:

- 3 기간 → Hold (신뢰도 57.2%)

- 5 기간 → Hold (신뢰도 58.44%)

- 10 기간 → Hold (신뢰도 59.05%)

✅ 최종 판단: Sell

📌 판단 근거: 매도 신호가 우세

💹 매수 점수: 15.00 | 매도 점수: 199.98