[2025-10-01] - AI Stock Analysis Summary: NAVER(035420), 한미반도체(042700), Pfizer Inc.(PFE)

Stock Summary

삼성전자 (005930)

💰 현재가: 83,900.00

📈 변동률: -0.36%

🔄 거래량 비율: 0.74배

🏷️ 태그: 없음

NAVER (035420)

💰 현재가: 268,500.00

📈 변동률: -2.19%

🔄 거래량 비율: 2.88배

🏷️ 태그: 거래량 급증

SK하이닉스 (000660)

💰 현재가: 347,500.00

📈 변동률: -0.43%

🔄 거래량 비율: 0.53배

🏷️ 태그: 없음

한미반도체 (042700)

💰 현재가: 96,500.00

📈 변동률: +5.46%

🔄 거래량 비율: 1.71배

🏷️ 태그: 급등/급락, 거래량 급증

두산에너빌리티 (034020)

💰 현재가: 62,700.00

📈 변동률: -0.32%

🔄 거래량 비율: 0.4배

🏷️ 태그: 없음

Pfizer Inc. (PFE)

💰 현재가: 25.43

📈 변동률: +6.65%

🔄 거래량 비율: 3.6배

🏷️ 태그: 급등/급락, 거래량 급증

CoreWeave, Inc. (CRWV)

💰 현재가: 136.85

📈 변동률: +11.70%

🔄 거래량 비율: 3.05배

🏷️ 태그: 급등/급락, 거래량 급증

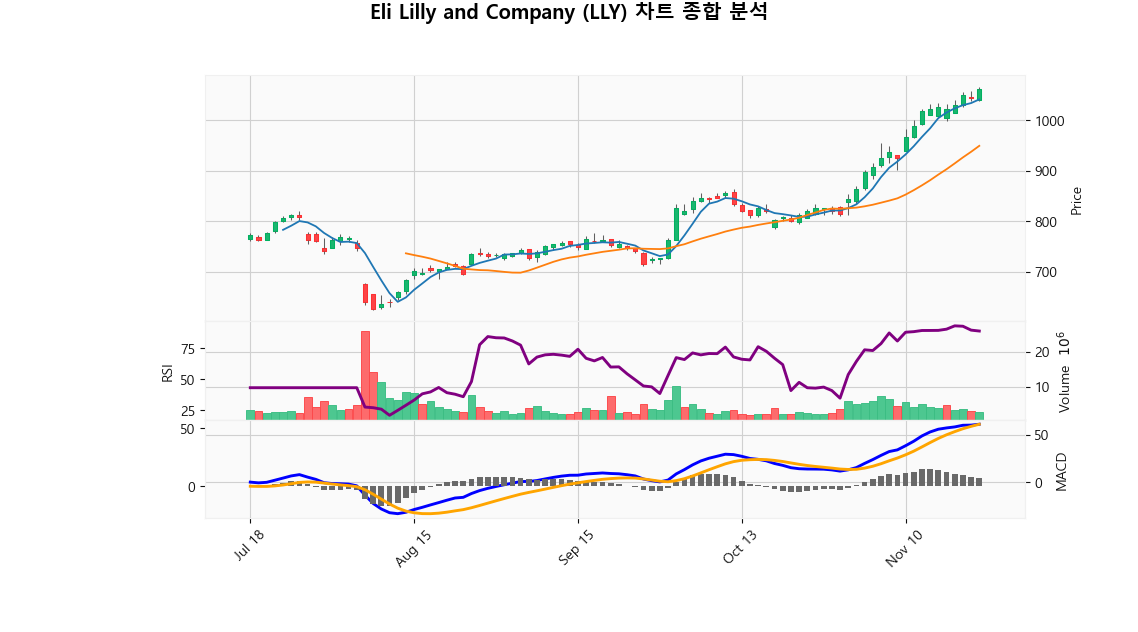

Eli Lilly and Company (LLY)

💰 현재가: 762.89

📈 변동률: +5.01%

🔄 거래량 비율: 1.4배

🏷️ 태그: 급등/급락

DraftKings Inc. (DKNG)

💰 현재가: 37.40

📈 변동률: -11.59%

🔄 거래량 비율: 4.56배

🏷️ 태그: 급등/급락, 거래량 급증

NVIDIA Corporation (NVDA)

💰 현재가: 186.57

📈 변동률: +2.60%

🔄 거래량 비율: 0.85배

🏷️ 태그: 없음

🔹 삼성전자 (005930)

현재가: 83900.00 | 변동률: -0.36% | 거래량 비율: 0.74배

설명:

동사는 1969년 설립된 글로벌 전자 기업이며, DX 부문 9개, DS 부문 5개 해외 지역총괄과 230개 종속기업으로 구성되어 있음.**Description:**

The company is a global electronics company established in 1969 and consists of 9 DX sectors, 5 overseas regional managers in DS sector, and 230 subsidiaries.

🔹 NAVER (035420)

현재가: 268500.00 | 변동률: -2.19% | 거래량 비율: 2.88배

설명:

동사는 1999년 설립, 2002년 코스닥 상장 후 2008년 유가증권시장에 이전 상장함.

→ **English Translation**: The company was established in 1999 and was listed on the securities market in 2008 after being listed on KOSDAQ in 2002.

🔹 SK하이닉스 (000660)

현재가: 347500.00 | 변동률: -0.43% | 거래량 비율: 0.53배

설명:

동사는 1949년 설립되어 경기도 이천시에 본사를 두고 4개의 생산기지와 3개의 연구개발법인 및 여러 해외 판매법인을 운영하는 글로벌 반도체 기업임.

→ **English Translation**: Established in 1949, the company is a global semiconductor company with headquarters in Icheon-si, Gyeonggi-do, and operates four production bases, three R&D subsidiaries, and several overseas sales subsidiaries.

🔹 한미반도체 (042700)

현재가: 96500.00 | 변동률: 5.46% | 거래량 비율: 1.71배

설명:

동사는 1980년 반도체 장비 제조 및 판매를 위해 설립되어 현재 3개 계열사를 보유하고 있음.

→ **English Translation**: The company was established in 1980 for the manufacture and sale of semiconductor equipment and currently has three subsidiaries.

🔹 두산에너빌리티 (034020)

현재가: 62700.00 | 변동률: -0.32% | 거래량 비율: 0.4배

설명:

동사는 1962년 현대양행으로 설립되어 2001년 두산그룹 인수 후 2022년 두산에너빌리티로 사명을 변경함.

→ **English Translation**: The company was founded as Hyundai Corporation in 1962 and changed its name to Doosan Energy Company in 2022 after acquiring Doosan Group in 2001.

🔹 Pfizer Inc. (PFE)

현재가: 25.43 | 변동률: 6.65% | 거래량 비율: 3.6배

설명:

Pfizer Inc. is a leading American multinational pharmaceutical and biotechnology company headquartered in New York City, well-known for its innovative contributions to healthcare, particularly in immunology, oncology, cardiology, endocrinology, and neurology. Founded by Charles Pfizer in 1849, the company has established a robust pipeline of medicines and vaccines, including several blockbuster products that generate over $1 billion in annual revenues. Pfizer's significant role in global health, exemplified by its rapid development of COVID-19 vaccines, underscores its commitment to addressing pressing health challenges and advancing therapeutic advancements. As a key player in the pharmaceutical industry, Pfizer continues to leverage cutting-edge research and strategic partnerships to enhance patient outcomes worldwide.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 CoreWeave, Inc. (CRWV)

현재가: 136.85 | 변동률: 11.7% | 거래량 비율: 3.05배

설명:

CoreWeave, Inc. is a leading provider of cloud infrastructure solutions focused on scalable computing for generative AI applications. Headquartered in Livingston, New Jersey, the company specializes in optimizing performance and offering robust support to developers and enterprises seeking to leverage AI capabilities effectively. With its innovative platform, CoreWeave is positioned to capitalize on the growing demand for advanced computational resources within the rapidly evolving AI landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: CoreWeave, Inc. 는 생성형 AI 애플리케이션을 위한 확장 가능한 컴퓨팅에 중점을 둔 클라우드 인프라 솔루션의 선도적인 공급업체입니다. 뉴저지주 리빙스턴에 본사를 둔 이 회사는 성능을 최적화하고 AI 기능을 효과적으로 활용하고자 하는 개발자와 기업에 강력한 지원을 제공하는 것을 전문으로 합니다. 혁신적인 플랫폼을 통해 CoreWeave는 빠르게 진화하는 AI 환경에서 고급 컴퓨팅 리소스에 대한 증가하는 수요를 활용할 수 있습니다.

🔹 Eli Lilly and Company (LLY)

현재가: 762.89 | 변동률: 5.01% | 거래량 비율: 1.4배

설명:

Eli Lilly and Company (Ticker: LLY) is a global leader in the pharmaceutical industry, headquartered in Indianapolis, Indiana, and operating offices in 18 countries. With a broad portfolio of innovative medicines across key therapeutic areas, including diabetes, oncology, and neurodegenerative diseases, Lilly's products are sold in approximately 125 countries worldwide. The company is committed to advancing scientific innovation and improving patient outcomes through research and development, positioning itself as a pivotal player in addressing complex healthcare challenges. As a market leader, Eli Lilly continues to focus on sustainable growth strategies while enhancing shareholder value through its robust pipeline and strategic partnerships.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 DraftKings Inc. (DKNG)

현재가: 37.40 | 변동률: -11.59% | 거래량 비율: 4.56배

설명:

DraftKings Inc. is a leading digital sports entertainment and gaming company based in Boston, Massachusetts, that offers a premier online sports betting platform and daily fantasy sports services. With a strong focus on innovation, DraftKings leverages cutting-edge technology to provide a seamless user experience and engage avid sports fans. The company operates in multiple jurisdictions across the U.S., positioning itself as a major player in the rapidly expanding regulated sports betting market. DraftKings aims to capitalize on the growing trend of sports wagering, driven by increasing legalization and consumer interest, thereby driving long-term growth and shareholder value.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

🔹 NVIDIA Corporation (NVDA)

현재가: 186.57 | 변동률: 2.6% | 거래량 비율: 0.85배

설명:

NVIDIA Corporation is a leading American multinational technology company headquartered in Santa Clara, California, specializing in the design and manufacture of advanced graphics processing units (GPUs) primarily for gaming and professional applications. Renowned for its pioneering work in visual computing and AI technologies, NVIDIA also develops System on a Chip (SoC) solutions for mobile computing and automotive sectors, positioning itself at the forefront of innovation in autonomous driving and AI-driven applications. With a robust portfolio that spans across gaming, data centers, and AI infrastructure, NVIDIA continues to drive significant advancements in technology, catering to a rapidly evolving market landscape.

→ **Source**: Alpha Vantage

→ 🇰🇷 **한국어 번역**: QUERY LENGTH LIMIT EXCEEDED. MAX ALLOWED QUERY : 500 CHARS

Market Summary

S&P500

미국 대형주 대표 지수

📈 +0.28%

Nasdaq

미국 기술주 중심 지수

📈 +0.46%

Dow Jones

30개 전통 우량주 지수

📈 +0.16%

10Y Treasury

미국 10년 만기 국채 수익률

📈 +0.29%

🔹 NAVER (035420)

⏱️ 1WK 분석

💰 현재가: $268,500.00

📊 거래량: 6,227,824

📈 RSI: 54.66

📉 MACD: 11146.65

📌 예측:

- 3 기간 → Hold (신뢰도 57.03%)

- 5 기간 → Hold (신뢰도 56.4%)

- 10 기간 → Hold (신뢰도 53.47%)

⏱️ 1MO 분석

💰 현재가: $268,500.00

📊 거래량: 37,784,135

📈 RSI: 66.15

📉 MACD: 6029.5

📌 예측:

- 3 기간 → Hold (신뢰도 62.04%)

- 5 기간 → Hold (신뢰도 62.18%)

- 10 기간 → Hold (신뢰도 60.53%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 0.00

🔹 한미반도체 (042700)

⏱️ 1D 분석

💰 현재가: $96,500.00

📊 거래량: 1,988,564

📈 RSI: 65.97

📉 MACD: 1765.69

📌 예측:

- 3 기간 → Hold (신뢰도 52.71%)

- 5 기간 → Hold (신뢰도 54.55%)

- 10 기간 → Hold (신뢰도 55.01%)

⏱️ 1WK 분석

💰 현재가: $96,500.00

📊 거래량: 2,598,120

📈 RSI: 44.46

📉 MACD: 464.78

📌 예측:

- 3 기간 → Hold (신뢰도 97.9%)

- 5 기간 → Hold (신뢰도 98.09%)

- 10 기간 → Hold (신뢰도 98.01%)

⏱️ 1MO 분석

💰 현재가: $96,500.00

📊 거래량: 16,878,443

📈 RSI: 41.26

📉 MACD: 7460.25

📌 예측:

- 3 기간 → Hold (신뢰도 47.67%)

- 5 기간 → Hold (신뢰도 47.39%)

- 10 기간 → Hold (신뢰도 47.46%)

✅ 최종 판단: Buy

📌 판단 근거: 매수 신호가 우세

💹 매수 점수: 10.00 | 매도 점수: 5.00

🔹 Pfizer Inc. (PFE)

⏱️ 1D 분석

💰 현재가: $26.22

📊 거래량: 35,883,000

📈 RSI: 41.83

📉 MACD: 0.07

📌 예측:

- 3 기간 → Hold (신뢰도 50.88%)

- 5 기간 → Hold (신뢰도 51.95%)

- 10 기간 → Hold (신뢰도 51.46%)

⏱️ 1WK 분석

💰 현재가: $25.48

📊 거래량: 203,143,190

📈 RSI: 55.84

📉 MACD: -0.09

📌 예측:

- 3 기간 → Hold (신뢰도 85.26%)

- 5 기간 → Hold (신뢰도 86.04%)

- 10 기간 → Hold (신뢰도 86.79%)

⏱️ 1MO 분석

💰 현재가: $25.48

📊 거래량: 1,099,708,407

📈 RSI: 28.15

📉 MACD: -2.98

📌 예측:

- 3 기간 → Hold (신뢰도 61.39%)

- 5 기간 → Hold (신뢰도 62.41%)

- 10 기간 → Hold (신뢰도 63.29%)

✅ 최종 판단: Sell

📌 판단 근거: 매도 신호가 우세

💹 매수 점수: 0.00 | 매도 점수: 15.00